EUR/USD

4 hour

The EUR/USD is showing a new lower low but still has some space left towards the two main Fibonacci targets. The oscillator will need to move down a lot lower and break below the previous bottom (purple) to avoid double divergence. The FOMC meeting minutes could heavily impact price action during today.

1 hour

The pace of the EUR/USD’s bearish wave 3 has been rather slow and price has only just managed to reach the 100% Fibonacci level. Typically waves 3 should reach the 161.8% target.

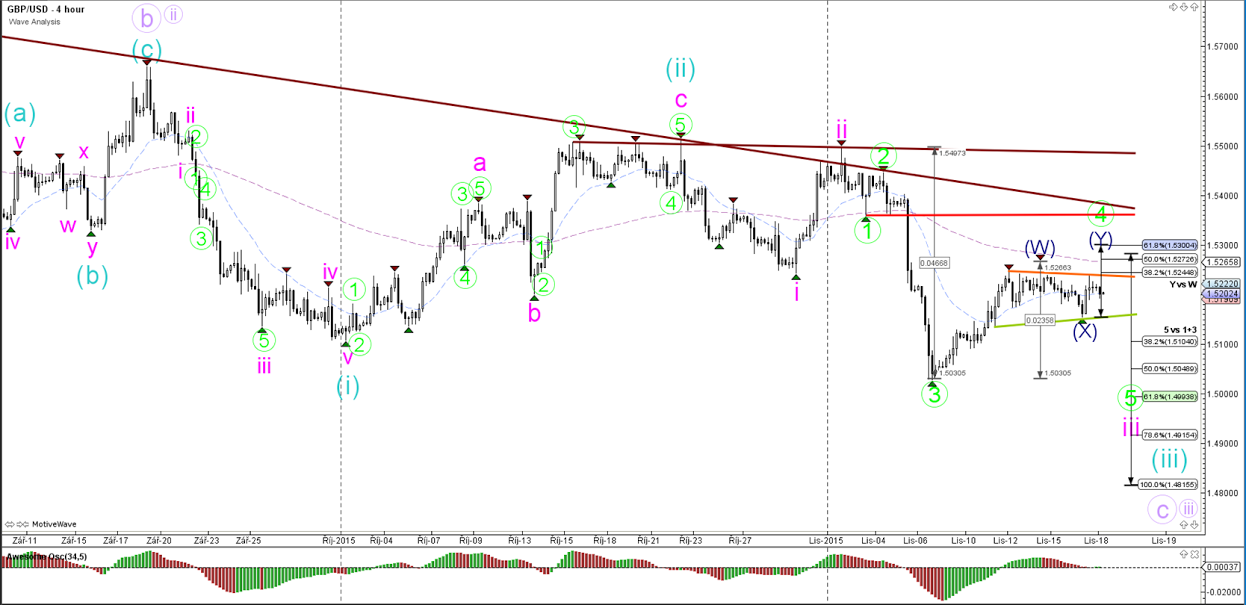

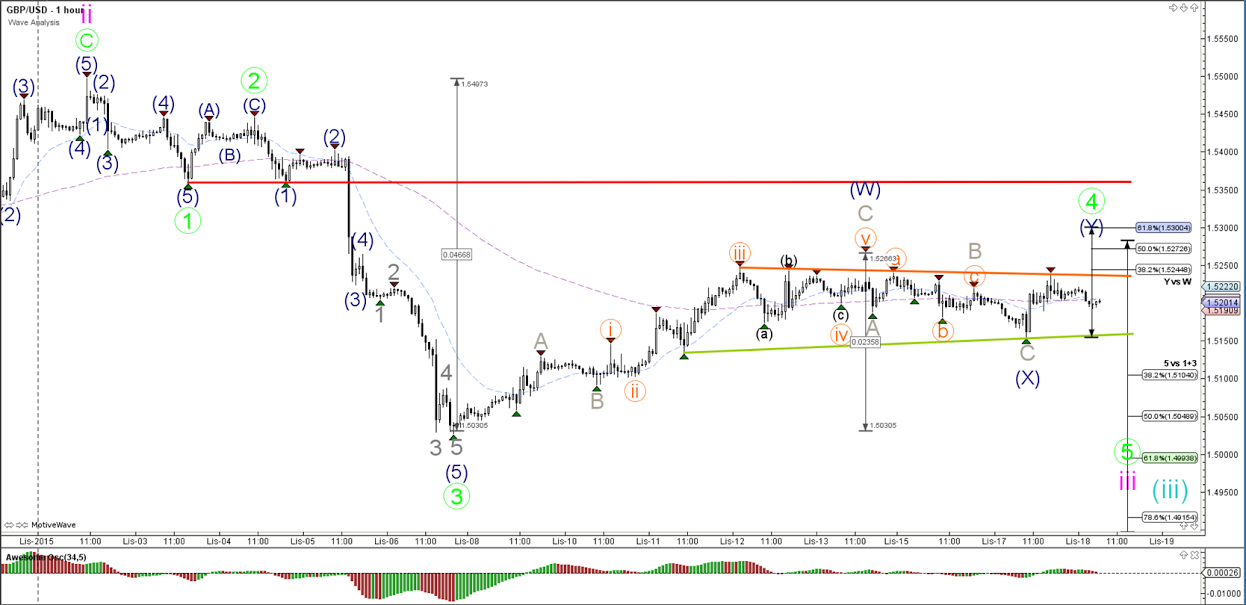

GBP/USD

4 hour

The GBP/USD is currently still in a wave 4 (green), which will be invalidated once price crosses the bottom and origin of wave 1 (red line). A bearish break of the small triangle (green/orange lines) could see price continue its downtrend for wave 5 (green) of wave 3 (pink). The FOMC meeting minutes could heavily impact price action during today.

1 hour

The GBP/USD has not started its wave 5 (green) impulse as yet and remains in between the support (green) and resistance (red) trend lines. Price still seems to be in a wave 4 (green) but a break above the resistance (red) invalidates the wave 4 count.

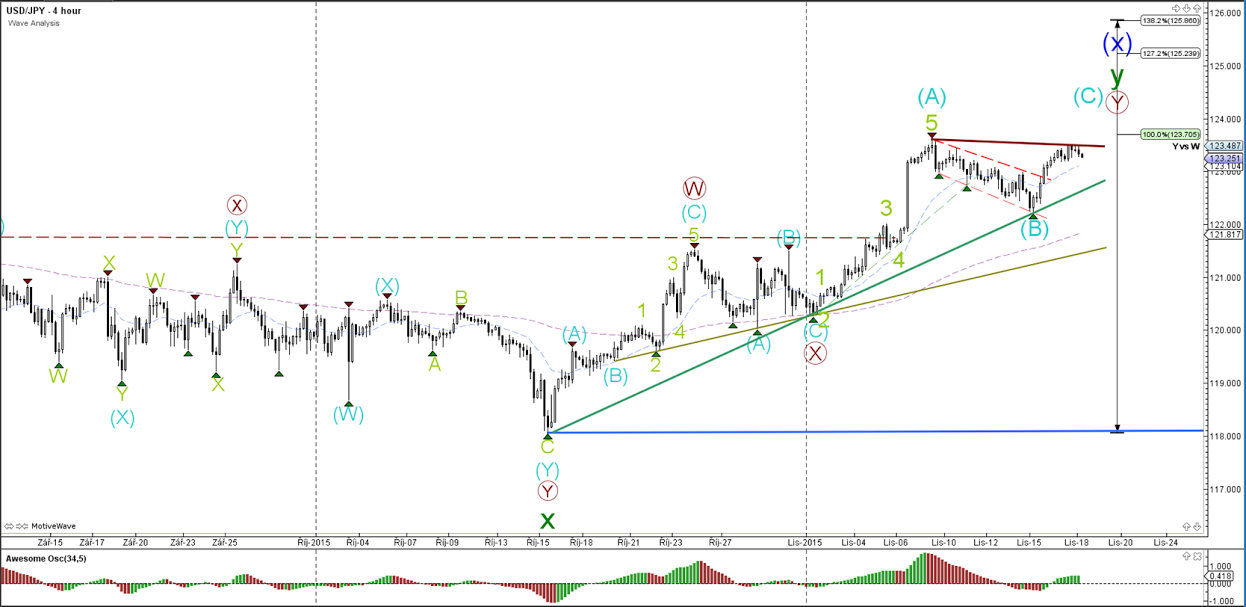

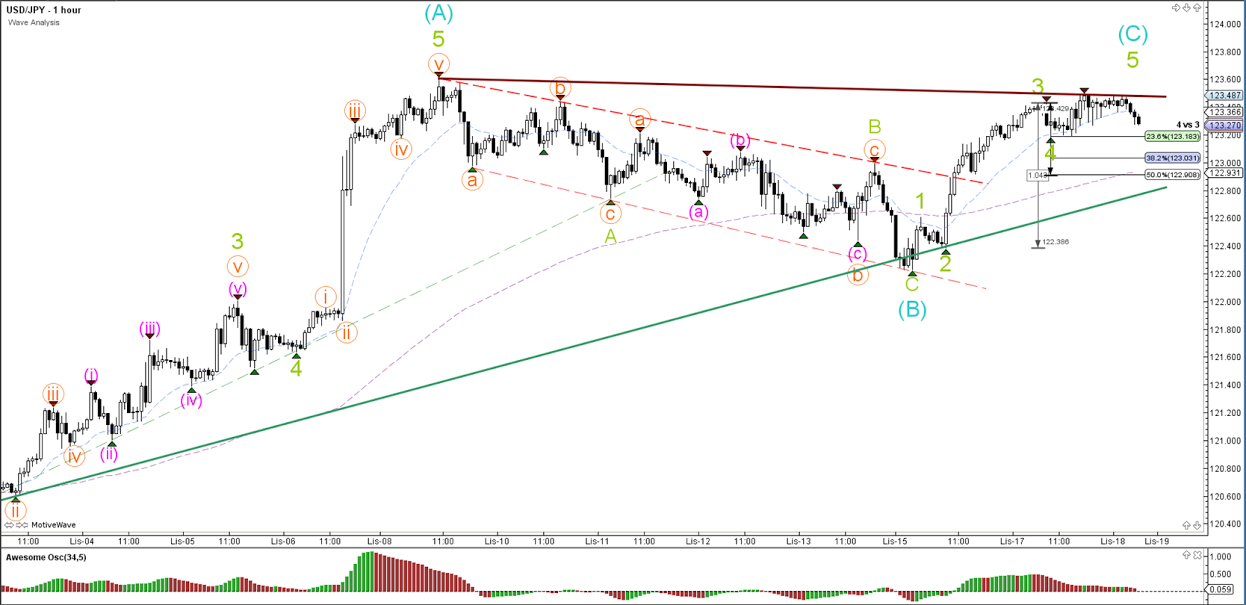

USD/JPY

4 hour

The USD/JPY is hesitating to break the previous top. The FOMC meeting minutes could heavily impact price action during today.

1 hour

The USD/JPY could still be in a wave 4 (green) retracement but in that case, price will need to respect one of the three Fibonacci levels mentioned on the chart.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.