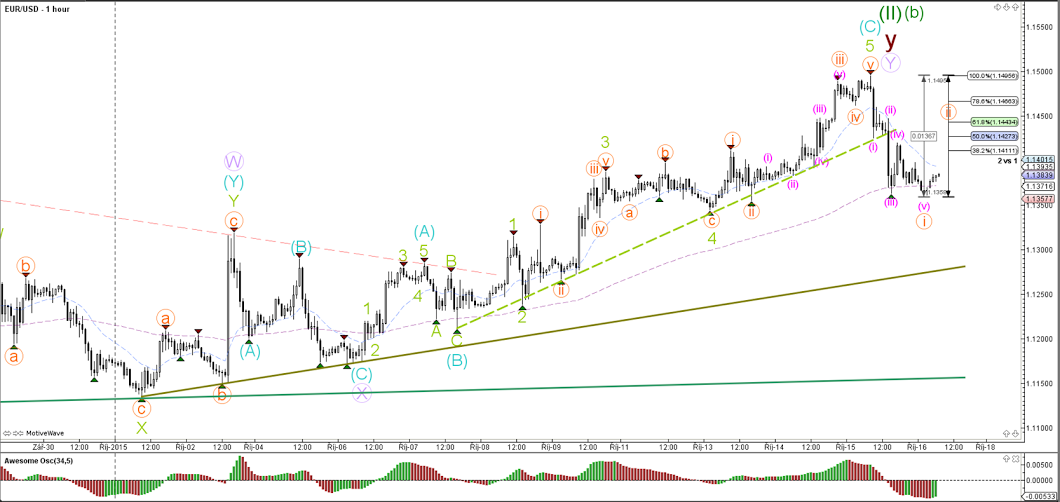

EUR/USD

4 hour

The EUR/USD seems to have completed a bullish 5 wave (green), which in turn could have completed the larger wave 2 (green) or wave B (green). Price has reached an interesting point where it will either continue with the bullish correction up to the 78.6% Fibonacci retracement level or start a new bearish impulse as marked on the current chart with a wave 1-2 (orange).

1 hour

The EUR/USD broke the support trend line (dotted green) which thereby completed the bullish 5 wave structure (green) and wave C (blue). Price could now be starting a new bearish impulse when analyzing the 5 waves down (pink). A break of the 100% Fib level invalidates the bearish count and indicates the potential for price to move up to the 78.6% Fib on the 4 hour chart.

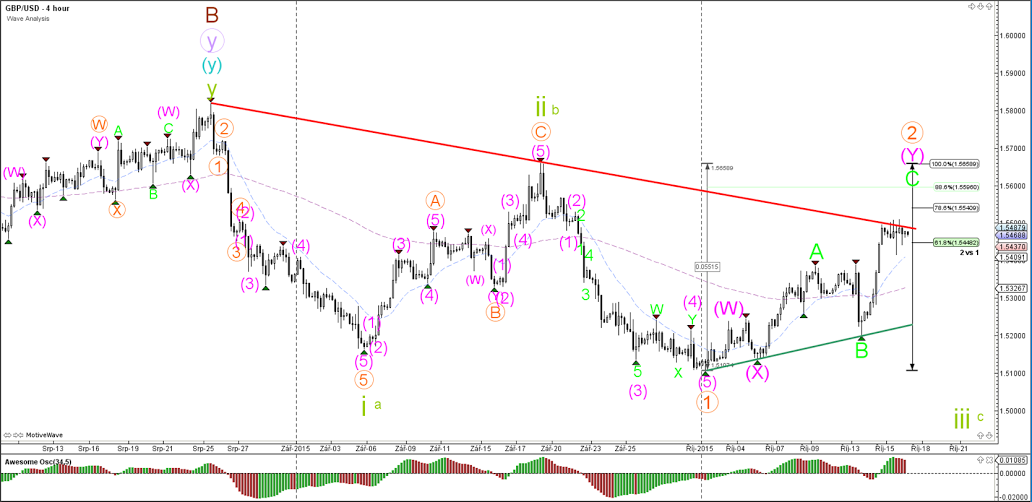

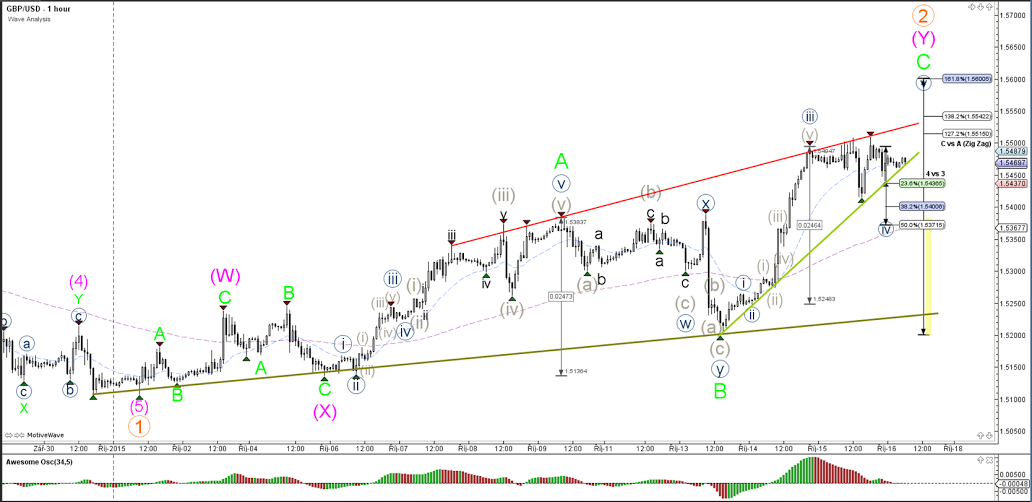

GBP/USD

4 hour

The GBP/USD has been struggling around the resistance trend line (red). Another layer of resistance is slightly higher at the 78.6% and 88.6% Fibonacci retracement levels. A move up towards that level could complete the expected ABC formation (green). A break above the 100% level invalidates the wave 1-2 (orange). A break below the support trend line (green) is needed before a wave 3 or C (green) becomes more likely.

1 hour

The GBP/USD is using the support from the wave 4 Fibonacci levels. A break below the 50% Fibonacci level indicates that the wave 5 (blue) and wave C (green) have completed at the most recent top. At the moment there is a decent chance that price will push higher within the wave 5 (blue) to the 78.6/88.6% region of the 4 hour chart.

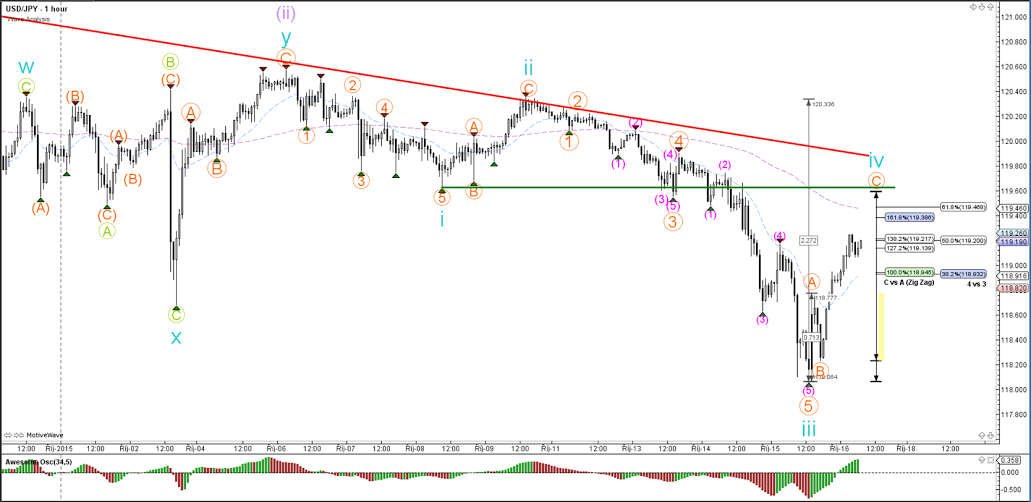

USD/JPY

4 hour

The USD/JPY managed to break below the support (blue) of the sideways zone but quickly reverted back into the area. Whether price has sufficient steam to make a sustainable bearish breakout remains to be seen. It will be interesting to see how price reacts when it retraces back to the mean: will there be a bounce for more downside or will price relapse into a consolidation?

1 hour

The USD/JPY pushed once more lower as part of the wave 5 (pink). Now price is showing an impulsive bullishness which could be explained via an ABC zigzag (orange). The potential wave 4 (blue) is invalidated when price crosses into the wave 1 price territory (green line). In that case a wave 1-2 structure instead of 3-4 is likely.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.