EUR/USD

4 hour

The US Non-Farm Employment Change together with the unemployment rate will have a high impact on the movements in the Forex market. In yesterday’s trading the EUR/USD broke the key support trend line (dotted green) with a strong bearish momentum candle (close near low). The Fibonacci levels are the potential targets but any movement is very depended on the news event.

1 hour

The EUR/USD is showing a potential for 2 internal waves within wave 5 (green). Currently it seems to be making a wave 4 consolidation. If the NFP sends the EUR/USD up then the alternative wave count shows a completed wave 5 (green) at the recent bottom.

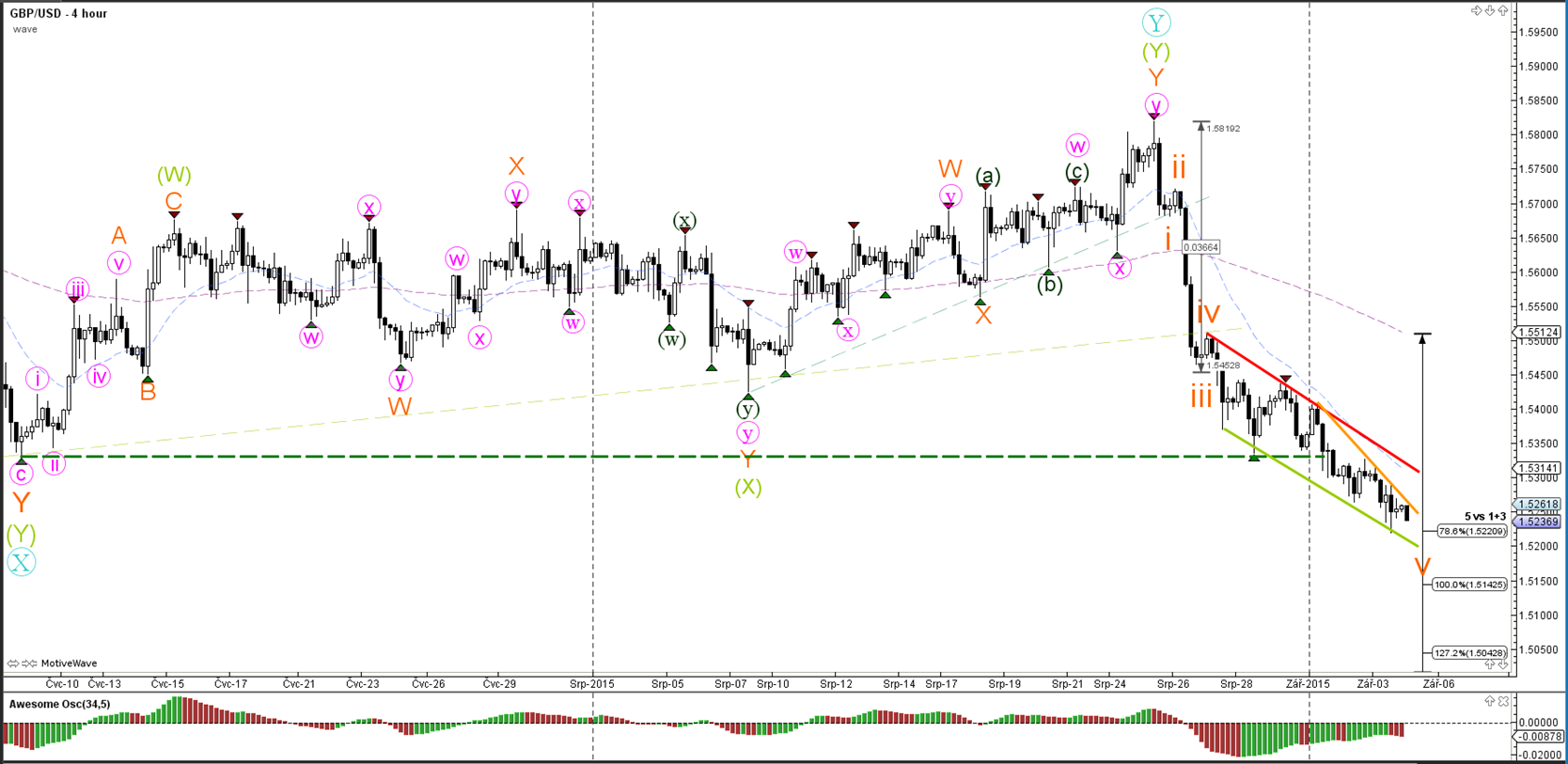

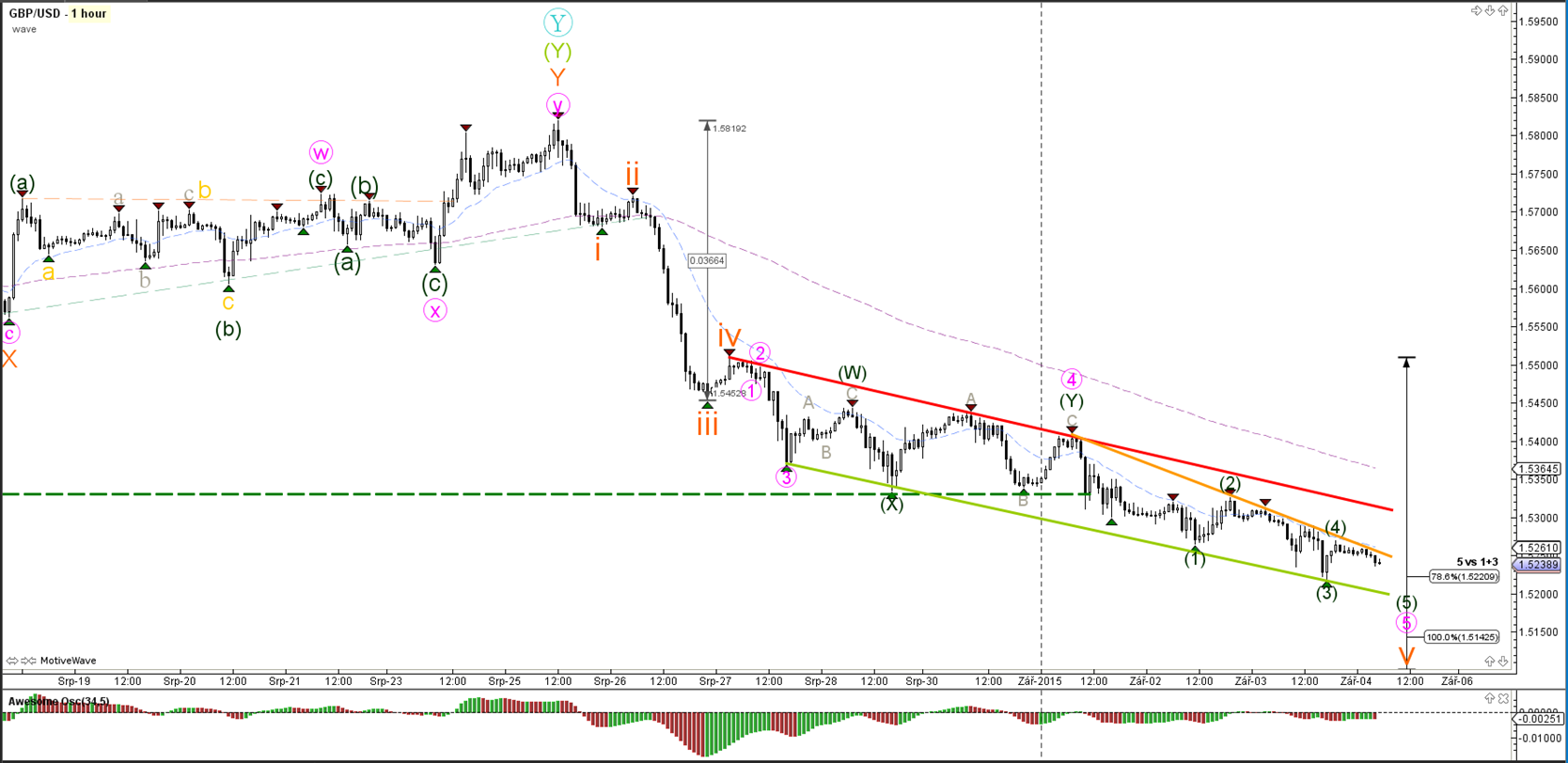

GBP/USD

4 hour

The US Non-Farm Employment Change together with the unemployment rate will have a high impact on the movements in the Forex market. The GBP/USD has moved lower to the 78.6% Fibonacci target and depending on the news event could either break the falling wedge (orange/green) to the upside or continue down to the next Fib levels.

1 hour

The GBP/USD continued yet again to the bottom of the downtrend channel (green/red). The momentum remains weak and therefore the wave structure resembles an ending diagonal pattern (dark green).

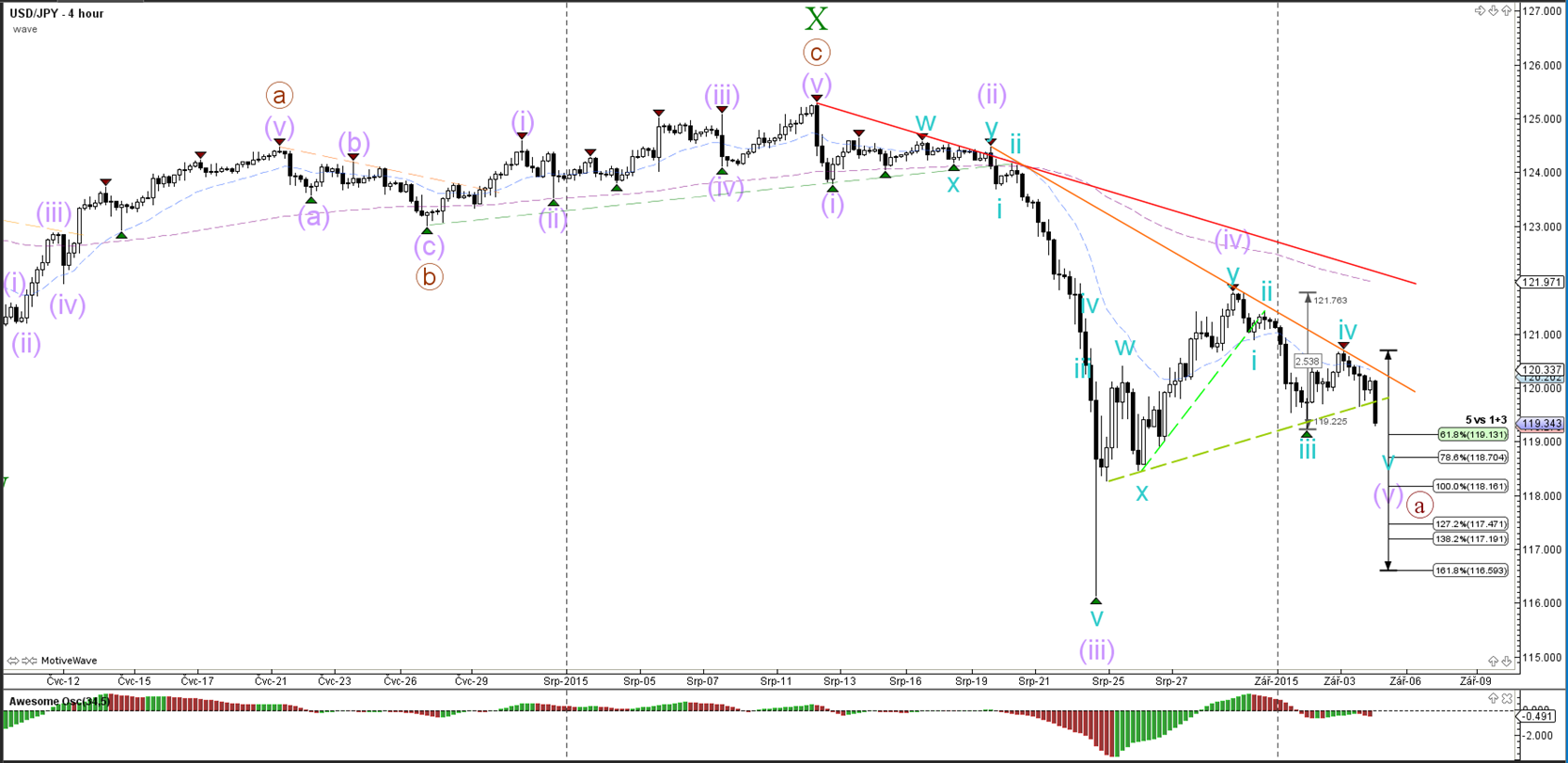

USD/JPY

4 hour

The US Non-Farm Employment Change together with the unemployment rate will have a high impact on the movements in the Forex market. At the moment price is attempting to break a support trend line (dotted green) which is most likely part of wave 5 (purple).

1 hour

The USD/JPY’s ABC formation (green) did not move into the price territory of wave 1 (purple line), which allows the wave count to show a wave 4 and 5 (blue) within wave 5 (purple). Price has broken below the support trend line (broken green) on the 1 hour chart.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.