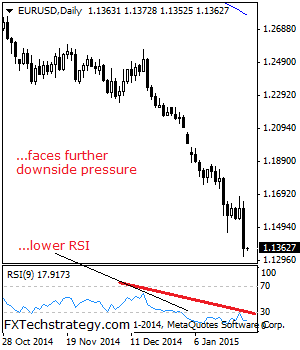

EURUSD: With the pair declining on Thursday, it now faces further downside pressure. Support is seen at 1.1300 level with a cut through here opening the door for more downside towards the 1.1450 level. Further down, support lies at the 1.1400 level where a break will expose the 1.1350 level. Below here will pave the way for a move lower towards the 1.1300 level. On the upside, resistance lies at the 1.1600 level where a violation will aim at the 1.1650 level where a break will aim at the 1.1700 level, its psycho level followed by the 1.1750 level. Further out, resistance comes in at the 1.1800 level. All in all, EUR remains biased to the downside in the medium term.

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.

Recommended Content

Editors’ Picks

AUD/USD gains ground on hawkish RBA, Nonfarm Payrolls awaited

The Australian Dollar continues its winning streak for the third successive session on Friday. The hawkish sentiment surrounding the Reserve Bank of Australia bolsters the strength of the Aussie Dollar, consequently, underpinning the AUD/USD pair.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.