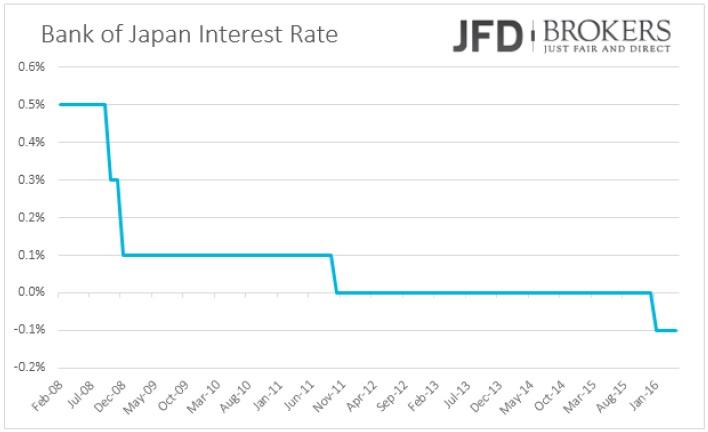

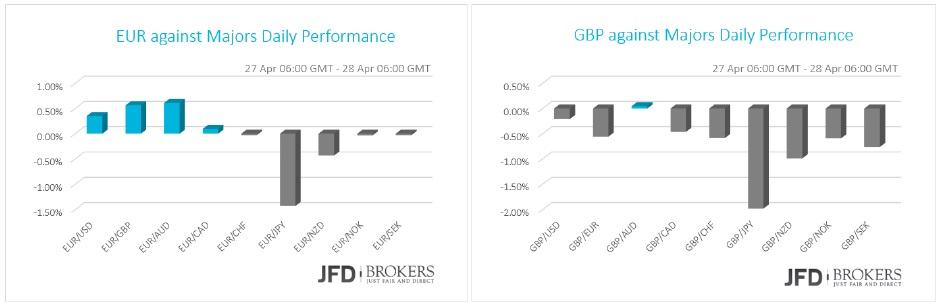

The FX markets overall had experienced a choppy session on Wednesday without vigorous changes following Fed policy meeting. None of the three policy meetings Fed, RBNZ and BoJ changed their benchmark interest rates, however, the decision from Japan to be against any fresh market stimulus, despite the headwinds the country faces, surprised the markets and surged the yen.

Fed: No rush to raise interest rates

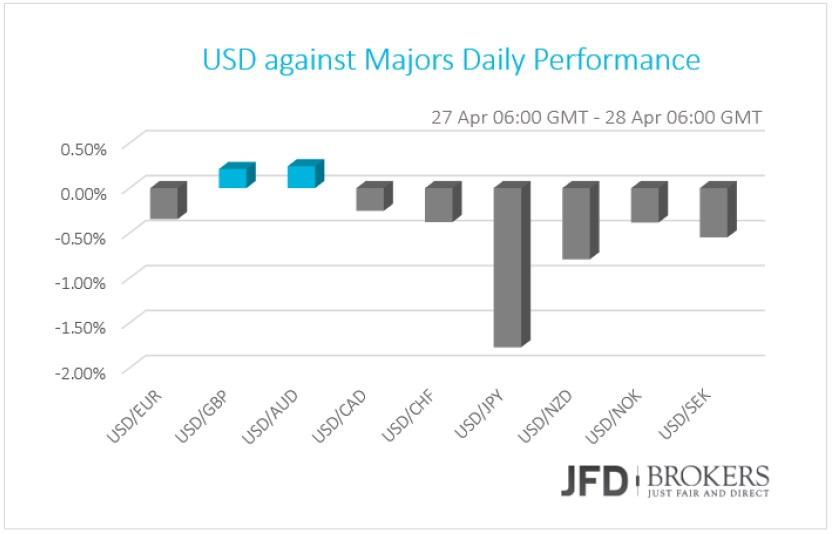

The U.S. dollar ended the day slightly lower against the most of the G10 currencies on Wednesday and early Thursday as the Fed signaled that interest rates remain on hold. The central bank that started raising the federal funds from near zero in mid‐December in a target range between 25 – 50 basis points left the funds rate unchanged and hasn’t pointed out its future plans. The Fed Chair Janet Yellen underlined that committee continues to eye the economic indicators and stated that labour market conditions have improved further even as growth slowed down. The household spending growth moderated but household real income has risen at a solid rate and consumer sentiment remains high. She also referred to the low inflation and the lower perspective on consumer prices growth.

Nothing of these suggests a rate hike or a decision for steady interest rates in June, maybe because even the FOMC is not sure for their June’s decision. The policymakers let us believe that the next rate hike is heavily data‐dependent and after many alternations of views and on and offs statements for the next rate hike the market was not ready to react to the cautious Yellen’s comments. The market needs something more specific either hawkish or dovish to have bold move.

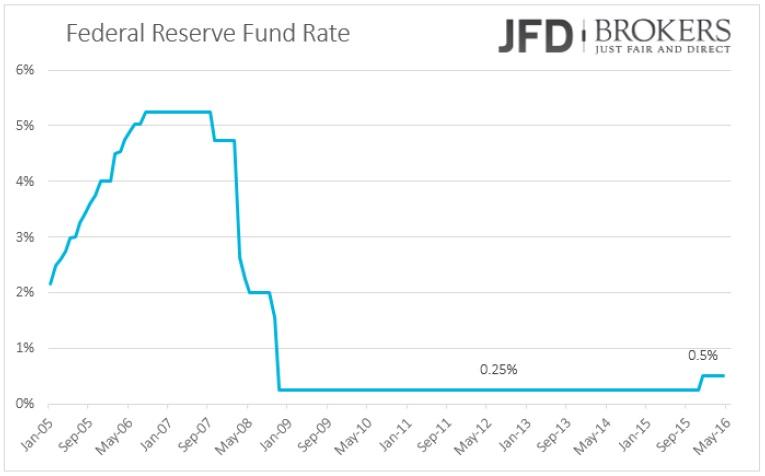

RBNZ Official Cash Rate on hold

The NZD/USD enjoyed the fourth straight winning session after the announcement that the Reserve Bank of New Zealand will keep interest rates on hold at 2.25%. However, the positive reaction of the kiwi following the policy meeting was on the back that the market was expecting the policymakers to signal a rate cut in the next policy meeting in June or further stimulus measures. The RBNZ statement did contain that “The outlook for global growth has deteriorated over recent months due to weaker growth in China and other emerging markets” and that “The exchange rate remains higher than appropriate” according to country’s export prices. A lower New Zealand dollar will favor the exports and boost inflation.

Following the event, the NZD/USD pair plunged below the 0.6835 figure, suggested level to sell, however, the bears failed to sustain their positions below the 0.6825 level and bounced up from there to turn the candle positive and to end the day above the psychological level of 0.6900, suffering some minor losses. Technically, following yesterday’s aggressive rally I would expect the NZD to appreciate further against the USD. Therefore, the next level to watch will now be the 0.7050 (June 2015 highs).

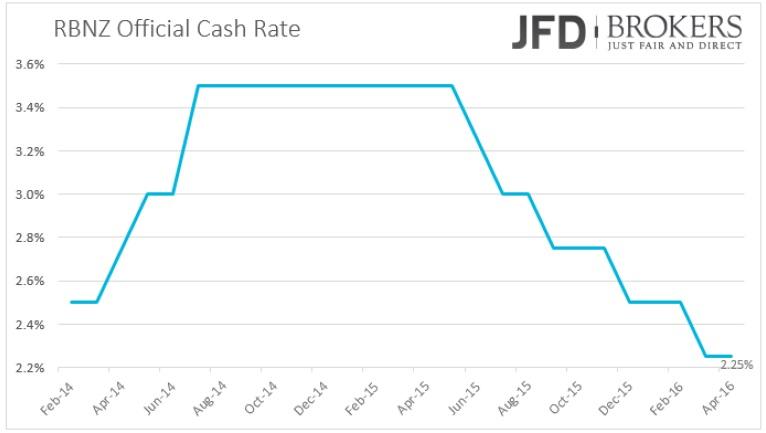

BoJ Refused to take further stimulus measures

Bank of Japan policy meeting was the most shocking out of the three and the one that has the biggest market reaction. Even though the central bank left the interest rate unchanged despite the high probabilities of a rate cut, the decision that shocked the market was the position of the policymakers against to fresh stimulus measures. The economy is facing some hardships and stagnating growth and the central bank will continue its negative rate policy and voted to keep its massive asset purchase scheme unchanged, however, no fresh measure will be taken to push the economy further.

The USD/JPY plunged below the 110.70, as suggested in yesterday’s report, and the 200‐SMA on the 4‐hour chart after the BoJ policy meeting to end the day ‐2.40% lower. We managed to take some profit, +65 pips, following the fall below 110.70, but the price continued to plunge as a result the traders that remained in the market to suffer a loss, since we expected the price to find some support around the suggested target area, 109.90 – 110.00. Two days before the end of the month, the pair is ready to record another negative month, currently at ‐3.27%, following a negative March ‐ 0.10% and a red February ‐6.90%. The USD look set to remain under some downside pressure against the JPY, although interest is beginning to become thin following yesterday’s rally and I don’t think it is heading anywhere too far from current levels.

Euro remains muted

Euro continues to be in the background for the week, as the absence of market driver economic news does not help the currency to determine its direction. The EUR/USD, unexpectedly, had a muted reaction to the release of the FOMC statement. The pair recorded an intraday low at 1.1270 before surpassing 1.1330. However, few minutes later the bulls failed to sustain their gains above that barrier and came back to close near 1.1300.

UK Economy Keeps the same growth potential

The UK economy kept the same rate of growth as the last quarter of 2015 at 2.1% year‐over‐year. Amid the Brexit worries, the market was expecting the growth to slightly slow down at 2.0%. The GBP/USD pair traded between 1.4470 and 1.4580 right after the FOMC statement, settling above 1.4515, and presents a mild positive tone in the 4‐hours chart. Overall, the upside remains favor, yet the pair needs to advance beyond the immediate resistance at 1.4640 to be able to continue rallying towards 1.4670. Therefore, we remain long on GBP/USD, targeting 1.4580 and then 1.4640.

Economic Indicators

During the morning, Germany’s unemployment rate for April will be released. Afterwards, in Eurozone, various sentiment indicators regarding consumers, businesses, services and industries in April will be released.

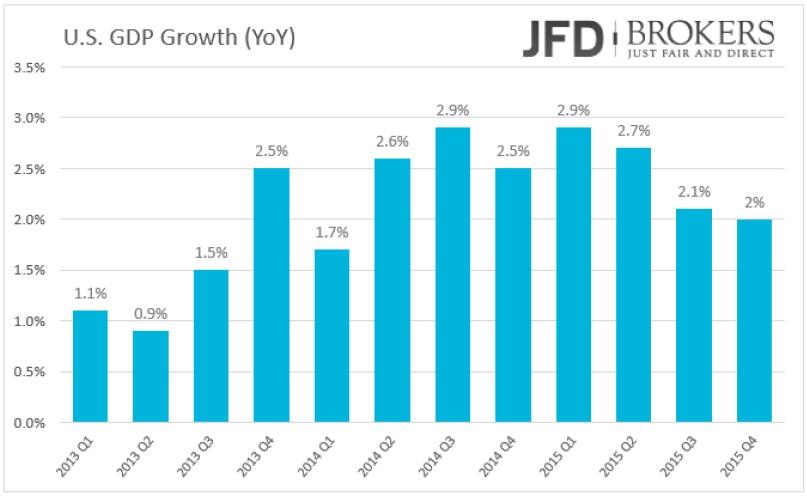

Going to U.S., the GDP for the first quarter is expected to slow down severely to 0.7% quarter‐overquarter from 1.4% before. There is no market consensus available yet for the year‐over‐year figure.

The weekly jobless claims will be released as usual as well as the Personal Consumption Expenditures Prices for Q1. The New Zealand’s Building Permits for March and UK’s Gfk Consumer Confidence for April will come out. Overnight, the Bank of Japan outlook report will be released.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.