Today is a big day for the market where three major banks will announce their interest rate decisions in the next 24 hours. The Federal Reserve, Reserve Bank of New Zealand and later the Bank of Japan have their policy meetings. In UK, the first estimate of the annual GDP Growth for the first quarter will be released.

U.S. dollar lower ahead of Fed meeting

The U.S. dollar was traded lower against most of the G10 currencies while it surged against the Australian dollar which plunged early in the morning following the inflation report released. The U.S. Durable Goods Orders rose by 0.8% in March below market expectation of 1.8%. The growth of the services sector increased to 52.1 in April from 51.3 before, according to the Markit PMI, however, it also disappointed as the market consensus was for a bigger growth of 52.3. The Consumer Confidence declined to 94.2 in April from 96.0 expected.

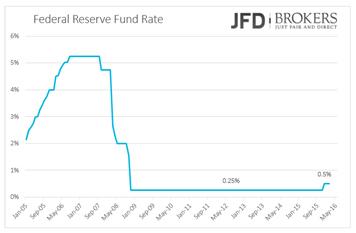

At 18:00 GMT time Fed will announce its Interest Rate Decision followed from a Policy Statement half an hour later. Since December, Federal Reserve Fund Rate stands at 0.5% with the perspective of more rate hikes to follow. Two more rate hikes are expected this year less than initially estimated. After many alternations of views that come out from the Fed policymakers, traders will closely watch Fed Chair Janet Yellen press conference to get more clues about how many rate hikes the bank will do this year and when it will be the next one. The press conference is very likely to leave the door open for a rate hike in the next policy meeting, June 15, but with a possible pullback if the data does not come as expected.

The forecasts for the first estimate of U.S. GDP growth suggests that the economy advanced just by 0.7% the first quarter of the year continuing the growth slowdown started the last year. The first quarter rose of 2015 the economy expanded by 2.9% slowing down to 2% the fourth quarter. Inflation Rate also fell from the record increase in January and is currently slightly less than 1%, below 2% inflation target but by far better than last year’s figures around zero. The labour market of the country still adds more than 200k jobs monthly, indicating a strong sign of expansion. The Unemployment Rate remains at 5% while the Average Hourly Earnings have been in a mixed up and down situation. In February, the wages declined by 0.1%, the biggest and the only drop over the last months while they also experienced numerous flat months and some increases of 0.3% in January and 0.3% in March.

EUR/USD – Technical Outlook

The EUR/USD pair has had a range bound session 1.1215 – 1.1330 on Tuesday ahead of the FOMC meeting due later today. The Federal Reserve are generally expected to remain on hold and this was underlined after the release of the March Retail Sales which fell less than expected, by -0.3%, but also saw a sharp decline on Durable Goods for March. As we said, the pair has traded in a range and currently sits pretty much in the middle, leaving the outlook unchanged. The initial support will arrive at Friday’s low, below which would then head to 1.1180 and then to 1.1100. Below there would then have the chance of returning to 1.1060, which includes the 200-SMA on the daily chart. If we see another move higher then the next target, above 1.1330, will be at last week’s high at 1.1400. Above this would then target the 11 April high at 1.1440 beyond which would then look towards 1.1460. Above the critical level at 1.1460, there is not a whole lot of support to be seen until 1.1600.

Reserve Bank of New Zealand Policy Meeting

At 21:00 GMT time, the Reserve Bank of New Zealand will have its policy meeting accompanied with a Monetary Policy Statement. The Benchmark Interest Rate is 2.25% and it’snot expected to change for now, as it has lowered rates last month. However, I would expect the monetary policy statement to mention that further rate cuts will take place if needed. Last month, beyond the lower Interest Rates, the policymakers stated that further stimulus may be required.

NZD/USD – Technical Outlook

NZD/USD is looking bullish at the moment as is trading above the psychological level at 0.6800, which coincides with the 200-SMA on the 4-hour chart. It’s remarkable that for the last 2 months the NZD added 500 pips to its value against the NZD, as the pair rose for a second consecutive month after rebounding from 0.6350. Both the Fed and RBNZ are likely to keep rates steady later today, and the focus rests squarely on the tone of their statements and any timing for an eventual rate hike. Technically, the 4-hour and daily charts remain positive, so a sustained break above 0.6950 could then see a move towards 0.7050. The downside will find sellers at 0.6825 and then at 0.6750.

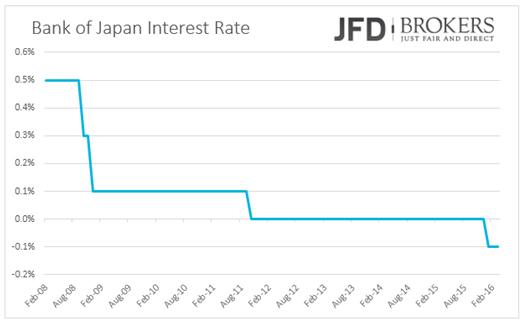

Bank of Japan Interest Rate Decision; Odds for a Rate Cut are High

Later in the Asian session attention will be turned to Japan. The National Consumer Price Index for March as well as the Unemployment Rate for the same month are coming out. The Core CPI is expected to show a drop of 0.2% from a flat month before yoy while there is no available forecast for the CPI. The Unemployment Rate is expected to remain stable at the record low level of 3.3%. The flash Industrial Production for March will be also out a few hours before the BoJ monetary policy.

During the night, the Bank of Japan will have its policy meeting and the probability for a rate cut is very high. The central bank will announce its Interest Rate Decision and will publish the Monetary Policy Statement. The Japanese yen is very high making more difficult to the economy to fight the global slowdown. The central bank surprised the markets in January by adopting a negative rate policy, cutting its Benchmark Interest Rate at -0.1%.

USD/JPY – Technical Outlook

The USD/JPY has been in a range the last few days ahead of the Fed and BoJ policy meetings. Following the aggressive rally which started from 107.60, speculation of further easing sent the yen reeling late last week, but uncertainty over whether the BoJ will actually deliver fresh stimulus at its April 27-28 meeting saw the yen recover some ground on Monday and early Tuesday. As it stands, I would expect the selling pressure to continue and the pair to test 110.70 and then the critical level at 110.00. However, as long as the pair remains above 110.00 I will remain bullish on this pair, targeting 113.15.

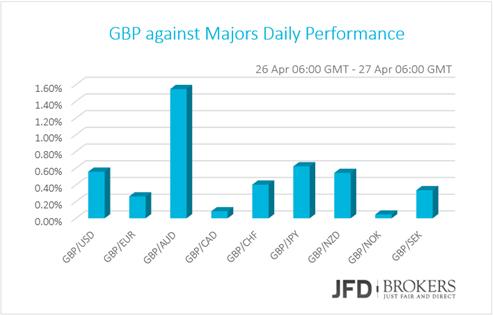

GBP Rises as UK Chances to Remain in EU increases; UK GDP ahead

The British pound rose versus the majors on the prospect that UK will not leave the European Union. The latest ORB poll released yesterday indicate that +51% are for staying in the E.U and +43% for leaving (prior poll was +53% and +43%). Today, the traders will eye the first estimate of the UK annual GDP for the first quarter of the year which is forecasted to remain at the same level of growth at 2.1% while compared to the quarter before, the economy is expected to rise by 0.4% lower than 0.6% before.

GBP/USD – Technical Outlook

The GBP/USD has rallied during yesterday’s session to a 2-month high as the market assesses whether they have been too hasty in pricing in the prospects of the U.K. exiting the EU. The pair rose for a second consecutive week adding more than 1.5%, recovering all the losses made the first 2 months of 2016. It is very significant that the pair is trading above the 1.4435 and the 1.4515 levels, as well as above the daily 50-SMA. With this in mind, I remain GBP-bullish targeting 1.4700, which coincides with the 200-SMA.

AUD/USD plunged following deflation figures for the first time after 7-years

The AUD/USD pair plunged after Australia’s CPI fell by -0.3% qoq as falling oil prices, food and clothing prices drove down the cost of a basket of goods and services. Australia saw deflation for the first time in seven years in the first quarter and thus will add a further pressure to the RBA next week to cut rates further. The annual Inflation Rate rose by 1.3% while it was expected to rise by 1.8%.

The pair is sitting just above the 23.6% Fibonacci retracement level, near 0.7600 and the medium term charts are now looking rather more negative for the Aussie and further losses could be possible in the days ahead. Looking to sell the rallies seems to be the plan, although the hourlies are becoming rather oversold, following yesterday’s sharp move, and may need to correct themselves so we could see better levels than these to look to sell into.

XAU/USD – Technical Outlook

The consolidation was seen in the precious metal over the last few months, which previously looked like a descending triangle has now become a symmetrical triangle. This is typically a continuation pattern, regardless of whether it appears in an uptrend or a downtrend, so the test to the upside during yesterday’s session came as no real surprise. What this does suggest is that following the aggressive rally over the last couple of days, we may finally be about to see a rally above the upper boundary of the triangle.

With this in mind, the next key level of support for gold, and therefore a potential exit from the pattern is the $1,260 level. Above here we have the $1,270 level which also coincides with the upper boundary of the symmetrical triangle. Above these levels, the next obstacle for the bulls will be the key resistance level at $1,284. Above there, as we said before, there is very little support until the ultimate target at $1,300. On the downside, the $1,225 continues to provide strong support to the bulls while the significant area at $1,208 - $1,210 will provide an important support to the bulls in case of a pullback. For now, I will remain bullish on gold, targeting $1,260. However, some other traders who prefer to keep a more conservative stance they should wait for a decisive exit above the upper boundary of the triangle.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD drops toward 0.6500 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is extending losses toward 0.6500, hit by an unexpected drop in the Australian Retail Sales for March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data failed to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY holds rebound to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold price traders remain on the sidelines ahead of FOMC decision on Wednesday

Gold price remains confined in a narrow range as traders prefer to wait on the sidelines. Reduced Fed rate cut bets revive the USD demand and act as a headwind for the metal. Investors now await the FOMC decision and US macro data before placing directional bets.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.