The greenback was traded lower against the majors as the housing sector gave a second slap to investors. The UK Prime Minister and the U.S. President supported Britain remaining in the European Union bolstering the sterling to rise versus its major peers. The euro has been on a clam session on Monday as well as the next few days with smattering low-level data out from the Euro area. Fed policy meeting tomorrow will be strongly eyed as investors expect to get clues regarding June’s rate hike, which means the next scheduled meeting on 15th of June. Traders’ attention will be on U.S. releases today as the economic indicators coming out will inform us for the Durable Goods Orders, Services sector growth and Consumer Confidence.

U.S. Housing Sector shows weakness; Dollar Lower

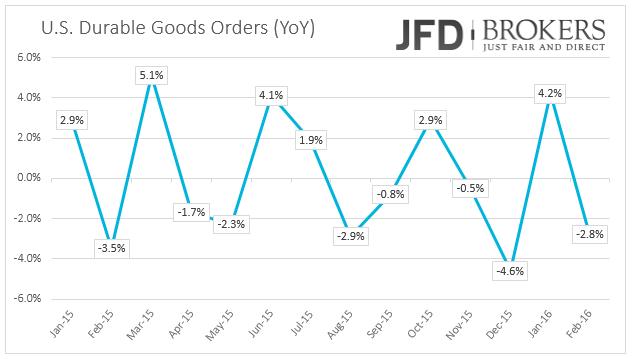

The U.S. dollar slumped slightly against all the majors on Monday after the New Home Sales revealed a severe decline of 1.5% to 0.511M in March from 0.519M before. Last month, they had also a drop of 0.4% and in March were expected to fell by 1%, less than the real figure. That was a second hit from the housing sector, as last week the Building Permits and the Housing Starts posted a big drop in March but the Existing Home Sales released later in the week, increased and relieved partly the housing investors. Today, we will get a flurry of economic data from U.S. ahead of tomorrow’s Fed interest rate announcement. The Durable Goods Orders for March and the preliminary Markit Services PMI for April will be released as well as the Consumer Confidence from April.

Euro marginally changed on quiet days

Except Thursday’s and Friday’s scheduled economic indicators, the rest of the week’s economic calendar is very quiet, no major events are expected that will affect the market importantly. The euro was marginally unchanged against the G10 currencies during Monday’s calm session. The German IFO Survey released yesterday showed that confidence in the Businesses, as well as the Expectations and the Current Assessment, slowed down more than anticipated in April.

EUR/USD - Technical Outlook

The EUR/USD pair has started the week with a slightly positive tone maintaining its gains above the significant support level at 1.1215 ahead of a busy week as the Fed, the RBNZ and the BoJ hold their respective monetary policy meetings. The pair came under pressure the last couple of days and fell more than 1%, following the failed attempt above the critical level of 1.1400, as well as the failed attempts 3 weeks ago above the 1.1454 – 1.1465 zone.

The pair managed to close above the 50-SMA on the daily chart despite numerous failed attempts in the last couple of days and is now attempting to test the key resistance level at 1.1300. It’s worth noting that the pair is moving above the ascending trend line which started back in mid-November 2015, as well as above the 200-day SMA.

Therefore, as long as the bulls hold above these obstacles I would expect to test the critical level at 1.1300. Beyond there would want to take a look at 1.1400 and a break of that would then allow a run towards the 1.1454 – 1.1465 zone. However, I think the level to watch will be the 1.1300 as I think it will be a strong hurdle for the bulls in the next couple of days since it coincides with both the 50-SMA and the 200-SMA on the 4-hour chart. The charts generally look quite positive for the greenback and a return to the downside would see some bids at 1.1230, below which would allow a return to 1.1150 and at 1.1100, around the trend line.

UK Prime Minister and U.S. President do not support Brexit boosting the sterling

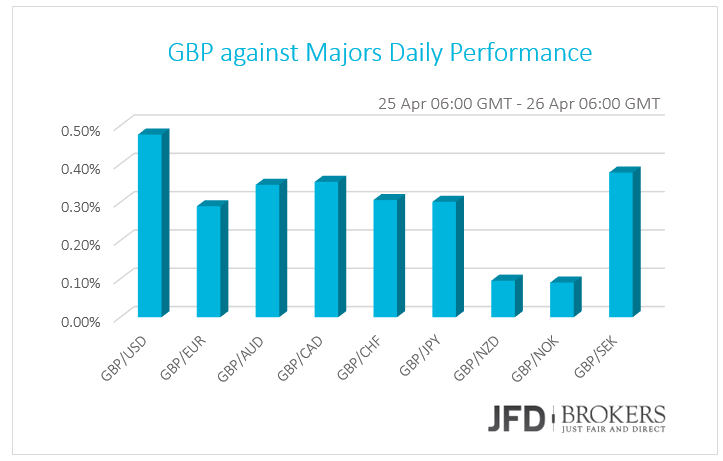

The pound was traded higher against its major counterparts on Monday as the UK Prime Minister David Cameron and the U.S. President Barack Obama stated their support for Britain to remain in the European Union. The perspective that Britain will vote to stay in the union supports strongly the pound.

GBP/USD – Technical Outlook

The GBP/USD pair rose 3.20% in March, its first monthly gain following four consecutive months of decline, with a strong April rally that appeared to have triggered a considerable amount of short covering alongside a build in bullish longs. UK will publish its GDP figures for the first quarter on Wednesday. UK economy is expected to have expanded by 0.6% qoq in the first three months of 2016.

Technically, there is again very little change, although the 4-hour chart does look a little more positive, following the aggressive rebound from the 1.4300 level, suggesting that we could see a squeeze to the upside in the next couple of days.

However, the pair is now testing a strong technical level at 1.4515, yesterday’s suggested target and March highs. If we see a pullback the bulls should find support around 1.4460 and then at the psychological level of 1.4400. Below the two aforementioned levels, the short-term descending trend line, as well as both the 50-SMA and the 200-SMA on the 4-hour chart, are ready to provide a significant support to the price action. On the other hand, a decisive break above the strong level at 1.4515 should open the way towards 1.4580. All in all, GBP/USD continues to face further upside risk.

USD/JPY – Technical Outlook

The dollar weakened against the yen for a second session Tuesday as investors sold the U.S. currency ahead of the Fed and BoJ policy meetings. Following the aggressive rally which started from 107.60, speculation of further easing sent the yen reeling late last week, but uncertainty over whether the BoJ will actually deliver fresh stimulus at its April 27-28 meeting saw the yen recover some ground on Monday and early Tuesday. As it stands, I would expect the selling pressure to continue and the pair to test 110.70 and then the critical level at 110.00. However, as long as the pair remains above 110.00 I will remain bullish on this pair, targeting 113.15.

USD/CAD – Technical Outlook

The USD/CAD pair fell more than 8% since the beginning of this year and it extended its losing streak to 3 months as it closed below what it had been a key support region throughout September and October 2015. While we are seeing some consolidation over the last few days, the outlook for the pair looks quite bullish for a correction towards the long-term descending trendline, around 1.2900. Along the way, it may run into resistance around 1.2750, 1.2820 and 1.2856, but given the busy week ahead of us, as apart from the Fed’s policy meeting, some major data releases will also be important for the dollar’s moves, I see no reason right now for it not to be trading back at April highs in the coming days. Furthermore, despite the spike higher in the pair at the end of last week above 1.2750, I think it is still looking bullish for further correction, although in order to confirm this I will need to see a break of the 50-SMA on the 4-hour chart, which currently lies around 1.2750. Alternatively, a failure to hold above 1.2600 in the coming days, could provide an opportunity to retest the key support level at 1.2593 (year lows) and thus would negate any bullish scenarios for the pair.

Brent crude and WTI: Oil hits fresh 2016 high

Oil prices hit a fresh 2016 high few days ago following a weaker dollar ahead of the U.S. Federal Reserve monetary policy. The Brent Crude oil added more than $18 per barrel since mid-January, reaching the significant level and our ultimate target at $45.00. West Texas Intermediate crude oil added more than $15 per barrel after reaching $26 per barrel back in mid-February. The U.S. Energy Information Administration (EIA) reported a 2.1 million-barrel climb in crude-oil supplies to 538.6 million barrels for the week ended April 15. Meanwhile, the total domestic oil production declined by 24k barrels a day to 8.953 million barrels a day in the latest week, EIA data showed. Technically, both the WTI and the Brent will face some hurdle around the $45.00 area, which I think it’s going to take at least 2-3 attempts or a pullback before we see a break above here.

Economic Indicators

Today, all the attention will be turned to U.S., as important economic indicators will be released a day ahead of the conclusion of the Fed two-day policy meeting. The Durable Goods Orders are expected to have increased by 1.7% in March compared to the month before that dropped by 3.0%.

The flash Markit Services PMI for April will be released as well as the CB Consumer Confidence for April which is forecasted to have slowed down in April. Meanwhile, in Canada the BoC Governor Stephen Poloz will give a press conference.

Later in the day, New Zealand’s Trade figures will be released while overnight, Australia’s inflation rate for the first quarter will be closely eyed. The year-over-year indicator is predicted to show that consumer prices rose by 1.8% the first quarter of 2016 from 1.7% the previous quarter. In Japan, the BoJ Governor Kuroda has a press conference.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.