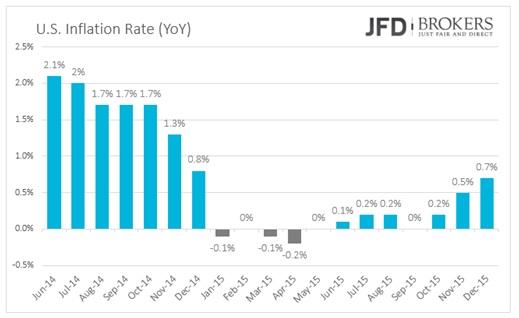

The U.S. dollar was slightly lower against its major peers on Wednesday and early Thursday as the consumer prices increased at a smaller pace than expected in December. On year-over-year, the U.S. inflation rate picked up to 0.7%, the highest since December 2014, however, the market predicted a biggest growth up to 0.8%.In comparison with the month before, the consumer prices decreased by 0.1%.

Euro drops ahead of ECB meeting

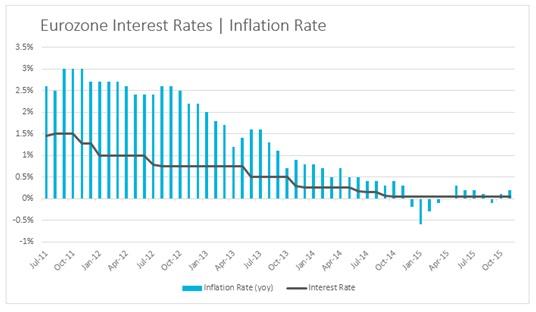

The single currency slumped against its counterparts on Wednesday ahead of the European Central Bank policy meeting. Wednesday was quiet in terms of economic news in Eurozone. Today, no changes are expected to the interest rates, to the Quantitative Easing program or further easing measures, however, the general tone is expected to be dovish after the disappointing December meeting.

The EUR/USD pair found support on the 4-hour 100-SMA and rallied upwards on Thursday morning, and the bulls keep this momentum and push the price above 1.0940, we may see the price at 1.0970 soon. On the other hand, if the pair manage to break below the psychological level at 1.0900 and to penetrate through the three simple moving averages, 50, 100 and 200, is likely to drop at 1.0820.

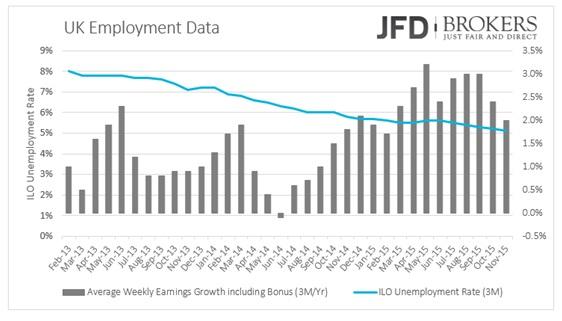

UK jobless rate on 10-year low while wage growth below expectations

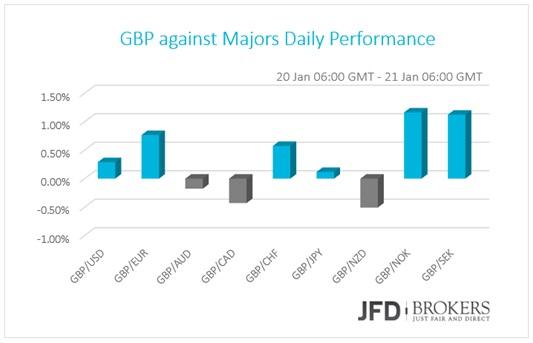

The sterling was traded mixed versus the G10-basket on the mixed data of the employment report. The UK jobless rate for the three months to November decreased at a 10-year low, 5.1% below expectations of 5.2%. The Claimant Count change for December revealed that the unemployed people declined by 4.3K while the wage growth slowed more than expected. The wages including bonus rose by 2.0% during the three months to November missing market’s forecast of 2.1% from 2.4% the month before.

The GBP/USD is in the track to deliver the fourth negative week and continues to be traded near 7-year lows. The pair is under heavy sell-off and dropped by 5.3% since the last week of December.

There are no any signals that the sharp sell-off is about to end. The next level to test to the downside is 1.4060. If the aforementioned level fails to support the pair the next level to watch is 1.3660.

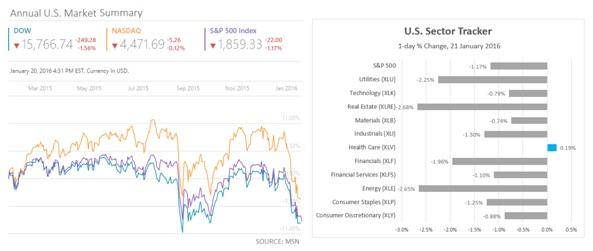

U.S. Indices Sell-Off Deepens

The U.S. indices raise concerns as they continue to fall with small daily pauses as the oil continues to fall and the Earning Reports to disappoint. The Dow Jones Industrial Average plunged 249 points or 1.56% on Wednesday while the S&P500 fell 1.17%. Nasdaq suffered slight losses of 0.12. However, on the macro-view, all of the three indices lost near 10% in January.

The most blue-chip stocks ended sharply lower. The IBM’s stock (NYSE: IBM) was by far the biggest drag on Dow Jones. It is the worst performed constituent stock in DJIA, and declined near 5%, followed by Exxon Mobil Corporation (NYSE: XOM) that tumbled by 4.25%. It’s worth to notice that Goldman Sachs shares closed at the lowest level has been in nearly 3 years following its Earnings Report. The EPS was 4.68 marginally below market’s forecast of 4.69.

The biggest losers overall were the Real Estate and the Energy stock as the U.S. housing starts dropped by 2.5% in December and missed expectations to rise up to 1.200M, instead the number fell to 1.149M while the oil fell below $28 per barrel.

Economic Indicators

Today, the European Central Bank will decide about their interest rates. Even though not changes to the monetary policy are expected, the shared currency is expected to be affected as the meeting is followed by a press conference of the ECB president Mario Draghi.

The weekly U.S. jobless claims will be out as usual. In Eurozone, the preliminary consumer confidence is anticipated to decrease to -5.8 from -5.7, a disappointing development following the consecutive improvements of the previous two months. During the night, in Australia, the Westpac consumer confidence for January will be eyed.

-------

Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.