The Apple stock (NASDAQ: AAPL) plunged -1.16% after the company announced that will install the device needed at some Starbucks coffee stores, KFC, and Chill’s restaurants to boost mobile-payment service. The service will be in a pilot form and these stores will accept that kind of payment by the end of 2016. The announcement may drop the stock in the short-term, based on the fact that previous efforts of other companies like Google Inc., and eBay Inc. to promote the mobile payment service failed, but in the long-term this may be proved out the start of a new technology leisure in our life, and profitable for Apple Inc., that will promote indirectly the apple watch as well! It’s notable that apple watch is a new-launched device the recorded below forecast sales, unprecedented for the Apple.

Apple stock fell for a second consecutive day, however, the losses were limited. Looking at the weekly performance the stock is set to deliver a second consecutive negative week, following a 3.77% losses the previous week. Moreover, the stock started the month in negating footing as it has been traded negative -0.73% so far this month, following a -2.18% for September, -7.04% for August, -3.28 for July and -3.73% for June; more than 15% losses the last 4 months.

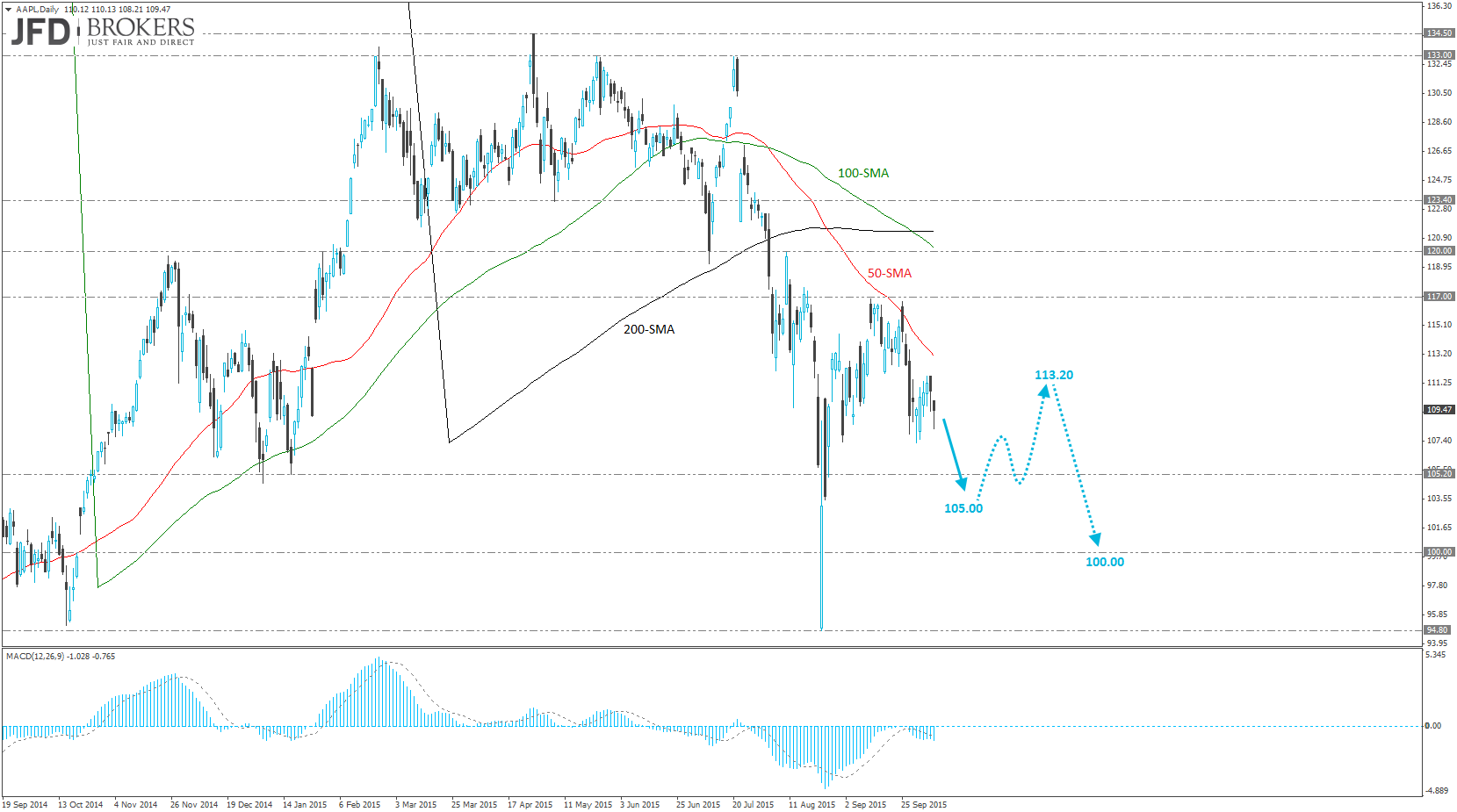

On our August’s Apple report “Is Apple Facing a Double Bite?” we have locked profit on our trading suggestion which forecasted the stock to fall below $100.00. “Such a move could easily spark a more aggressive run towards the ultimate price target and historical level at $100.00.”

Following the mid-August move, where the share moved below the psychological level of $100.00, but didn’t achieve a daily close below that level, it will now be the next highlight for the stock, whether can hold above this level and for how long, following the pressure of the its last Earnings report. The report of the Q3 had missed the estimated revenues and revealed the then new device the company launched, the apple watch, was unable to reach the break-even point, even though its possibilities were “enormous” according to the CEO Tim Cook.

I would expect the stock price to remain under pressure and test the psychological level $105.00 in the short-term. From there, I would expect a pullback and then, is more likely to rise up to $113.20. If the bulls fail to sustain the move above the level of $110.00, I would expect the stock to test the psychological level of $100.00.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.