EUR/USD Roller Coaster on the Run! Pound Plunged 450 pips in 7 Days! NOK collapsed after Norges Bank Rate Cut!

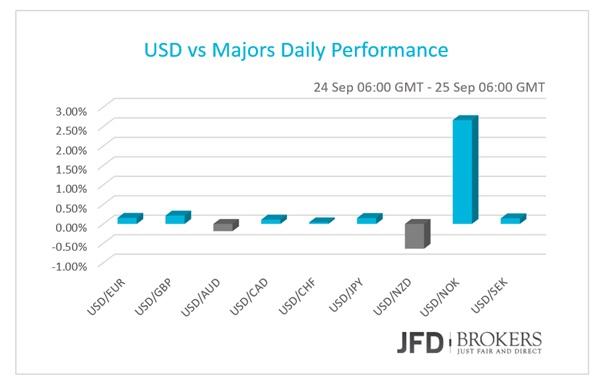

Fed Chairwoman Janet Yellen’s hawkish speech increased by far volatility in the market. Most of the major FX pairs closed at their opening levels after sharp moves except NOK cross pairs. Norges Bank cut interest rates, for the second time this year, plunging the currency.

Fed Chairwoman said clearly rate hike is likely this year

On Thursday, most of the major FX pairs ended near their opening levels, however, there was significant volatility during the trading session. The U.S. dollar was the driver currency of the day moved by Janet Yellen’s comments. The greenback fell sharply the first half of the trading session and rallied upwards the rest of the day. Fed Chairwoman said that the U.S. central bank is likely to raise interest rates later in this year if the economy achieves the conditions they set which include the increase of inflation rate and employability maximization. Beyond that, she kept a distance by saying that economic “surprises” could force them to change that plan.

The Durable Goods Orders met expectations of -2.0% in August while the Durable Goods Orders ex-Transportation remained the same with 0.0% change, falling short of the forecasts to have grown by 0.1%. The New Home Sales showed a recovery in the sector after a slight slowdown the months before.

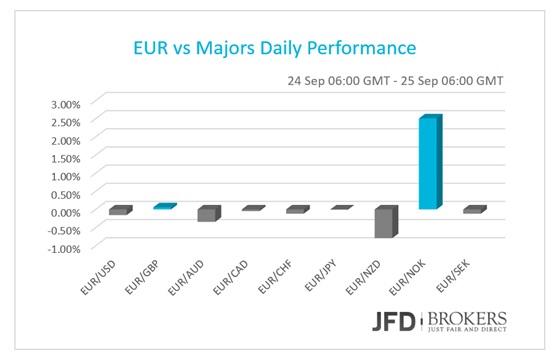

Euro marginally unchanged but had significant volatility through the day!

The euro currency pairs closed Thursday’s trading session at the same level they opened, except against the Norwegian krone, as Norway’s central bank cut interest rates by 25bp to 0.75%, and the New Zealand dollar.

The German Gfk survey showed a decreased morale among the consumers in October of 9.6, below the market’s forecasts to fall at 9.8 from 9.9 before. The IFO Survey revealed that the Current Assessment in Germany worsened more than expected in September while the Business Climate and the Expectations, also for September, improved. The Targeted LTRO (Long-Term Refinancing Operation) decreased to €15.5 billion from €73.8 billion before.

EUR/USD, roller coaster on the run!

The euro had a roller coaster ride this morning against the dollar, in fact, the EUR/USD tested the 1.1297 level with a range of 150 pips. The most surprising thing is that the pair went all the way back, in only eight hours, from 1.1297 to yesterday’s opening levels of 1.1165. In my last EUR/USD post, my closing comments emphasized that the market was heavily short euro and that a move towards 1.1090 – 1.1105 zone might squeeze out some late shorts to the game. Downward pressure may eventually return, following the temporary buy above the aforementioned zone, however, the key to watch will be the 50-SMA around the 1.1150 and the 200-SMA slightly below the 1.1090 – 1.1105 zone, both on the daily time. So, a break of these obstacles would strongly suggest there’s been a change of bias in the markets.

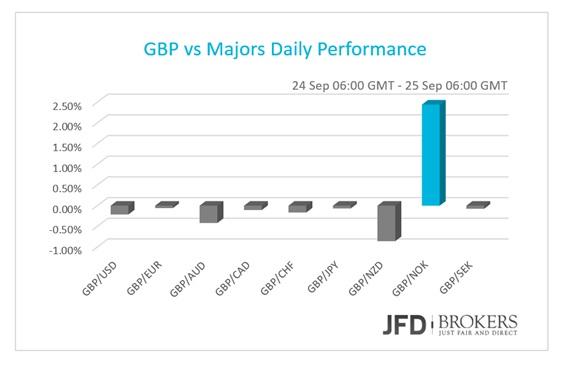

Sterling covered its losses despite the absence of domestic economic news

The absence of market-driver news at the domestic macroeconomic front on Thursday pushed the GBP cross pairs to react as the rest of the major FX pairs, closed near their openings levels. The only economic indicator released from the UK was the BBA Mortgage Approvals for August which rose to 46.7K from 46.3K prior.

GBP/USD is also looking bearish!

Sterling is also looking a little bearish against the dollar this morning. The bearish move came following the break below the significant 1.5500 level, as well as, below the both the 50-SMA and the 200-SMA on the daily and 4-hour charts. If we see a 4-hour or even better a daily close below the significant level of 1.5160, then we could see a much bigger retracement, following seven consecutive negative sessions. Therefore, the key level to watch for this pair is the 1.5160. A close below here would have suggested that the pair had entered a new downtrend, prompting a move towards 1.5100 for intraday traders and then to 1.4980 for short to medium term traders.

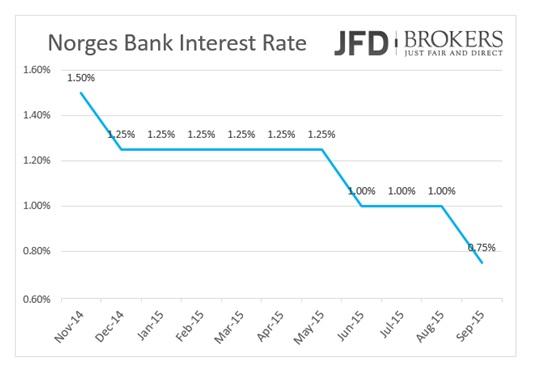

Norwegian Krone Slumped after Surprise Rate

Cut The Norwegian krone plunged near 2.5% against the U.S. dollar, the Euro, and the British Pound, after Bank announced its decision to its benchmark interest rate by 25bp to 0.75%, the second rate cut in the year. The central bank took this surprise decision on the weak growth of the economy. The Governor Oeystein Olsen stated that “Growth prospects for the Norwegian economy have weakened, and inflation is projected to abate further out. The Board has therefore decided to lower the key policy rate now.” He also added that the current economic outlook suggests further rate cuts in the coming year.

The U.S. dollar surged above the psychological level of 8.3000 against the NOK, following the announcement from the Norges Bank, closing the day with gains more than 2%. It is very remarkable that the USD/NOK pair is on track to record a fifth straight positive month, currently being at 2.45% for September. Having in mind the above, we should pay more attention to the longer term chart, which is continuing to show the pair as being bullish and according to an old saying that “The trend is your friend” we remain bullish on this pair, with the next target being the 1.4850 and then 1.4920.

Gold - Technical Outlook

Gold surged above $1,142 on rate hike doubt, while the dollar regained some of its ground against its major counterparts. The precious metal found a strong support around the psychological level of $1,100 and since then is moving north. The next obstacle for the bulls will be the $1,170 barrier, the August’s high, while it will be a very significant move for the bulls to sustain the move above the $1,142 level, as well as, above both the 50-SMA and the 200-SMa on the 4-hour chart. Short-term traders should also watch the 200-SMA on the daily chart as is ready to provide a significant resistance to the metal around the $1,170 level, a level that I think we could see in the next few days.

U.S. Indices lower on Yellen's comments

Fed Chair Yellen pushed the U.S. stocks lower. All of the three most popular closed down for the third consecutive day. The weekly performance of the three indices showed that Dow Jones and S&P 500 lost more than 1% while NASDAQ edged lower near 2.0%. The blue-chip stock Caterpillar Inc. was the top loser company of DJIA with a record loss of -6.30%!

Economic Indicators

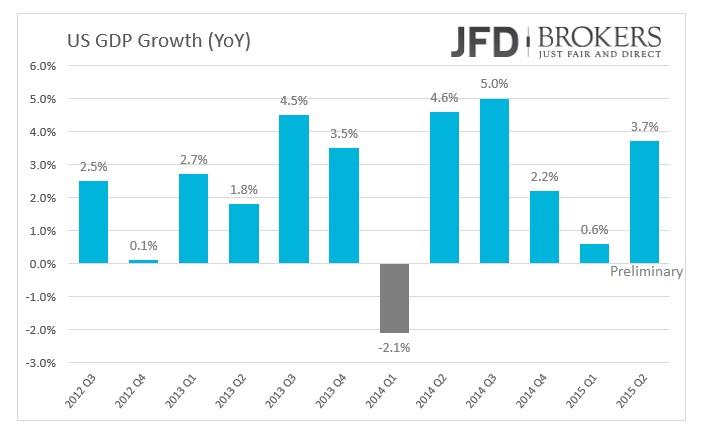

The German Buba president has Jens Weidmann has a press conference. In US, the release of final GDP growth for Q2 will hog the limelight.

The personal consumption expenditures for Q2 is scheduled to come out as well as the flash Markit Services and Composite PMI for September. The University of Michigan will print the flash consumer sentiment index also for September.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD rises to daily tops past 1.0800 post-NFP

The selling bias in the Greenback gathers extra pace on Friday after the US economy created fewer jobs than initially estimated in April, lifting EUR/USD to the area of fresh peaks above 1.0800.

GBP/USD surpasses 1.2600 after disheartening US Payrolls

The resumption of the downward pressure in the US Dollar motivates GBP/USD to extend its earlier advance to the area beyond 1.2600 the figure in the wake of the release of US NFP.

Gold climbs to new highs above $2,300 on poor NFP prints

The precious metal maintains its bullish stance and breaks above the $2,300 barrier on Friday after US Nonfarm Payrolls showed the economy added fewer jobs than expected during last month.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.