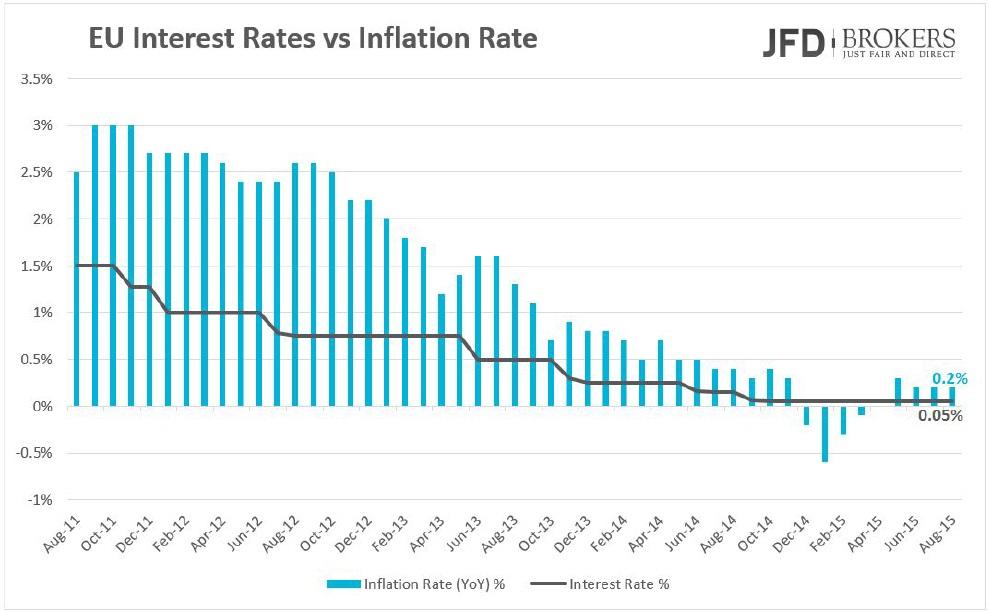

European Central Bank keeps its interest rate unchanged at the record low of 0.05% the last year after multiple continuing rate cuts the three years before. In this policy meeting, we would expect the ECB President Mario Draghi to give more emphasis to the positive marks. Six months after the ECB began the Quantitative Easing programme (QE), eurozone's growth has improved and the unemployment rate fell to its lowest figure since February 2012 and inflation is back above zero.

Furthermore, the recent slowdown in China, even though it has been triggered global fear and aggressive sell‐off in the markets, the impact on the eurozone should be relative small; thus the recent euro appreciation. The euro surged more than 2 percent in August, emerging as one of the winners vs the dollar. Even though Draghi avoids commenting on the euro, the recent euro appreciation is likely to be in the main stage in the Questions and Answers (Q&A) part.

Despite that the European Central Bank is expected to keep interest rates unchanged in today’s meeting – the central bank maintain a ‐0.2 percent deposit rate, a 0.05 percent main refinancing rate, and a 0.3 percent marginal lending facility rate – the weaker inflation outlook as well as the recent euro appreciation raise speculation that the central bank could provide more stimulus to the eurozone economy. This is another significant point that the market participants will watch closely, as any comments from Draghi on this topic could spark more volatility in the markets.

Eurozone's road to QE

The European Central Bank’s road to QE programme, which started on 9 March 2015 and will last at least until September 2016, led to an aggressive sell‐off of the euro’s value, which typically helped support the banking system, as well as, it has helped to improve both the exports and inflation. The euro’s depreciation from the psychological level of 1.4000 against the U.S. dollar which drove the euro to as low as 1.0460 after QE was launched, came to an end, as the recent market turmoil and the Federal Reserve delay to raise interest rates pushed it higher to about 1.1700 in late August before retracing again below the psychological and significant level of 1.1400.

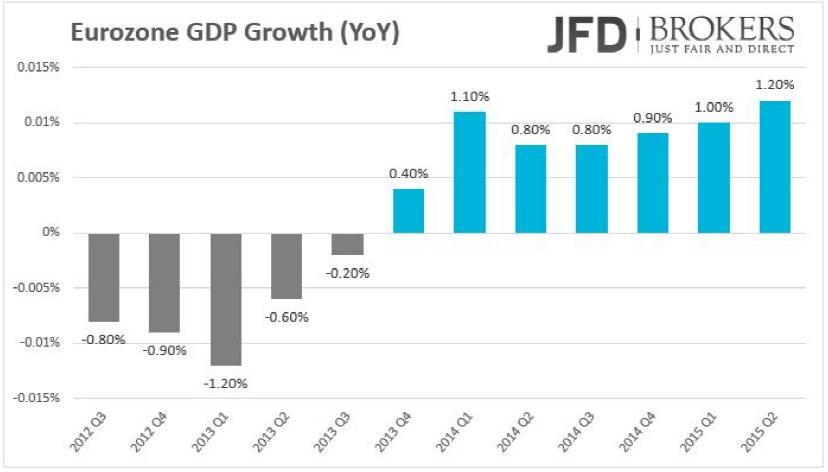

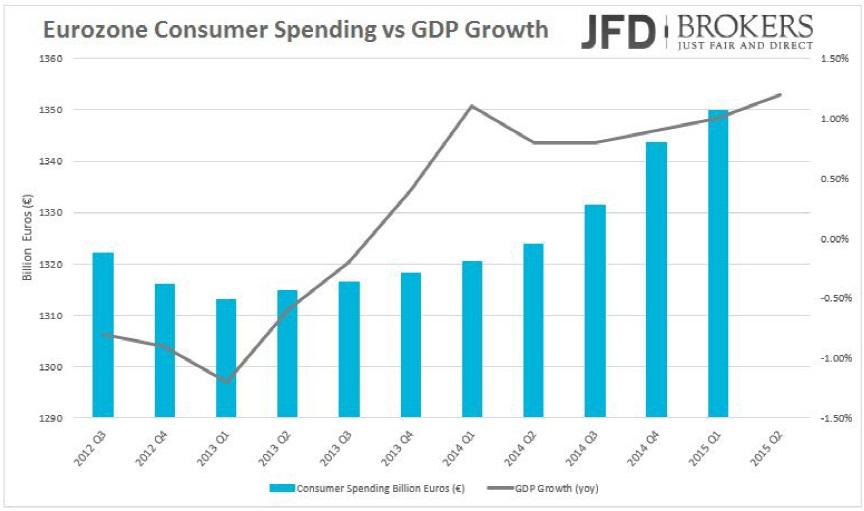

Economic Growth

Eurozone’s economy keeps advancing steadily since the start of 2014. Beyond that, the second quarter of 2015, the economy posts its highest growth in the last four years, of 1.2%, driven from the fastest growing personal consumption. The consumer spending reached an all‐time high the first quarter of 2015 rising more than 2% compared to the same quarter a year before.

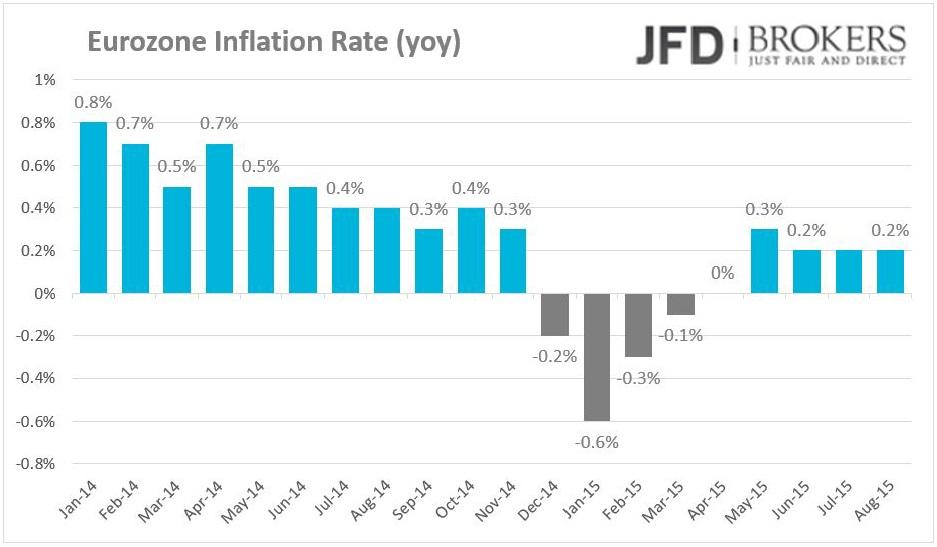

Inflation rate

Another one possible action from ECB is to cut inflation forecast. In every policy meeting, the inflation rate is high on the agenda and is one of the main reason ECB cut interest rates in the recent past and started buying bonds issued for governments in the eurozone to stimulate the economy.

The QE programme started in March 2015 and showed its impact on inflation rate quickly. During the last four months, consuming prices rose at a steeper pace than 0.2%, on a yearly basis, leaving behind the months of deflation. However, after the recent events with China’s devaluation and the plunging oil, the central bank may consider than inflation rate forecast for 2016 of 1.3% is far away from the current figures. The Inflation expectations for 2017 is 1.6%.

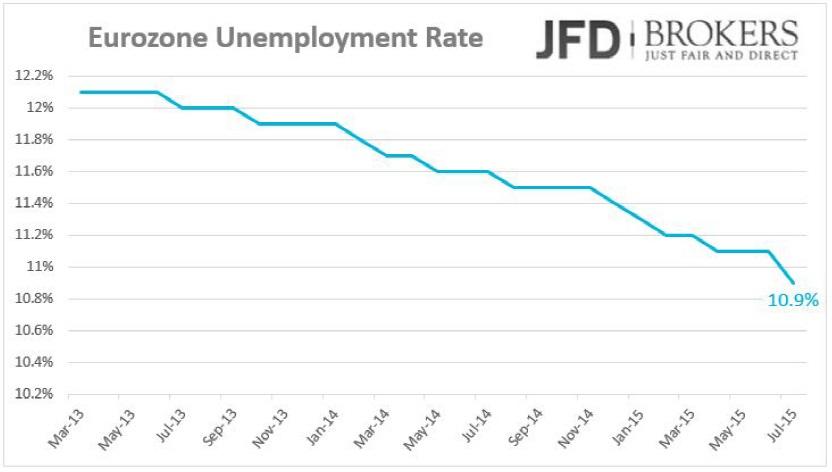

Labour Market

We expect the ECB President Mario Draghi at his press conference to comment on the labour market that showed a powerful growth the last months on the back of strong GDP growth. The unemployment rate drops gradually since mid‐2013 reaching a two‐year low in July. The people actively looking for a job in the Eurozone decreased to 10.9% of the total labour force, while the employment change posts positive numbers since the beginning of 2014. Another one strong card in the labour market that the ECB president can refer to is the wage growth. The first quarter of this year, the wages grew by 2.2% marking the biggest increase since 2012.

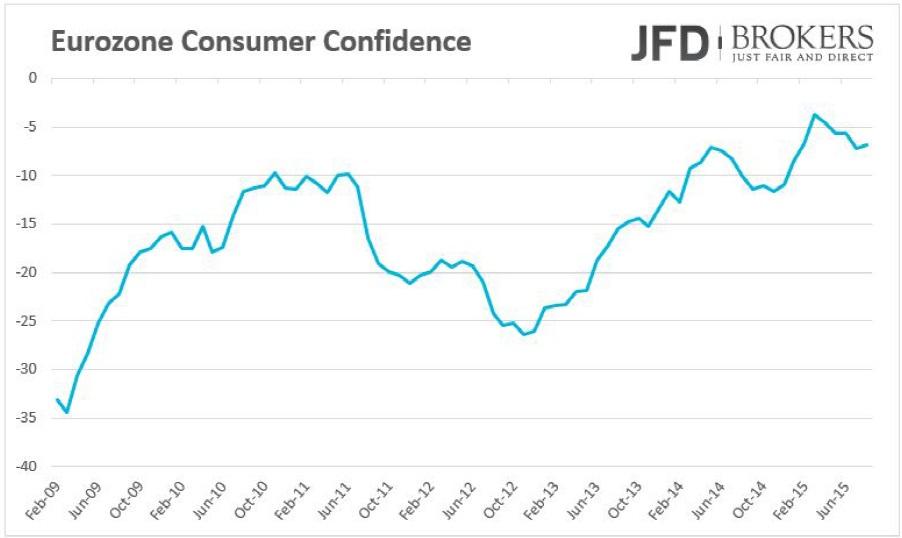

Confidence among consumers is rising impressively

Consumer Confidence, a significant factor in an economy in order to keep consuming spending high, is rising impressively since the end of 2012 with a little dent at the end of 2014, before the beginning of QE program. The indicator is negative since its all‐time high of 2.40 in 2000, however, positive numbers may be eyed soon, if consumers keep their momentum in confidence unchanged.

Euro Relieved from Grexit Fear

Another reason that the euro has picked up is the fact that Grexit has been left in the past. Greece’s debt crisis was solved by both sides agreeing on all of the terms for the third bailout package of €86 billion. Greece met all of its debt requirements to the International Monetary Fund and the new discussions between Greece officials and their creditors are now looking forward to a debt relief.

Conclusion

The recent positive developments in the eurozone are evidence that the euro’s cyclical recovery has finally begun, despite the recent turmoil in the global financial markets. The Eurozone’s economy fundamentals are improving, with strong GDP figures, since the launch of the QE in March. Furthermore, the technical picture for euro looks more bullish as the euro continues to recover against the dollar, as the EUR/USD pair has been trending higher since March. Ahead of tomorrow’s U.S. NFP and Fed’s policy meeting mid‐September, the ECB event could easily turn into a non‐event since traders will pay more attention to Fed's interest rate decision.

EUR/USD Outlook!

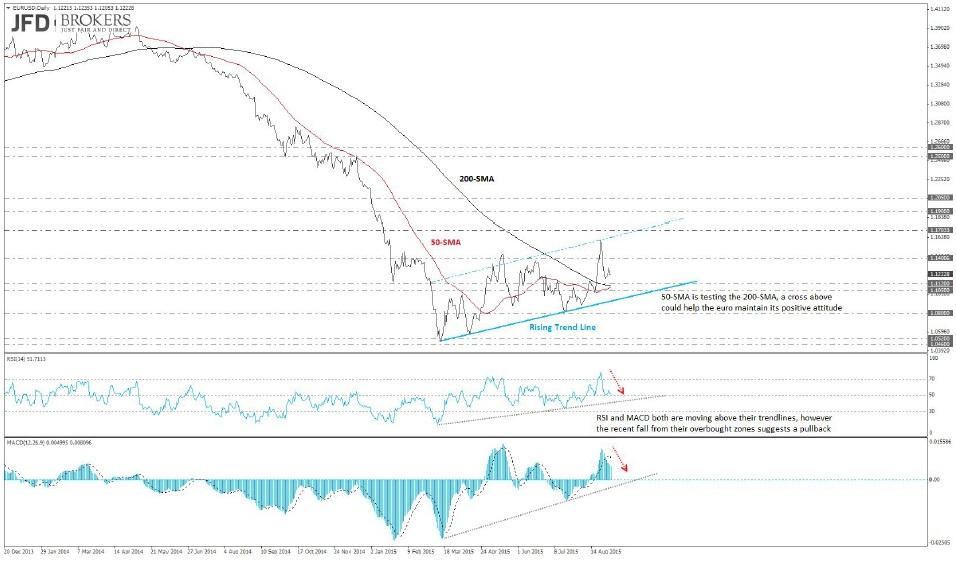

The long‐term charts show a series of lower lows and lower highs after the pair reached the 1.40, however, in the correction of recent months there have been a series of higher lows and higher highs following the break of the long‐term descending trend line which started back in May 2014. The pair gradually consolidated between the psychological level of 1.0800 and 1.1400, following the aggressive buy above the latter level, where the euro reached the 1.1700 mark, levels not seen since January 15.

Looking at the daily chart, following the so‐called fake breakup above 1.1400 the euro’s pullback was extremely sharp. The key to watch on the downside, ahead of the ECB meeting, will be the 50‐SMA and the 200‐SMA as well as the key support level of 1.1050, which all of them are likely to provide a significant support to the bulls.

If Draghi reinforces a dovish message, this could add further pressure on the euro and we could see it testing the aforementioned obstacles. It is very important the pair to hold above these obstacles ahead of tomorrow’s NFP report. A failure to do so, would act as confirmation of a continuation pattern – the recent consolidation –prompting further pressure on the ascending trend line that has provided so much support so far. Below here, further support would be found around 1.0800. On the other hand, in case of a change in the language and the ECB’s tone, this could add to euro’s recent positive sentiment, which could help the pair break out of the range. Breakouts from such consolidations often lead to sharp moves and thus a fresh high above 1.1700 should be seen before the all‐important Fed meeting.

EUR/GBP Outlook!

Despite the last few bullish weeks, on a weekly basis, the EUR/GBP pair has been in a downtrend and the prices are still way below the major descending trend line. Currently, the pair is locked in a range between the support of 0.6940 and the resistance of 0.7500. The weekly history shows that the 50‐ SMA is acting as a dynamic resistance zone and currently, the prices are traded close to it. Even though, we have seen a bullish impulse as the pair rebounded from 0.6940 lows, the main trend remains bearish as long as the prices are traded below the descending trend line. Technically, we expect the pair to test the resistance zone above 0.7500, rebound and head towards 0.6940. A close below 0.6940 will be a signal for further declines towards 0.6600. On the other hand, if the bulls are able to push through 0.7500/0.7600 and the prices remain above the descending trend line, the scenario turns bullish and a rally towards 0.8050 should be expected.

EUR/JPY Outlook!

During the last couple of weeks, the EUR/JPY pair has confirmed for a 3rd time the main descending trend line and rebounded successfully from it, favouring the downtrend. The weekly price action suggests that bears are dominating the pair. We spot two very big bearish engulfing patterns that have left the prices way below the 50‐SMA. From a technical perspective, as long as the prices are traded below the descending trend line, the downtrend is likely to continue, and a weekly close below 133.00 would be a confirmation for further declines towards 126.00. The technical structure, the candlestick price action and the fundamental picture, all point for further depreciation of the single currency against the Japanese Yen. However, technically, a bullish push that breaks through the main descending trend line would be a signal for change in the long‐term bearish trend and a weekly close above 141.30 would be a double confirmation for a trend reversal.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.