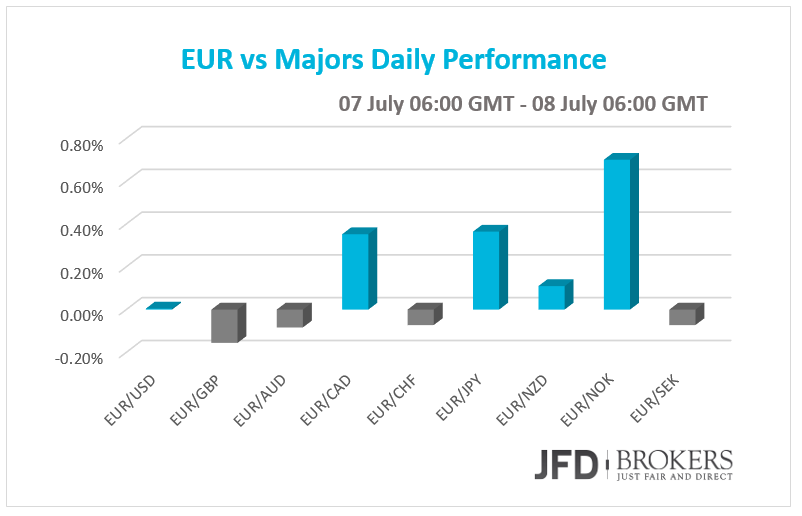

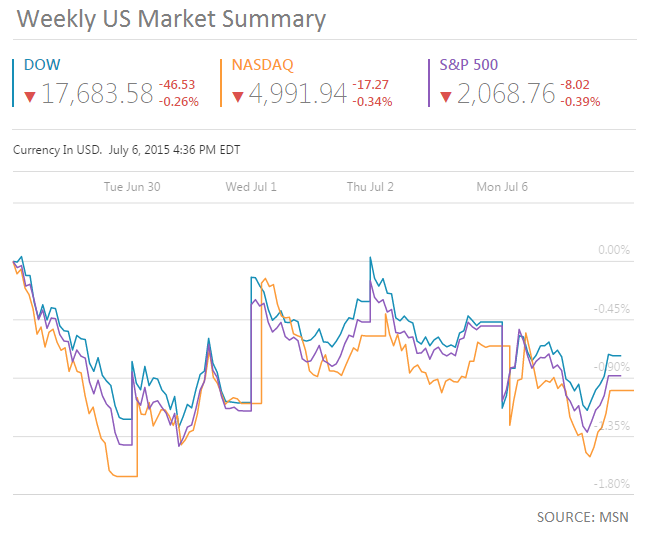

The greenback firmed against most of the major currencies since Monday, with significant gains only against Norwegian Krone and losses against Swedish Krone. The Markit Services PMI for June met the preliminary numbers, indicating the third time in raw that the sector performance declines. The euro stuck at 1.1000 as awaits news on Greece while the pound bounced from 200-SMA and rose to reach 1.5630 where the 100-SMA provides resistance. AUD/USD remained unchanged over the last three says as RBA kept its Interest Rates unchanged for the second straight month. Gold and Silver remained under pressure on the back of a stronger dollar. The three most popular US Indices edged lower on Grexit worries.

EUR under pressure on Greek final Chance for a Plan without Grexit

The euro was traded mixed against the major currencies on Monday and early on Tuesday as Greek Prime Minister was given hours to prepare a new plan in order to keep the country in the euro. Today the Prime Minister will submit the plan at the emergency meeting today and if the EU creditors refuse the plan the Grexit could be a deadlock. The IMF Director Christine Lagarde informed the Greek PM for their policy to not lend money on countries on arrears. Greece missed the €1.6 billion debt payment to IMF on 30th of June 2015. Meanwhile, the Greek Banks remain closed at least until Wednesday and the Capital Controls of €60 per day continues. The new Finance Minister of the government is Euclid Tsakalotos after Yanis Varoufakis resigned to give a potential to the discussion, as he stated.

EUR/USD hovering near 1.1000

The single currency started early Tuesday trading lower after the Greeks voted (61%) to refuse further austerity measures. Greece failed to repay €1.6 billion to the IMF on June 30 and is also due to pay €3.5 billion on July 20 in a maturing bond that is currently held by the ECB. EUR/USD continues to trade heavily below both the 50-period SMA and the 200-period SMA on the 4-hour chart, as well as below the key resistance level of 1.1150. Having in mind the above, the psychological level of 1.1000 is a very important support and an eventual break here could lead to a further downward pressure, opening the way towards the critical 1.0800 – 1.0900 zone, which is a key zone for the bulls in the medium-term.

Pound Under Correction; Finds Support at 200-SMA

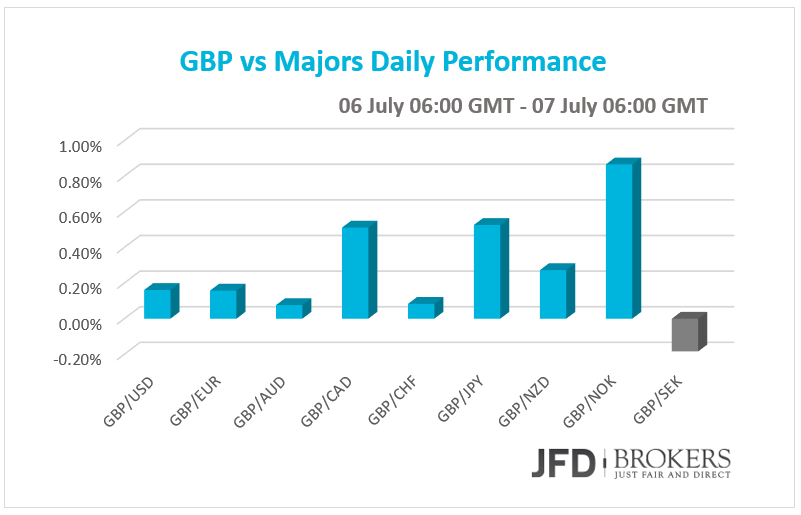

On the short-term view, the British pound rose against the major currencies on Monday and early Tuesday as the UK Banks have limited exposure to Greek Banks and GBP traders feel safer as they know that the UK officials met to prevent the country from the Greek crisis consequences. No economic data released from Britain on Monday. The BoE Monetary Policy meeting in Thursday will attract considerable attention, although, is not expected to enclose any changes.

GBP/USD Bulls could take the lead

The pound declined over the last several days by 400 pips, in what is considered a technical correction of the trend, as it was expected! (http://bit.ly/1GPCU1R) ‘However, I would expect the pair to test the 1.5540 – 1.5550 area before it resumes upwards towards the 1.5660 – 1.5570 zone’. As it stands, I would expect a battle to take place between both market forces, the bulls and the bears, around the 1.5500 – 1.5530 zone, where the 200-period SMA as well as the ascending trendline which started back in mid-April, combined to provide a significant support to the price action. Following the correction below the 1.5750 and 1.5660 levels, I would expect the GBP/USD pair to test the 1.5660 barrier in the next couple of days. If it fails to achieve such a test, it could prompt a more aggressive move towards the key support level at 1.5500, with the next support level coming around 1.5440.

USD/JPY pauses declines at 122.00

The correction between the dollar and the Japanese yen is continuing this morning as the price moved higher after testing the lower boundary of the sloping channel and the 121.90 level. The medium term and the long term bias certainly appears to remain bullish, however, I expect the price to move further down for more correction in the near term before the rally continues. A decisive violation below the 122.00 barrier, which coincides with the lower boundary of the sloping channel, will confirm the validation of the correction, targeting the next support at 121.50, an important technical level. Alternatively, only a break above the 125.80 will confirm the continuation of the uptrend and negate any bearish scenarios. However, for now we could see the pair testing some significant resistance levels including the 123.00, 123.75 and 124.35 levels, before testing the 125.80 level.

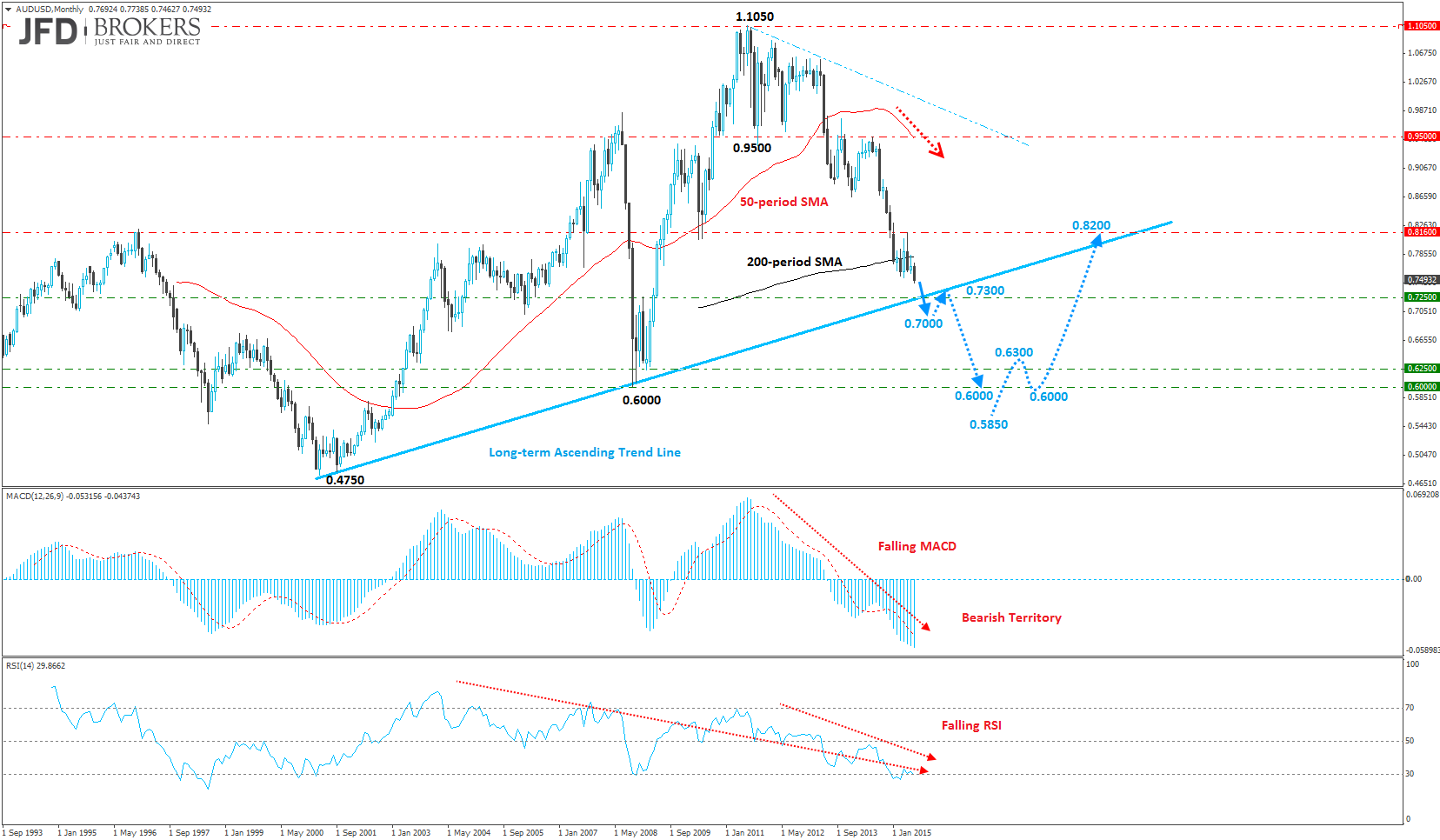

AUD/USD Dropped slightly after RBA hold off its Interest Rates

The Australian dollar dropped 0.10% against the greenback after the Reserve Bank of Australia announced its decision to hold its interest rate unchanged at 2.0% after May’s rate cut. Although, the bank left the door open for another rate cut. The weaker Aussie do not concern RBA Governor Glenn Stevens as the AUD dropped as much as other currencies. The Australian economy was growing over the past year but less than the long-term average growth. The Labour sector of the country advances but very slowly while the inflation rate is foreseen to remain consistent the next couple of years, even with a low exchange rate for the Australian dollar.

AUD/USD continues to trade within a small range the last couple of days, moving between 0.7535 (intraday high) and 0.7463 (6-year low). The break below the 0.8000 has allowed the pair to reach a fresh 6-year lows, which could now prompt a move towards 0.7410. This is also close to the next key psychological level of 0.7400. The next major target for the pair will be around 0.7250. Going forward the longer term picture is continuing to look bearish since the 50-period SMA remains below the 200-period SMA on both the daily and weekly timeframes. On the monthly chart, the pair remains under heavy pressure, approaching the ascending trend line which started back in 2001. It is very significant that the price is moving below the 200-period SMA while the 50-period SMA is sloping downwards.

U.S. Dollar Index

Back in the middle of June the Dollar Index (DXY) surged higher to through the resistance level at $95.00 to a then a month high around $96.70, before spending the next few days consolidating and trading within a narrow range around $96.50, receiving support from the key $96.00 level. If we drop down to the hourly chart, the 50-period SMA as well as the 200-period SMA, both are providing a significant support to the index, especially the 200-SMA. The level of $96.00 is the key to understanding whether we are watching for a correction for the US index. However, at this stage there is no evidence indicating this and therefore I will remain dollar-positive.

U.S. Indices closed slightly down

The most popular U.S. Indices closed down on concerns of Greece after the “OXI” (NO) message to more austerity measures from the referendum on Sunday. The Nasdaq Composite PMI lost 0.34% of its value with significant stock declines. The Emmis Communication Corp stock (NASDAQ: EMMS) decreased by 53.33%, the top loser stock of the Tech index. The Dow Jones Industrial Average suffered 0.26%, -46.53 points down to 17,684 with General Electric Co (NYSE: GE) the stock with the major losses of 1.87% and the Intel Corp (NASDAQ: INTC) following with 1.73% down. The S&P 500 edged 0.39% below its opening level, closing at 2,069.

Gold and Silver Outlook!

The precious metal rose more than 1% on Thursday following the US Non-farm Payroll report, however it came under selling pressure and fell below the $1,170 early Monday despite the Greek historic ‘NO’ - Greeks rejected the terms of a bailout package in a referendum. The precious metal typically seen as an alternative investment during times of financial and economic uncertainties, however the last months it moves opposite the dollar value. A stronger dollar makes gold more expensive for holders of other currencies, while also lowering its appeal as a hedge. Technically, the metal is trading in a range of $1,230 - $1,130, for some time now, with the $1,200 being a crucial level, while is forming lower highs since mid-2013. As long as the metal holds above the $1,135 - $1,140 zone I remain bullish. At this point it’s worth noting that the 4-hour MACD is moving upwards above it trigger line while the RSI bounced from the 30 level and moved upwards suggesting that the bears are losing ground.

A similar picture prevails in Silver, with the white metal to remain under pressure below the resistance level of 16.50, where the 50-period SMA and the 200-period SMA are combined to provide a resistance to the metal in case of a pullback. The key levels to watch are the 15.50 and 15.25. Below here we have the 15.00 level and then the 14.30 barrier, which also roughly coincides with a previous fibo level. At the moment, this looks like the most likely point of reversal for the XAG/USD, although this is of course just a guess at this stage.

WTI and Brent Crude oil: More downside expected

WTI fell sharply early on Monday after Greece rejected austerity measures demanded in return for bailout money. WTI crude oil fell below the key support level of $56.60 which includes the 200-period SMA on the daily chart. Going forward, until the end of last week the 4-hour chart was looking a little bearish with the move below the $60.00 level, followed by the period of consolidation, creating a trading range formation. Now that we’ve had confirmation of the bearish bias, as the price plunged below the $56.60 level, we expect the crude oil to fall further prompting a more aggressive move towards the psychological level of $50.00.

Brent crude oil plunged more than 1% and fell below the key support level of $61.40. Brent crude prices slipped for a fifth straight session. It is clear that oil prices are still affected by the bearish sentiment on the back of the melting situation in Greece. At the moment writing, the crude oil is trading near a new found support at $56.35. Going forward, the latter level is providing sufficient support to the bulls but I do not expect this to hold much longer. The key level here will be the $55.00 for me. If this level is broken in the next few hours, it would suggest that the market has turned more bearish, opening up a move towards the $50.00 level. All in all, the bias will remain bearish as far as the $62.00 level is intact.

Economic Indicators

The spotlight of the day is the European Leaders Special Summit on the afternoon which will give a first signal what the European Leaders and the Greek government plan for the Greek future.

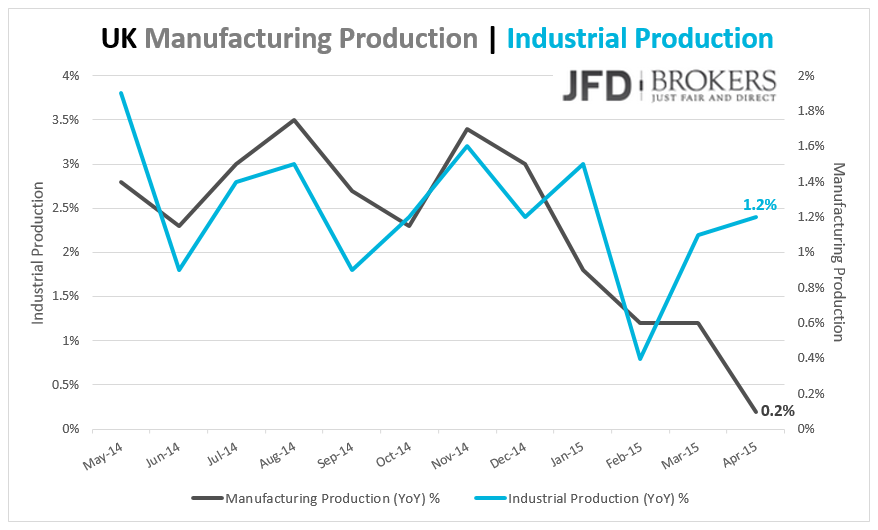

In UK, the Industrial and Manufacturing Production for May are scheduled for release. Later in the day, the NIESR GDP Estimate for the last three months will be eyed from the investors, as the BoE officials will monitor closely the GDP for their decision to raise interest rates.

In the US, the JOLTS Job Openings for May and the Economic Optimism for July are expected.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.