The Canadian dollar is trading slightly lower against the euro as traders anxiously awaited today’s Bank of Canada policy meeting. The market expects the BoC to maintain its policy rate unchanged at 0.75%. Earlier, the loonie rose to a month-high vs euro, boosted by better-than-expected GDP data, which came at 2.4% qoq, a bit slower than the pace seen in the previous quarter but better than what analysts were expecting of 2.0%.

From the end of 2010, the interest rates were risen and kept at the level of 1.0%. In their last meeting, the BoC decreased its interest rates to a historical low of 0.75% in response to falling oil prices. This rate cut, was a measure to avoid the risk of deflation. Inflation fell to 1.0% in January from 1.5% in the previous month and 2.0% in December. The continuous fall of oil price, keep the traders alarmed as it directly affects the value of the Canadian dollar.

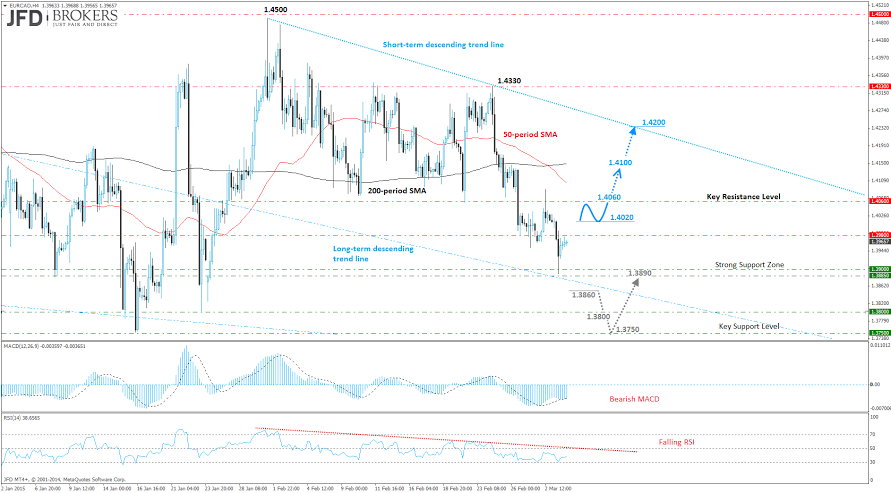

Technically, the EUR/CAD pair found strong support yesterday just below the psychological level of 1.3900, where the descending trend line which started back in May 2014, propped it up. This was also a previous resistance so there was clearly plenty of support around this key level. On the upside, the pair is expected to face a hurdle near 1.4100, which includes the 50-period SMA as well as the 200-period SMA on the 4-hour chart.

Going forward, the 1.3980 is providing sufficient resistance to the pair but I do not expect this to hold much longer. The key level here will be the 1.4060 for me. If this level is broken in the next few hours, it would suggest that the market has turned more bullish, opening up a move towards the 1.4200 barrier. A break above here, then it would open the way towards the 1.4330 region. All in all, the bias will remain bullish as far as the 1.3885 – 1.3900 zone is intact.

Alternatively, if we see a break lower, which I do not foresee at the moment, the pair should find support around the key support level of 1.3800 and 1.3750.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD drops toward 0.6500 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is extending losses toward 0.6500, hit by an unexpected drop in the Australian Retail Sales for March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data failed to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY holds rebound to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold price traders remain on the sidelines ahead of FOMC decision on Wednesday

Gold price remains confined in a narrow range as traders prefer to wait on the sidelines. Reduced Fed rate cut bets revive the USD demand and act as a headwind for the metal. Investors now await the FOMC decision and US macro data before placing directional bets.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.