Last week all traders expected specifics of terms of interest rate increase of Fed U.S., however, Janet Yellen didn't mention exact dates in her speech. It caused a panic in the currency market as expectations of a great many of people weren't satisfied, as a result the raised volatility has been lasting till current week, as a consequence the currency pair EUR/USD passed 200 pips. However, you shouldn't forget that the panic is a temporary phenomenon and everything will calm down soon and will resume its normal course, and here everyone will remember "the quantitative easing program ", and that the destiny of Greece is still not decided. Therefore further decrease in couple of currencies is expected.

Main movement of currency pair

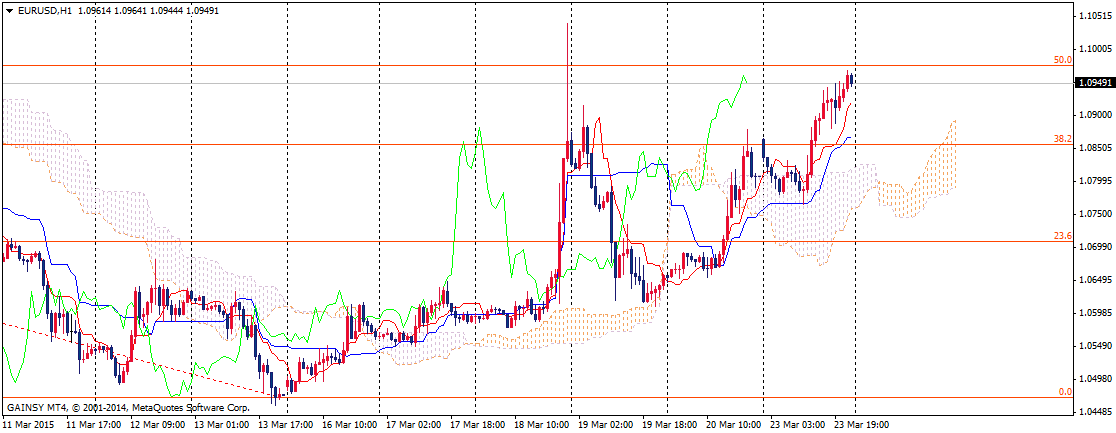

EUR/USD pair switched into ascending movement, Tenkan and Kijun lines are below the price curve, the price moves above the descending cloud, the descending movement of currency pair from the level of resistance 1,0975 is predicted. Traders should take “sell” positions below the level of resistance 1,0975, to fix profit at the levels of support 1,0915, 1,0860, 1,0820.

Alternative movement of currency pair

If EUR/USD pair manages to break through and get fixed above the level of resistance 1,0975, continuation of the ascending movement to the following levels of resistance 1,1000, 1,1040 will be possible.

Level of resistance: 1,0975; 1,1000; 1,1040.

Level of support: 1,0915; 1,0860; 1,0820.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.