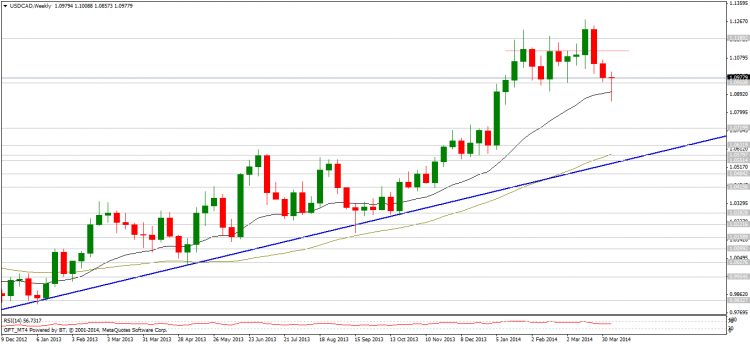

Weekly chart: The drop was stopped at the 20 moving average and thus the exchange rate might be able to climb higher on the chart following the two and a half week long selling period.

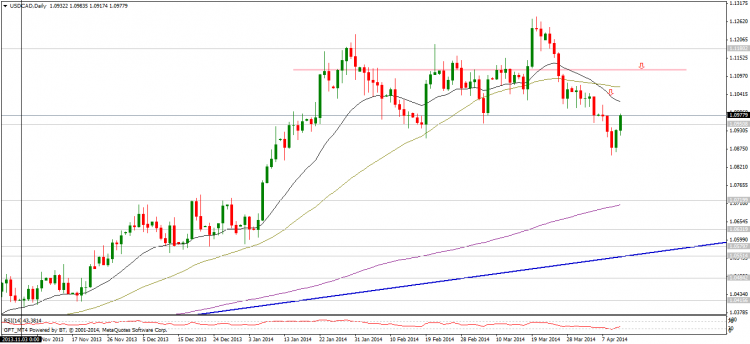

Daily chart: The selloff following the fake breakout stopped at the 1,085 levels as it changed direction in the last days of the week. Further advances are made possible if the pair can conquer the 1,0950 levels back, but the resistances at 1,111 and the moving averages should keep a lid on upmoves beyond these levels. The long term uptrend is becoming steeper and this brings with it a possibility of a drawn out correctional phase.

Marketprog Ltd. excludes any liability for any damages resulting from the use of data and information representing the published content or the company website. Analytical reports, evaluations and selections available on the website and as published content are exclusively for informational purposes; they cannot and shall not be considered to represent investment advice or analysis from Marketprog Ltd. or a public offer. Neither shall the content of the website or otherwise published content be considered a call encouraging investment in products researched by the Software embedded in the website or in any published content. All liability and risk in connection with making any investment decision shall be borne by the user irrespective of how the use of the Software embedded in the website, or any published content might have influenced such decision.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.