Market Overview

Market sentiment is positive still and this is allowing equity markets higher. The interesting factor is that as US Treasury yields continue to move higher (ever since the FOMC meeting put December back on the table for a possible rate hike), Wall Street is also pushing higher. This would suggest markets are comfortable with this prospect (at least for now). The improvement in the China Services PMI to 52.0 from 50.5 last month is also a boost for sentiment and risk appetite. With Wall Street closing higher again with the S&P 500 up 0.3%, which has also helped to push Asian markets higher, whilst comments from China President Xi suggesting that China growth would not be lower than 6.5% in the years to 2020 have also been supportive. European markets have started well in early trading.

Forex markets remain on a similar track to yesterday, with euro weakness and the Aussie once again stronger. The yen and sterling are both broadly flat. The continued rebound in the oil price has also been supportive for market sentiment, with the bounced helped by news of potential supply disruptions in Brazil and Libya.

Traders will be watching for the service sector PMIs which are released throughout the day. The Eurozone data is at 0900GMT and is expected to improve to 54.2 from 53.7 last month. The UK services PMI is at 0930GMT and is expected to also improve from last month’s terrible reading of 53.3 back higher to 54.5. The US ISM Non-Manufacturing rounds off the PMIs at 1500GMT and is expected to drop slightly to 56.5 (from 56.9). However there are other data releases due, with the ADP Employment at 1315GMT which can often be a gauge for the crucial payrolls report on Friday (although this certainly was not the case last month), the expectation for ADP is for a dip back to 180,00 from 200,000. There is also the US international trade balance which is expected to improve to -$41.1bn from -$48.3. However, as ever it is important to look at what is driving any change, as a reduction in the deficit due to declining imports would not be a positive; ideally you would want improving exports to be the driving force.

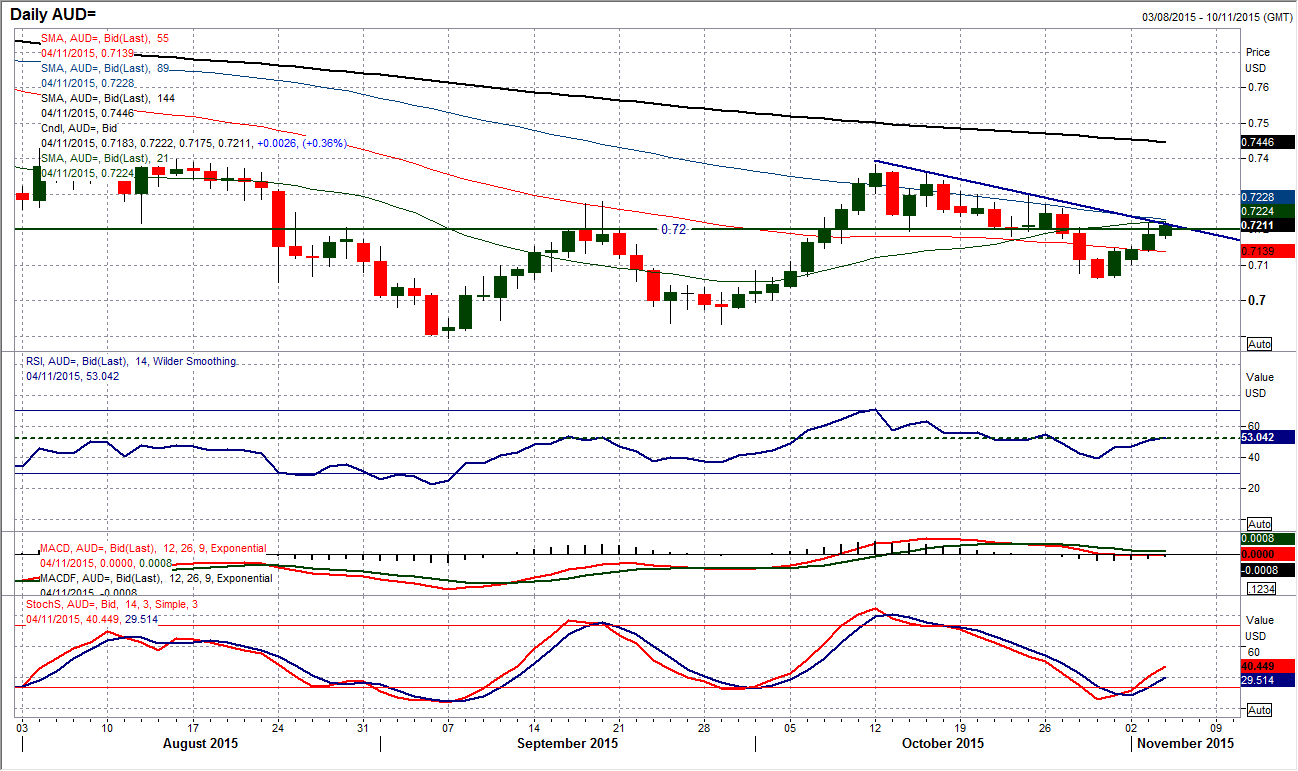

Chart of the Day – AUD/USD

The announcement that the RBA was standing pat on interest rates (and did not push for a rate cut) pulled the Aussie higher again yesterday, and this is now three completed positive candles in a row. The question is whether this now materially changes what had previously looked to be a corrective outlook. The past three weeks have seen the Aussie steadily slide lower and having broken the near term support at $0.7200 last week I argued that this was a top pattern that implies a move back towards a target of $0.7020. The rebound yesterday however hit the resistance of a three week downtrend which remains intact. The test of the outlook will come with the key neckline around $0.7200, however for now this remains a basis of resistance with which could now be eyed up as a chance to sell. There would still needs to be confirmation that this move is merely counter to the bearish trend, and the 50 level on the daily RSI is a key signal for me, so watch the movement around this level today. The key resistance comes in at $0.7296.

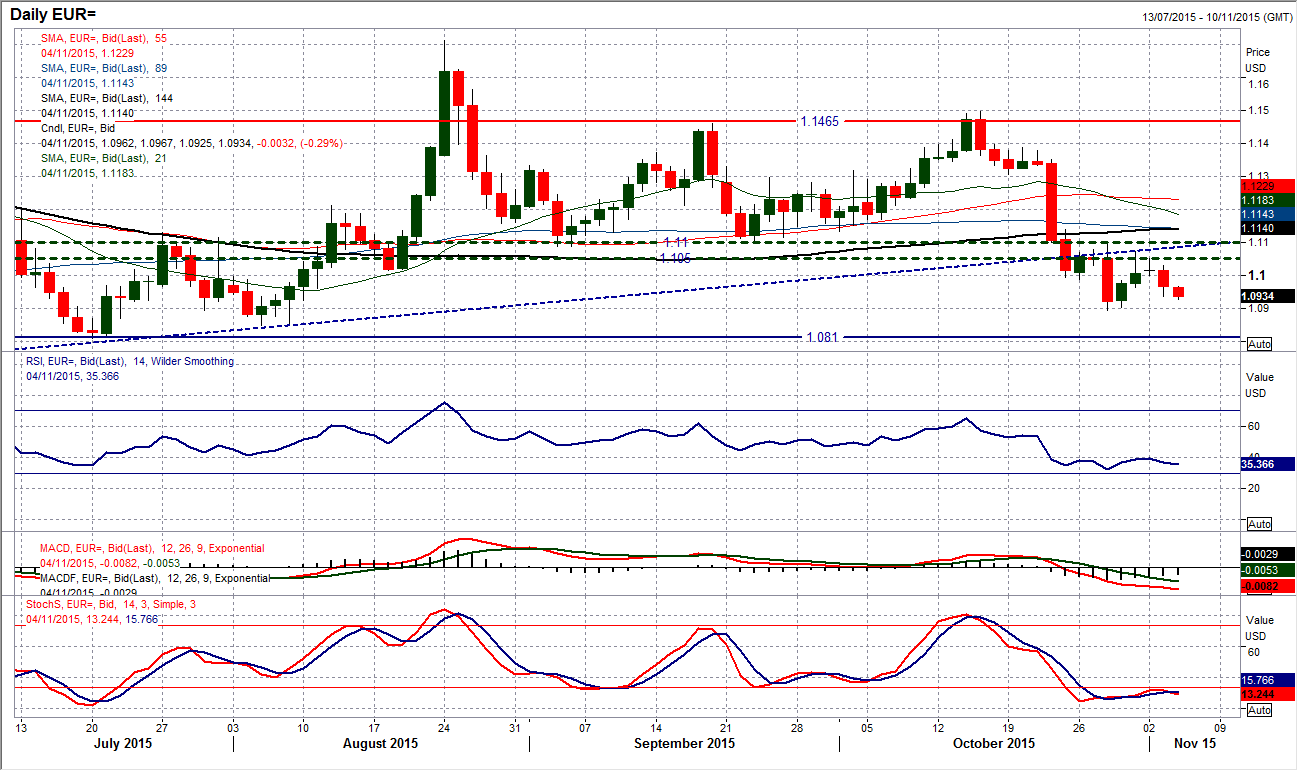

EUR/USD

The euro has once again backed away from the resistance of the pivot band at $1.1050/$1.1100. After the doji candle on Monday, yesterday’s trading engaged a downside shift which has left resistance at $1.1030 before the bears then proceeded to dominate for much of the day. This leaves the euro at risk of a retest of the $1.0894 low now. The daily momentum indicators remain bearishly configured with intraday rallies are seen as a chance to sell. The intraday hourly chart shows the breach of the minor support at $1.0964 has now turned the outlook negative again as a reaction high within the mini recovery has been broken. Furthermore, trading below the hourly moving averages which are turning lower also confirms this outlook. So look to use a bounce today as a chance to sell, with resistance near term starting around $1.1000, a level which, looking at the hourly moving averages, would probably be ideal.

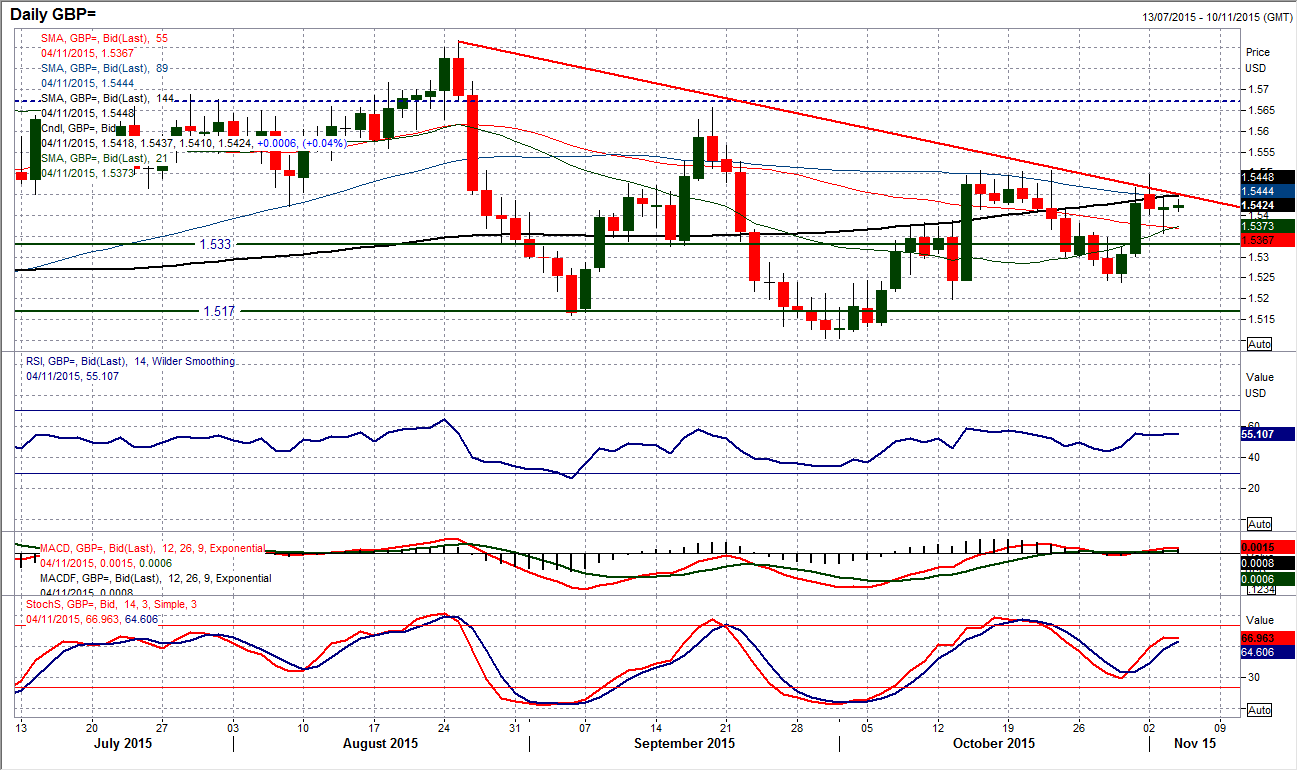

GBP/USD

There was an intraday rebound yesterday that has meant that the daily candle formed a “doji”. This means that the bears have not managed to wrestle control back quite yet and the outlook is still a little uncertain. I remain mindful of the downtrend over the past 10 weeks which is leaving a series of lower highs, but this little intraday bounce into the close yesterday has just questioned who is charge of market direction. The momentum indicators have flattened off and are of little help on the daily chart, whilst the hourly signals are also giving little away either. The downtrend and strength of the resistance at $1.5510 leads me to believe that the upside potential is fairly limited at these levels but the moves today will be data driven (with UK services PMI and US ISM Non-manufacturing in focus). Minor resistance at $1.5445 protects the overhead key resistance at $1.5510 whilst support at $1.5357 would re-open the downside. I spoke yesterday about a small top pattern that subsequently completed and also is guiding towards a possible $1.5300 target area.

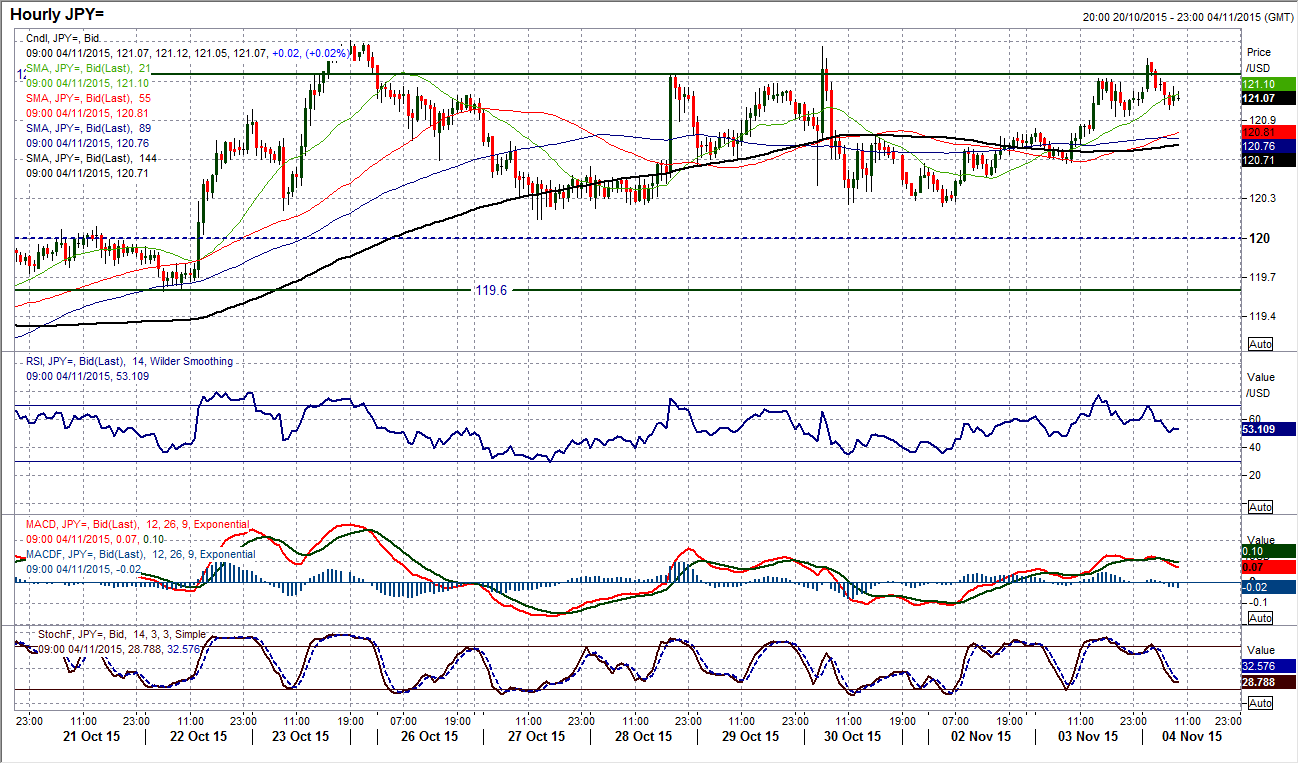

USD/JPY

Dollar/Yen remains stuck in this tightened 135 pip range between 120.15/121.50 and despite two arguably positive candles in a row (well, within the confines of the band), there is still no real sign of any breakout yet. The two positive candles mean that the pair is trading towards the resistance again but looking at the intraday hourly chart there have just been bearish divergences formed on the hourly RSI, MACD and Stochastics which are likely to now act as a drag on the pair once move. A move back below 120.90 would open for a retreat once more. Subsequent supports come in around 120.60. Continue to play the range with short time horizons on trades.

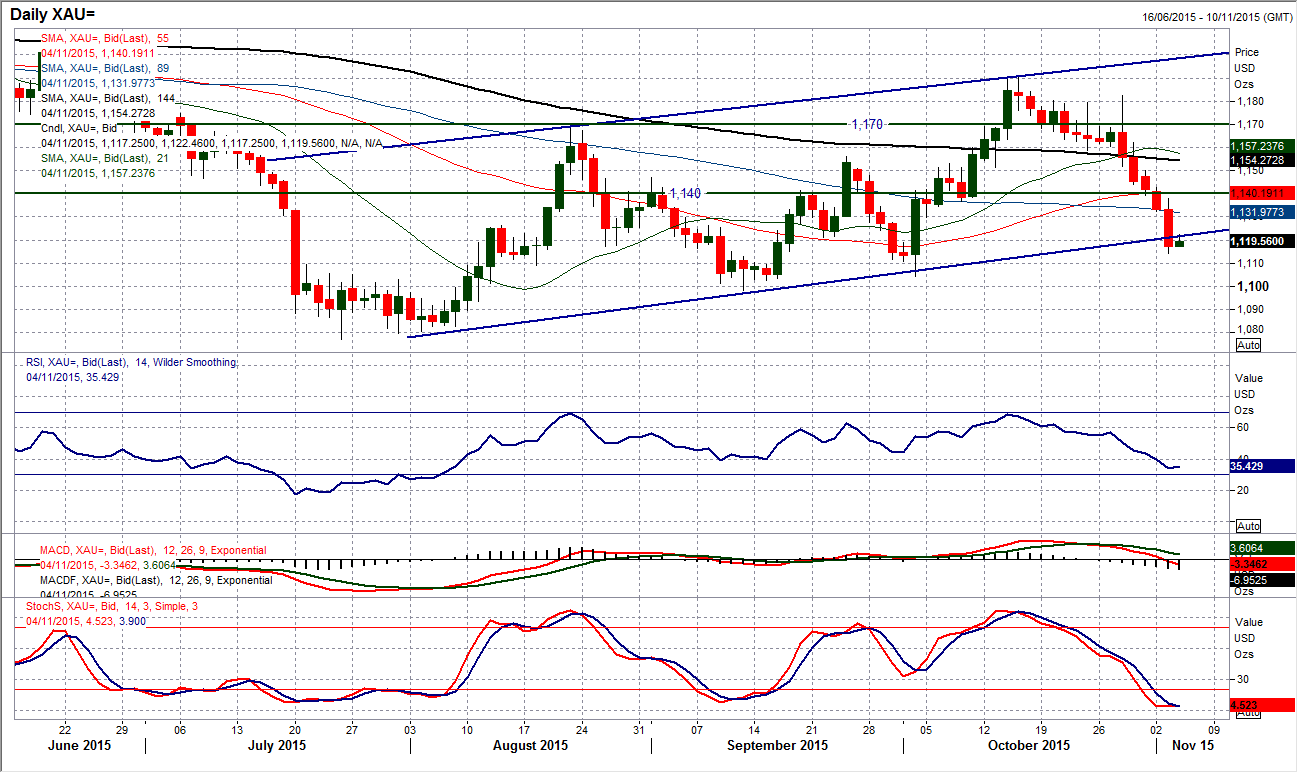

Gold

Gold has just completed a fifth consecutive strongly bearish daily candle as the selling pressure continues. It is interesting because every day for probably the past three sessions, I write this analysis with the Asian session showing a degree of support for gold early on, which comes prior to the European/US sessions which have traders selling gold lower again. This has happened again today, with a small green candle, but this does little to show any real sign of a reversal and I have to retain my corrective outlook. The move has now breached the lower support of the shallow uptrend channel, but realistically the next main support comes in at $1104.10 which was the October low. Daily momentum indicators remain corrective and gold is once more trading below all its moving averages which adds to the bearish outlook. The intraday hourly chart shows the consistent lower highs which show rallies continue to be sold into, so use any unwinding rally as a chance to sell. The hourly RSI back around 40 to 50 seems to be where the rebounds struggle.

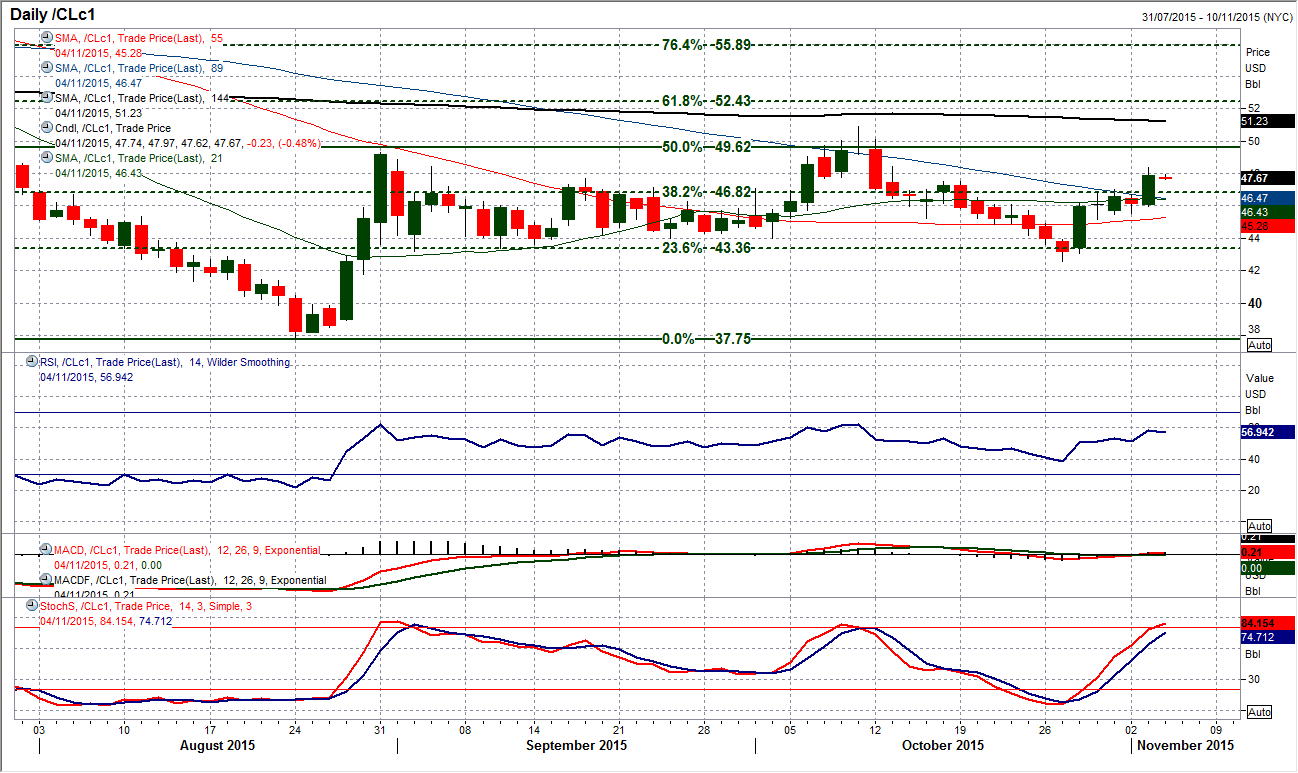

WTI Oil

With yesterday’s gains on the oil price, the near term outlook is turning increasingly positive. This means that the consolidation around the 38.2% Fibonacci retracement is now breaking higher with yesterday’s closing level that was well clear of $46.80. However, it was the break above the reaction high at $47.50 that the bulls will be most happy about as this is a resistance that now suggests there is potential upside towards the 50% Fibonacci retracement around $49.70. Momentum indicators have picked up and also confirm the improvement in outlook within the range, with the RSI and Stochastics at a 3 week high. The intraday hourly chart shows strong near term momentum but slightly stretched near term. However corrections should now be seen as a chance to buy, with support in the $47.00/$47.50 band. The key support band remains $45.15/$45.50. The key overhead resistance comes in now at $50.10/$50.90.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.