Market Overview

Janet Yellen’s perceived to be hawkish comments on Friday seemed to have sharpened the market’s view that any sign of improvement in the US economic data will be one step closer to a Fed rate hike, especially with a pick-up in core CPI. “Good news is bad” again, if it was not already. The US Dollar Index has shot higher as a result in the past few days, but is just having a near term unwind after a strong day yesterday. Likewise, we are also seeing a slight rally on Treasury and Bund yields today, whilst equity markets are also mildly positive. The trading directions of the past few days are just engaging in a minor retracement this morning.

Greece and its creditors are still looking to find a solution that will prevent the default on €300m of repayment to the IMF on 5th June. As yet nothing has been concluded but apparently Germany is confident that a deal will be done. This could add to support for the euro (and counterintuitively the DAX) today. This issue is likely to continue to drag European indices around on newsflow in the coming days.

Wall Street sold off into the close with the S&P 500 off 1.0% which put Asian markets under pressure. Despite the huge weakness in the yen, the Nikkei could only gain 0.2%. In forex markets the dollar is just coming under slight corrective pressure across the majors in the wake of such a strong run in recent days. This is also helping to provide support for both gold and silver after yesterday’s declines.

Traders have not got a great deal to trouble them today, however Canadian Loonie traders will be looking out for the monetary policy decision by the Bank of Canada at 1330BST. There is no expectation of any movement on rates which are currently at 0.75%.

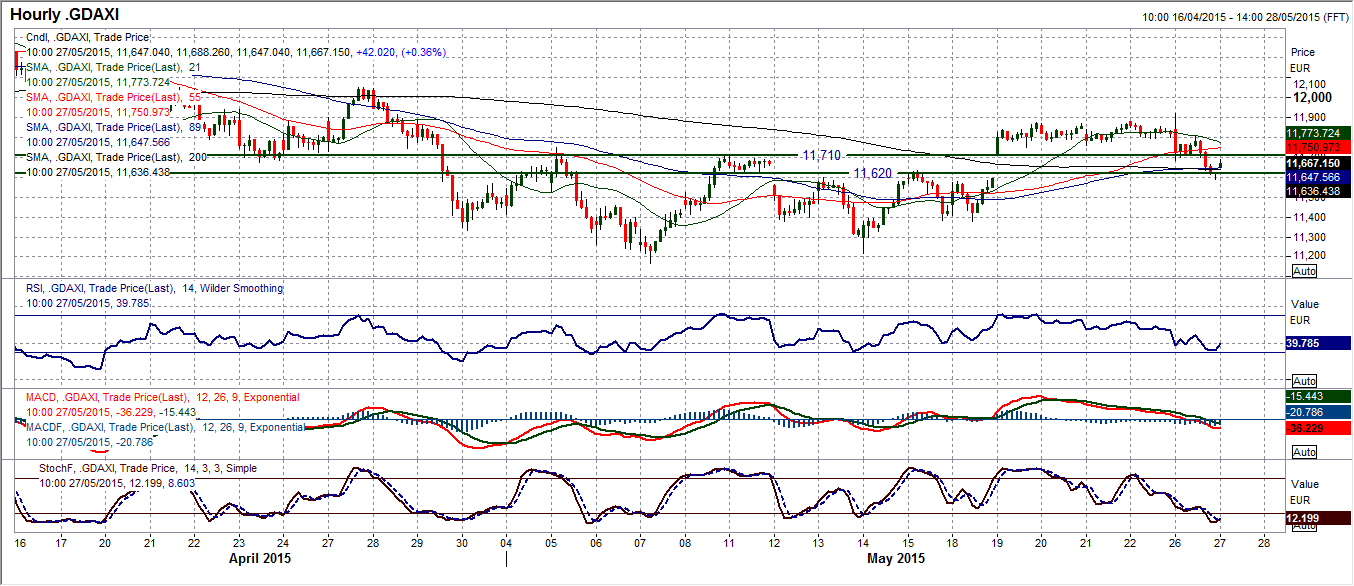

Chart of the Day – DAX Xetra

What we now have is a series of mixed technical signals on the DAX across different time frames. On the daily chart there was rather a large bearish engulfing candle which changes the outlook near term to negative. The Stochastics have crossed lower and RSI is falling away again. However the correction has come back to find support once more around the old neckline at 11,620 again. I see the DAX as being in a volatile rangebound phase now and although this bearish candle yesterday gives the sellers a boost it is not a trend defining candle. The hourly chart shows that throughout May the RSI has been oscillating between overbought and oversold and never really able to build any sustained momentum before a reversal kicks in. The hourly RSI is once more close to 30 again. I see the band between 11,620/11,710 becoming increasingly pivotal, having been used on several occasions over the past few weeks. Holding on to this support today could be key as a failure would open the support around 11,380.

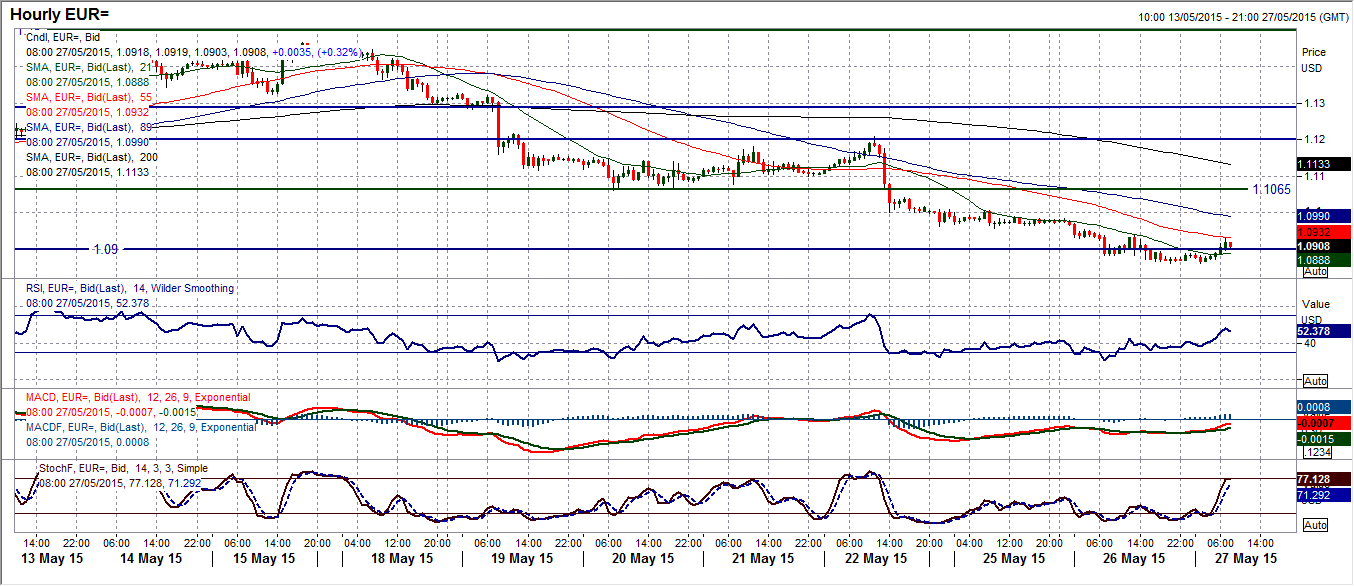

EUR/USD

The euro has now been in consistent decline now (give or take the odd intraday rally) for the past seven sessions. The corrective forces at play have resulted in momentum indicators turning negative near/medium term and now having broken below $1.1065 the way is now open to test the next band of support $1.0735 down to $1.0660. However these corrections do not tend to move in one direction without giving the occasional rally that can act as a chance to sell again. There has been an early push higher today, which in the context of the recent selling pressure is rather minor, but could provide an opportunity again. The intraday hourly chart shows the momentum indicators unwinding from an oversold position within what appears to be a continued bearish outlook. The overhead resistance levels come in a range between $1.0965 and $1.1000, whilst the old key support at $1.1065 is now the first significant resistance to watch. The hourly RSI is already quickly unwinding and it will be interesting to watch for any sell signals that are likely to be seen overhead. Buying into a technical rally is dangerous as it is difficult to know how far it will go before the sellers resume control. Best to look for opportunities to go short.

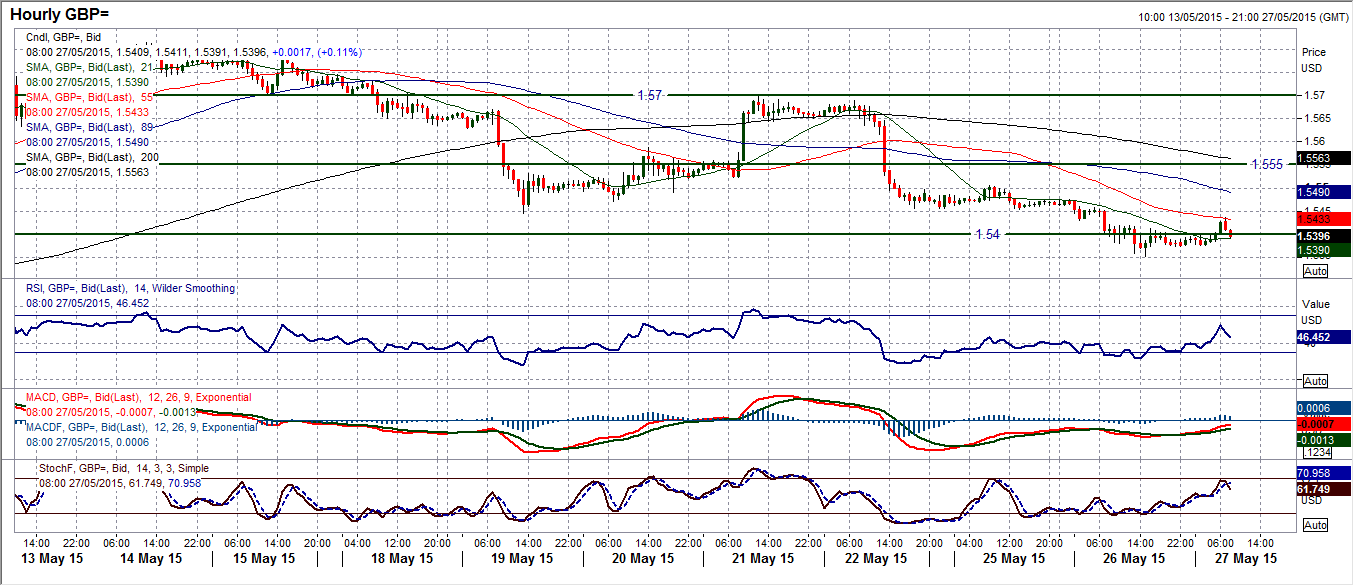

GBP/USD

I have been talking about how sterling continues to outperform the euro, and in that context the technical deterioration in Cable has not been on the scale of what it has been like on Euro/Dollar. However, yesterday’s break below (and close below) support around $1.5400 confirmed that the sterling bulls have now decisively lost control. The daily momentum indicators are all deteriorating now an much like the rally seen on the 21st May, the strength of the selling pressure means that rallies are being sold into and I now expect to see a continuation of a building series of lower highs to accompany the lower lows. I am now therefore looking to use today’s rally as another chance to sell. Watch for the old support levels to now become the overhead resistance levels. Looking on the hourly chart that would suggest to look for resistance starting to come in around $1.5450, however the more important levels come in around $1.5500 and then the old key breakout level at $1.5550. Hourly momentum is currently unwinding, so I would watch for the RSI and Stochastics starting to fall over around these key resistance levels. Support comes in around $1.5350.

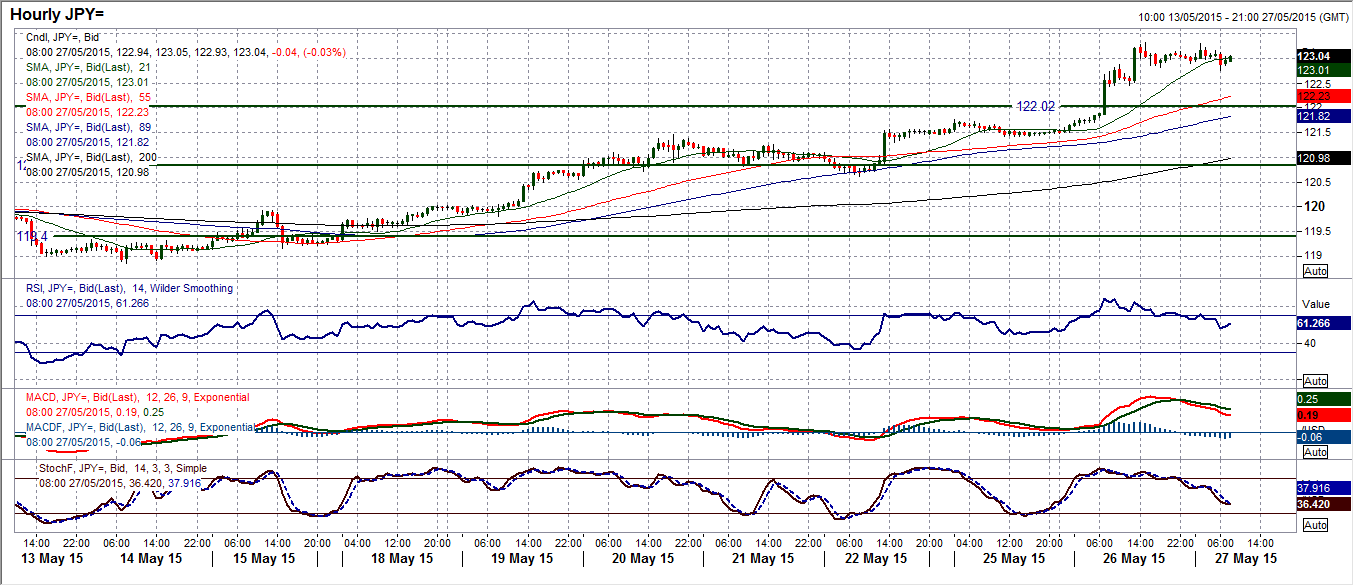

USD/JPY

What a day for the bulls yesterday. The confirmation of the upside break above 122.02 to new 8 year highs just kept going, to post a huge bullish candle (on decent volume). The next resistance levels come with the key highs of 123.65 (July 2007 high) and 124.15 (2007 high). Chasing the move higher may not necessarily be the best move currently though. Momentum indicators confirm the breakout with RSI at the highest level since December, but at over 70 perhaps chasing this one now is not the best idea. Perhaps look for the breakout to settle a touch. This is already being seen on the hourly chart with an intraday correction looking likely today. The old resistance around 122 now becomes supportive (with minor support also from yesterday around 122.50), so today could turn out to be a day where the breakout consolidates and gives another chance to buy. Seeing where the intraday hourly momentum indicators settle will be telling as to how bullish the market is on this breakout. A buy signal between 122/122.50 would now be ideal.

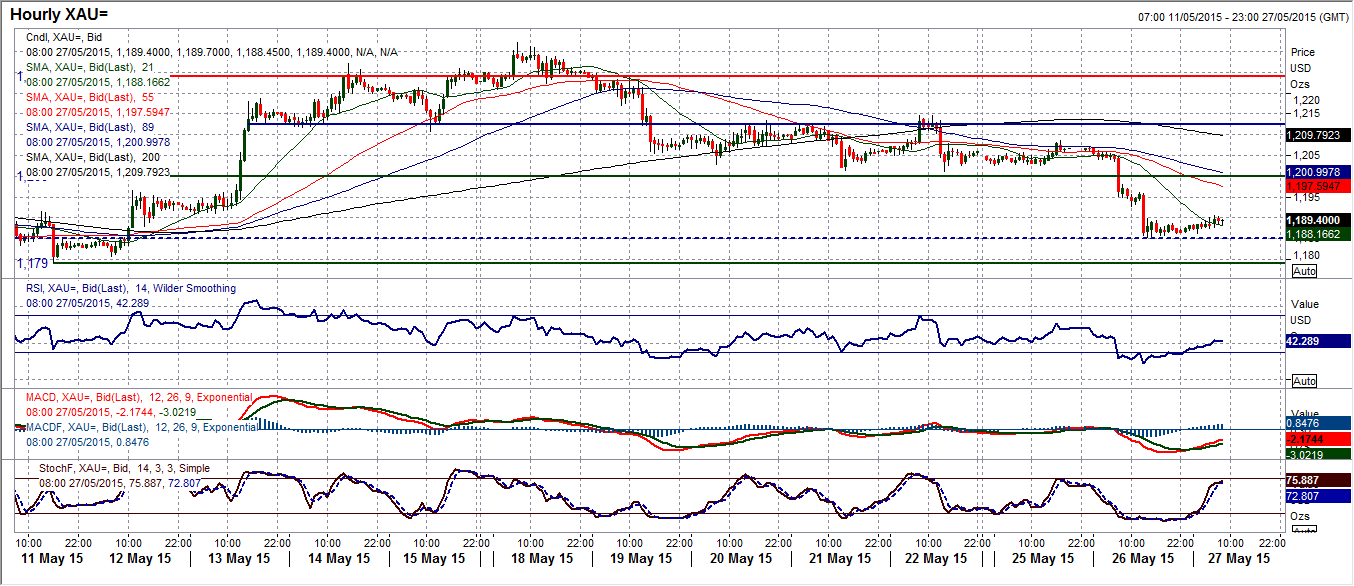

Gold

A second big bearish candle in just over a week means that gold has gone from straining to breakout at the top of the range, to eying the bottom once more. I am interested in the RSI momentum indicator again, as through the course of this range it has oscillated between 40/60. I am now looking to see if the RSI starts to move consistently below 40, which could be a signal of a potential range breakdown. The Stochastics continue to fall away which suggests that despite the early minor rally overnight, the pressure continues to the downside. The intraday hourly chart suggests that this is just a minor technical rally that should help to renew bearish momentum. So watch for the hourly RSI rebound rolling over between 50/60, the MACD lines failing again around neutral and the Stochastics also turning down again. The near term support at $1185 is likely to come under further threat, whilst the hourly chart shows that old supports in the band $1178/$1179 are the real test. Resistance for the unwinding technical rally comes in between $1196/$1200.

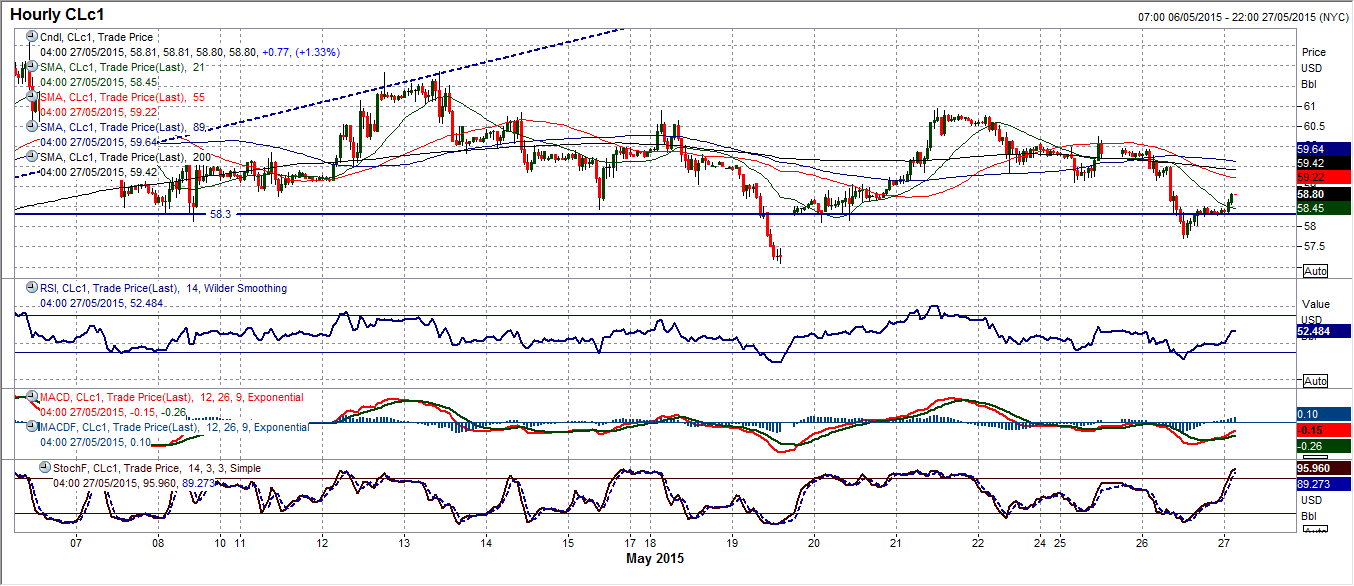

WTI Oil

With the US dollar beginning to strengthen again, the price of WTI is beginning to come under pressure again. The volatility has ramped up in recent sessions now and the recent daily candles are big and bold. In the past couple of seeks the number of bearish and corrective candles are outweighing the positive candles by at least a factor of two to one. I mentioned yesterday about the sequence of lower highs now on the daily chart, and this sequence is being confirmed by lower highs on the RSI but also more prominently on the daily Stochastics. The selling pressure built up yesterday would now suggest that last week’s low at $57.09 could now be under pressure. Intraday moves suggest that using any rallies as a chance to sell, with resistance in the band $59.00/$59.90. Only a move above the lower high at $60.94 (the latest key lower high) would change the near term corrective outlook.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.