Market Overview

In the past few days, markets have given a few signals of concern and change. The weakness in equities has been clear, but yesterday’s failure for Wall Street to hold on to earlier strong gains leads to a few concerning glances at how sustainable the outlook of the S&P 500 is. Also, if you add in the fact that the dollar is just beginning to have a few questions asked of its bullish outlook and the potential for a change in sentiment is there. However, maybe it is because we are coming up to silly season with Christmas fast approaching (and I don’t just mean the jumpers). Markets can often trade that bit more erratically with volume beginning to fall away. Also traders still do not know what to make of the continued decline in the oil price and whether it should be taken as a positive (pseudo tax cut for consumers) or a negative (a signal of economic slowdown).

The Asian markets are up, following the S&P 500 which closed 0.5% higher (it was up around 1.5% at once stage before a late sell-off). The Nikkei 225 was up 0.7% in the final trading session before Sunday’s general election that should see incumbent Prime Minister Shinzo Abe voted back in. European markets are however trading sharply lower in early trading as the falling oil price continues to weigh on the heavily weighted oil sector.

In forex trading, the US dollar is trying to regain some element of lost control today and is trading mildly positively against all the major currencies. The Aussie dollar is weak after Chinese Industrial Production fell to 7.2%, missed expectations of 7.6% and lower than 7.7% last month as the data from the world’s second largest economy continues to deteriorate and signal slowing growth.

The only data to watch out for today is the US Producer Prices Index which is expected to fall by 0.1% on the month at 13:30GMT. There is also University of Michigan consumer sentiment at 14:44GMT which is forecast to show a slight improvement on last month with a rise to 89.6 (from 88.8).

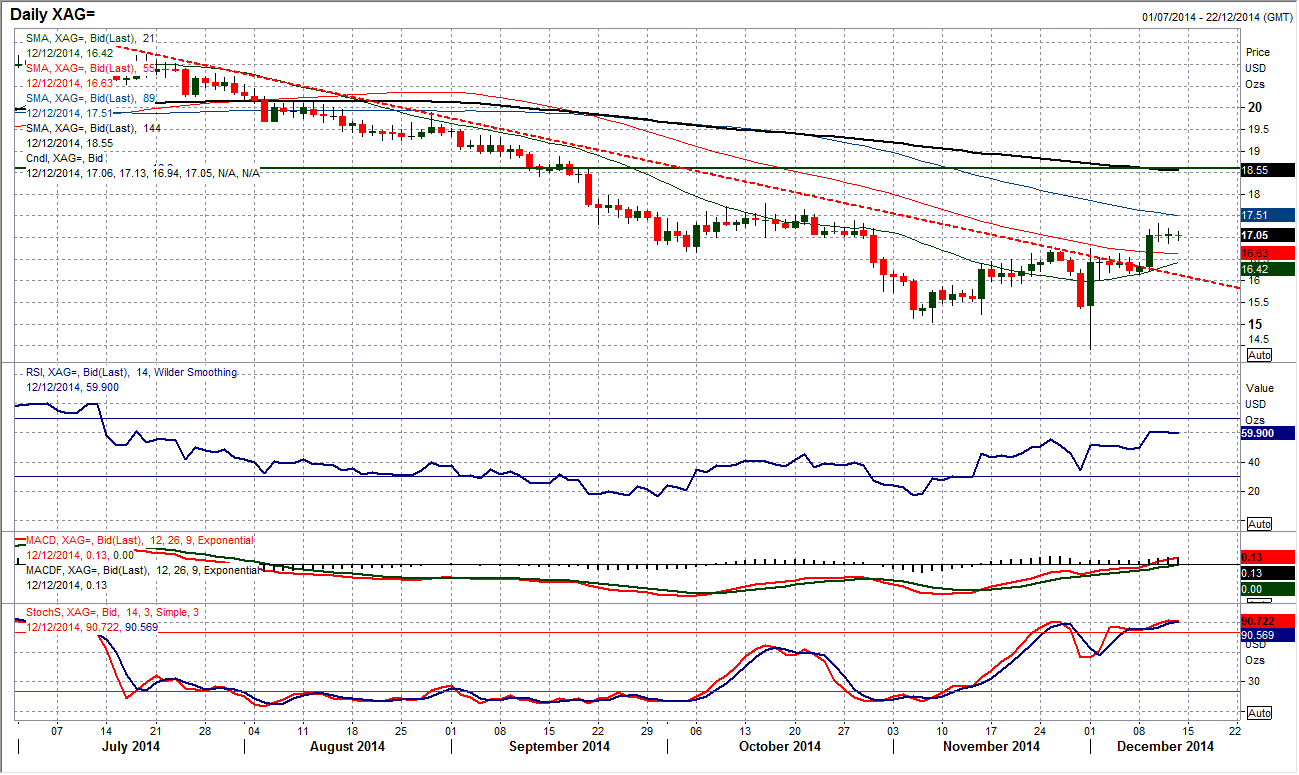

Chart of the Day – Silver

Further questions have been asked of the bearish outlook for silver in the past week as the downtrend that has been intact since July has been decisively broken by a sharp rally which took the price to a 6 week high. Not only that, but the 21 day moving average (currently $16.42) which had consistently provided resistance over recent months, has turned up and is now providing support. The momentum indicators continue to improve too. The immediate term movement has just come under some consolidation which a couple of “doji” candlesticks which denoted uncertainty with the outlook having reached a peak so far at $17.33. However, if the bulls can muster the energy for an assault on $17.80 then this move can be considered to be more than just a bear market rally. That is because silver is still yet to breach a key lower high within the rally and until that is seen the positive outlook will continue to have question marks.

EUR/USD

The bearish outlook has had a few questions asked of it in the last couple of days. The strong gains from Wednesday continued into early Thursday to mean that the euro has had the first breach of this solid downtrend in place over the past few months. However there is still a feeling that there is a pivot level around $1.2500 which is still able to do a decent job as resistance at the moment and the bulls have subsequently run out of steam. We are now back to watching the $1.2357 old key support which helped to provide a floor on Wednesday and has again done the same late last night. It is therefore a touch difficult to call the immediate direction on the euro as some of the bearish argument has diminished. I would not want to be too quick to abort the significance of the downtrend which has served the bears so well in recent weeks and still be inclined to expect pressure on the support. Sub $1.2357 re-opens $1.2300 and then $1.2245. A breach of resistance at $1.2500 would begin to seriously question how much control the bears have lost.

GBP/USD

Not only am I having to reconsider the bearish outlook on the euro but also sterling has strengthened to now test its own long term downtrend. The concern for the solid bearish technical position which has served so well is that we are now being faced with improving momentum indicators. Despite the price still being below the $1.5825 late November high, the RSI, MACD and Stochastics are all at levels not seen since October which suggests the momentum is improving. Cable is subsequently today right on the downtrend. The rate is still 100 pips away from the $1.5825 high and the sequence of lower highs remains intact, but the candlesticks show that the last two daily closes have come towards the high. The intraday chart shows broken 7 week downtrend (sharper than the 5 month downtrend that is currently being tested) and hourly technicals are also improving. There is immediate resistance at $1.5763 that has held back the rally, but it seems as though the bulls are gaining in confidence. Key near term support for the recovery bulls to stay in control is at $1.5645.

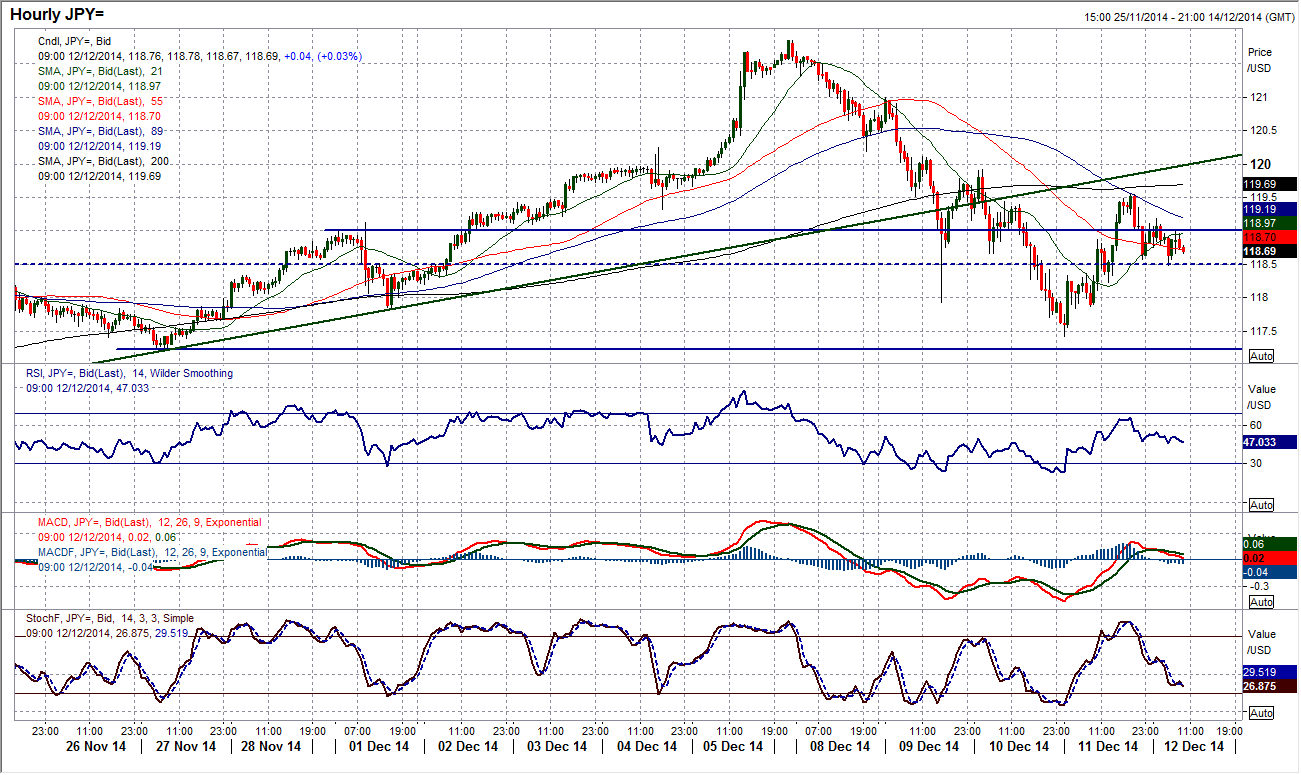

USD/JPY

The continuation of this week’s correction formed a low early yesterday morning that could be a key low now. The fact that the low came in place at 117.43 which was above the 117.33 key reaction low from 27th November should not be ignored. This means that the bulls can still argue that this move is just a correction within the bull run and with no breach of any key lower high the trend remains solid. The truth is though that the positive outlook has taken some punishment and it is damaged. The uptrend in place since early November was breached and was used as the basis of resistance on yesterday’s rally to 119.55. This now needs to be taken out quickly to prevent too much damage being done. There is some near term consolidation underway and the support band 118.25/118.50 is taking on added near term significance. The hourly momentum indicators have already rolled over and the rally looks to have run out of steam. This is becoming an important mini-phase that could mould the medium term outlook.

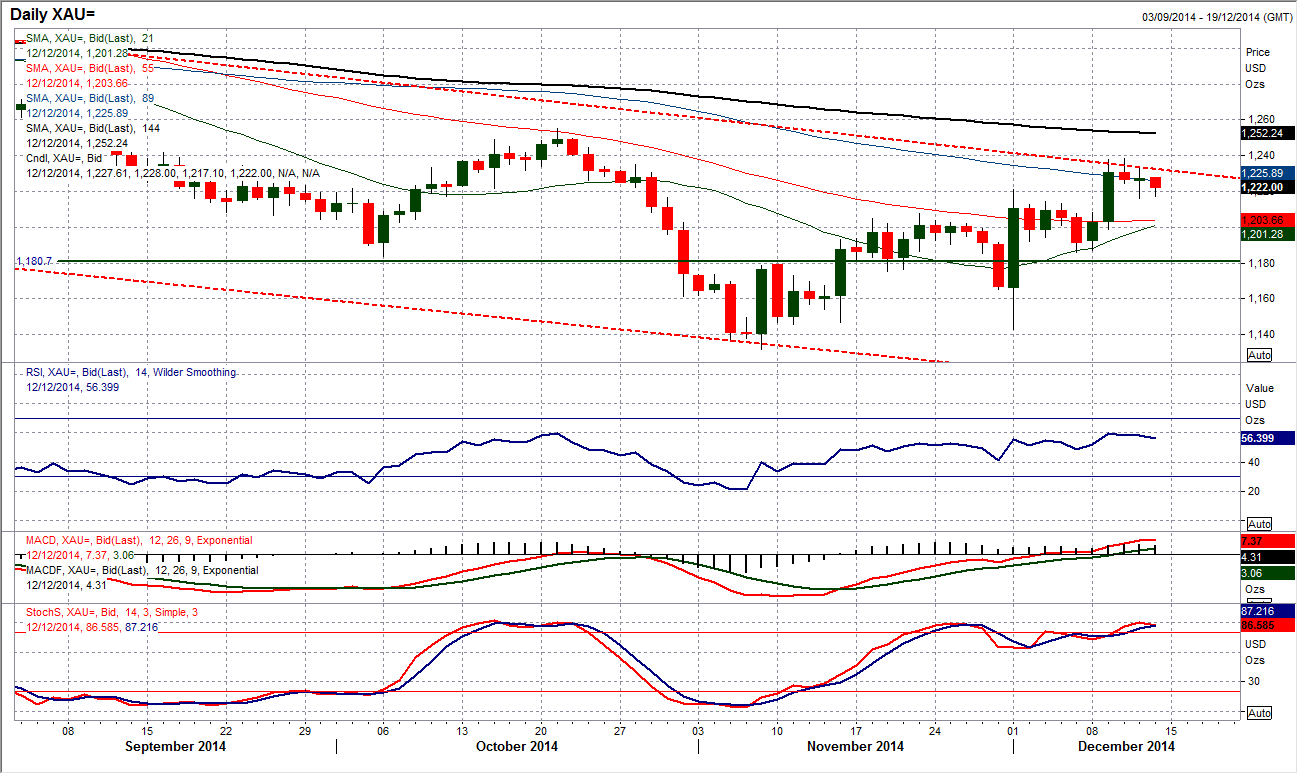

Gold

The major downtrend has held back the advance of gold. This week’s spike higher hit the resistance of the downtrend that has been intact since October 2012, turning lower at $1238.20 with the price subsequently drifting lower. However the bulls will be pointing to the support band of the previous breakout levels ($1214.50/$1221) which has so far held a correction, with yesterday’s low at $1215.90, and the key reaction low now coming in until $1186.10. Momentum indicators are still supportive of the rally too. I remain in a state of uncertainty on gold as the near term outlook is positive which the medium/long term trend is decidedly negative. Until the October high at $1255.20, which is a key lower high, is taken out then this is still likely to just be a bear market rally.

WTI Oil

Any signs of support are now continually being ignored as the sequence of daily lower highs and lower lows completes its sixth day. Looking at the daily chart, oil is now at the stage now where momentum is so bearish and strong to the downside that it has become incredibly difficult to see where a turnaround in sentiment might come. Even if it might be seen on an intraday basis, the bears are quick to move in once more. The RSI is at 21 which is now close to the level it reached on 28th November (the day that the US came back to trade after Thanksgiving and the OPEC meeting. The past two days have had strong bearish candles. A breach of the July 2009 low support at $58.30 opens downside towards $54.55 and then $50.50 (also key levels from 2009). On the intraday hourly chart shows resistance at $61.66 and then at $64.20.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.