Market Overview

Wall Street bounced back last night as the Fed meeting minutes just confirmed a few things and failed to really give the market too much of a clue towards when the tightening cycle might begin. Boosted also by an upbeat set of Q2 figures that sent the shares of Alcoa 6% higher, the S&P 500 and the Dow Jones Industrial Average both added around 0.5%. Asian markets were fairly mixed though and did not take the lead after Chinese trade data disappointed the market on both imports and exports. Overnight also, the Australian unemployment figures were broadly in line with expectations, although the unemployment rate crept slightly higher to 6% as the participation rate increased. European markets are slightly lower in early trading.

The Fed meeting minutes suggested that as things are progressing, its asset purchases programme will be winding down in the October meeting, but also that there was nothing majorly new to add and this helped to reassure the market that there would not be an imminent tightening. The dollar lost ground against the major currencies on this news with 40/50 pips added to both Euro/Dollar and Cable.

Forex trading has settled already since last night’s Fed meeting minutes, with a mixed performance from the dollar, although there is a slight air of reduction in risk as the yen has strengthened and the Aussie dollar has dropped after the Chinese trade data missed and Aussie unemployment lifted slightly.

Traders will be keeping an eye on the Bank of England’s rate decision at 12:00BST. The chances of any movement are slim, with the Monetary Policy Committee hawks likely to be kept in check after the disappointing manufacturing production data suggested spare capacity in the economy remained an issue. More attention is likely to be paid to the meeting minutes in a couple of weeks, with this being the first opportunity for new MPC member Kristin Forbes to vote. Other than that, in the US weekly jobless claims are announced at 13:30BST, with 315k expected (the same as last week).

Chart of the Day – GBP/JPY

The early July break above 174 changed the longer term outlook. Prior to that the rate had been in a sideways consolidation for several months, but the Sterling bulls have now taken control. The break reached 175.35 (which was the highest since October 2008) before seeing a minor consolidation. This consolidation has now formed support around the breakout and this looks to be another chance to buy. The support has also formed around a six week uptrend, in addition to the 21 day moving average which has held each of the last three corrections. Daily momentum indicators are all in bullish configuration and suggest that the recent drift back to support is a good opportunity to buy. Expect a retest of the 175.35 high in due course. The intraday hourly chart shows initial support comes in around 173.70 and then 173.10, with the outlook remaining bullish until a breach of support at 172.30.

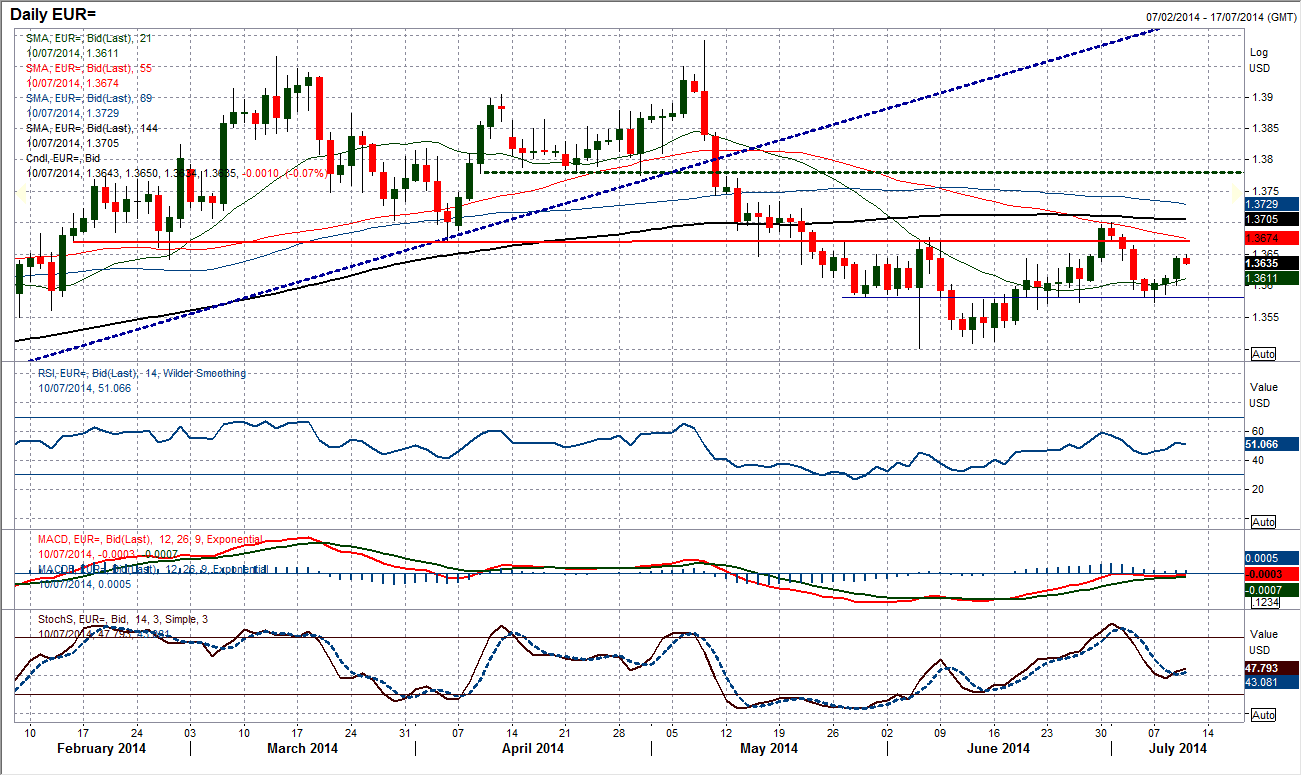

EUR/USD

Despite a choppy day’s trading yesterday, the euro has managed to continue a mini recovery, helping to bolster the importance of the support band now in place $1.3574/$1.3585. Despite this, and although not as weak as previously had been, daily technical indicators still seem to suggest that this will be another rally that is likely to be sold into for the euro. The looming overhead supply between $1.3670/$1.3700 should be sizeable enough to hold back the recovery. There is also the 55 day moving average which is falling at $1.3674 and which capped the June rally. So it seems as though the euro is coming towards another key test. The bulls will need to push decisively through the resistance to suggest this is anything more than another bear market rally. I still back the view of selling into strength on the euro, but I would have to take a rethink on a decisive break of $1.3700.

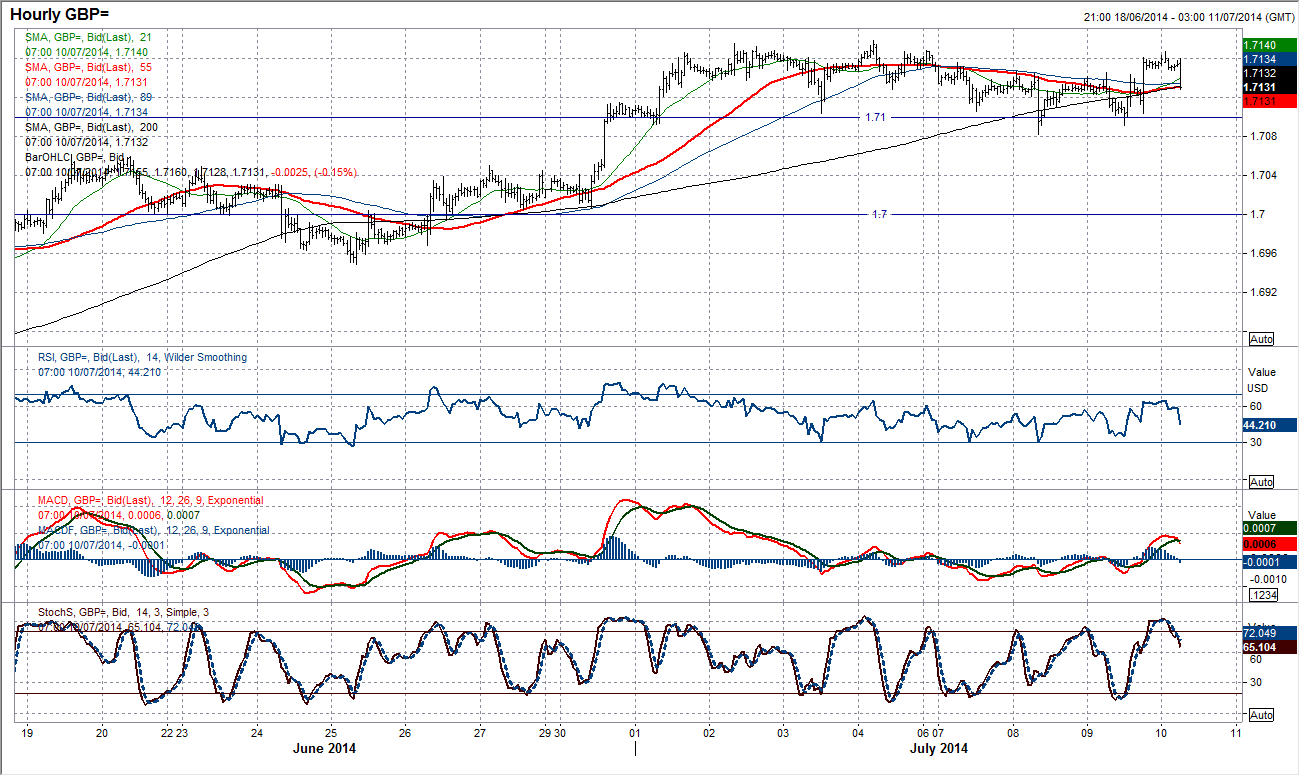

GBP/USD

Yesterday I focused on the fact that I no longer saw this as a potential top pattern above support at $1.7100 as the sideways trading had gone for too long. I now see this as a consolidation period that will ultimately end in the next leg higher. The only question is whether the bulls will get a nice dip as another opportunity to buy. The reaction to last night’s FOMC minutes was positive and added around 50 pips to Cable so there may not be that opportunity. Momentum indicators retain a positive configuration, whilst this consolidation is also giving moving averages a chance to catch up. The intraday hourly chart shows a very positive set up on all moving averages and momentum now. I would now view any correction back towards $1.7100 or even $1.7060 as a chance to buy. Once the break above $1.7179 is seen there is little to stop Cable until the 50% Fibonacci retracement of the huge bear market of 2008 at $1.7330.

USD/JPY

The US dollar has come back under pressure following the release of the FOMC meeting minutes last night. This has dragged Dollar/Yen back lower again and is testing yesterday’s low at 101.42. The rate has been trading in this sideways band 101.30/102.80 for 3 months now but just recently the bears seem to be gaining control as the rallies are failing at just over 102.20 and the pressure is mounting to the downside. This is seen with a cluster of moving averages which are now in decline and capping the gains too. For their part though, the momentum indicators are almost entirely in neutral configuration still and are not pointing to any imminent breakdown. The intraday hourly chart shows a deterioration since the Fed minutes but again nothing too bearish as yet. The likelihood is that there will be a retreat to the support band 101.42/101.21 which will be supported by the bulls once again. My outlook of a trading range would begin to change is there was a close below 101.30 which has not been seen since early February.

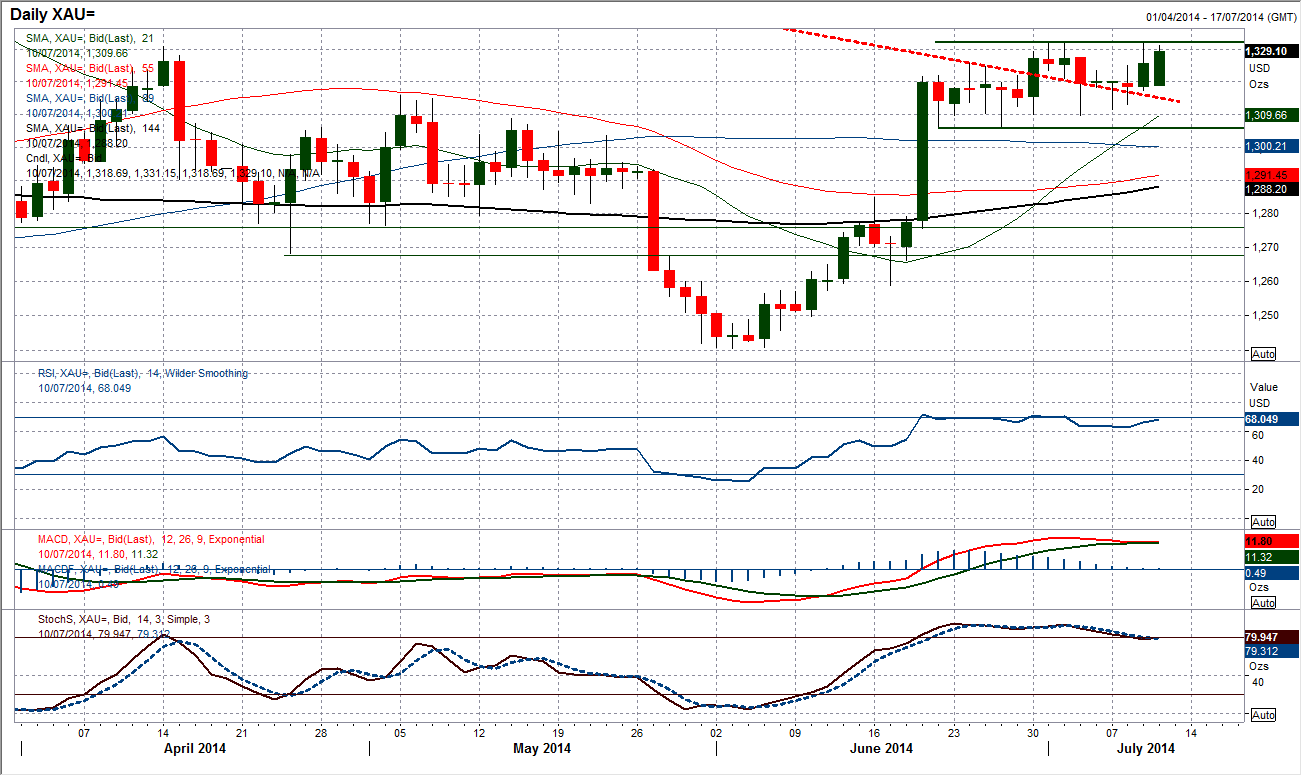

Gold

Boosted by the Fed minutes, gold has started to challenge the resistance of the trading range between $1306/$1332 again. This is dragging the corrective momentum indicators back towards a positive configuration and gives the bulls hope of an upside break. Furthermore it is putting the primary downtrend under significant strain once more. A break above $1332 is what the bulls will be hoping for today. A decisive more above $1332 would complete a range breakout and suggest a test of the initial resistance at $1342, but also imply a target of $1358. The past 24 hours has seen the intraday hourly chart take on a far more positive set up with hourly moving averages rising and the support band around $1320 acting as a floor in the price. If this continues then the pressure to the upside will grow and gains become more likely. However we still await the breakout.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.