Market Overview

Trading tends to be somewhat cautious and reticent in front of Non-farm Payrolls, which due to the Independence Day public holiday in the US are being announced a day early. Despite the huge beat on the ADP employment data (which some believe gives a steer to Non-farms) there was little real appetite to push Wall Street higher. The Dow Jones Industrial Average came within a point of 17,000 although the S&P did just manage yet another closing all-time high. The Asian markets were mixed overnight with the Nikkei slightly lower despite the significant weakening for the yen. European trading is also mixed in early trading and is likely to remain indecisive through to the Payrolls report, although there is a raft of data out today that could impact.

Forex trading amongst the major pairs saw a sizeable dollar rally yesterday, helped by the ADP employment data that beat expectations significantly yesterday. This was added to by comments (that some might have perceived as slightly hawkish) from Janet Yellen concerns over increased risk taking in financial markets arising from low interest rates. This dollar recovery is now seriously testing some key levels against several of the major currencies now which makes today’s Payrolls release even more important.

Expectations of Non-farm Payrolls have been slightly increased from 210,000 to 212,000 since the ADP report, with the release at 13:30BST. This comes at the same time as the ECB press conference in which Mario Draghi is expected to provide more detail to the TLTRO (Targeted Long Term Refinancing Operation) which formed a significant element of the ECB’s monetary easing programme. This could mean significantly volatility around this time as the press conference comes simultaneously with the Payrolls data. Traders will also be looking at the services PMIs which are due throughout the day with the UK announced at 09:30BST (58.3 exp) and the ISM Non-Manufacturing at 15:00BST (56.3 exp).

Chart of the Day – USD/CAD

After 4 weeks of almost relentless selling pressure for the dollar, is Dollar/Loonie about to form a low. This comes as a rebound for the dollar yesterday posted the first really positive candlestick for a month. Using the daily RSI this move means that we are close to a buy signal (when RSI moves below 30 to then cross back above). This is though still early stages of a recovery as both the MACD lines and the Stochastics remain in negative configuration. However on the intraday hourly chart, the Dollar is trading above the 89 hour moving average for the first time since 18th June and a downtrend has been broken. Look for confirmation of a recovery which would be found on a move above 1.0700 resistance. It may be very early stages, but there are signs of hope for dollar bulls here. A move back below 1.0643 would be disappointing, while the sellers would be decisive below 1.0622.

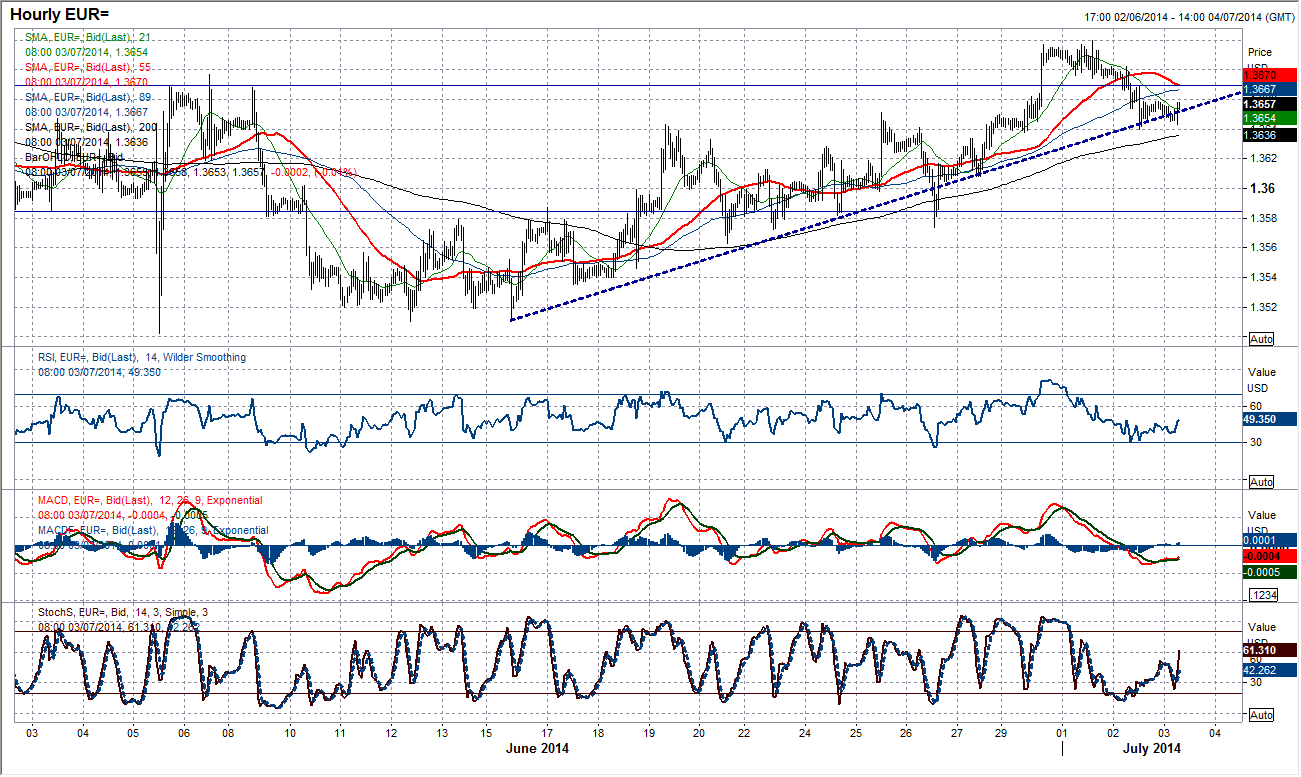

EUR/USD

As we approach the crucial Non-farm Payrolls report the euro is facing something of a junction on the technicals. A sharp move to the downside has put the pressure back on the bulls. Following the much better than expected ADP employment report, the market is now pondering a better Non-farm Payrolls report which has given the dollar a boost. This has strengthened the dollar and pulled the euro back to the support band $1.3640/$1.3670. This also means that the uptrend since the low of $1.3510 in June is also being tested. The intraday hourly chart shows the retreat back towards the old peaks of late June so as things stand this is a still a fairly positive set-up for the euro. I would be looking at the 200 hour moving average which comes in at $1.3635 and has shadowed the uptrend nicely throughout. The payrolls number will always tend to increase volatility and this could create a lot of noise on EUR/USD. The bulls would retain an element of control in the chart unless the support around $1.3585 was breached. Resistance comes in at $1.3680 and $1.3700.

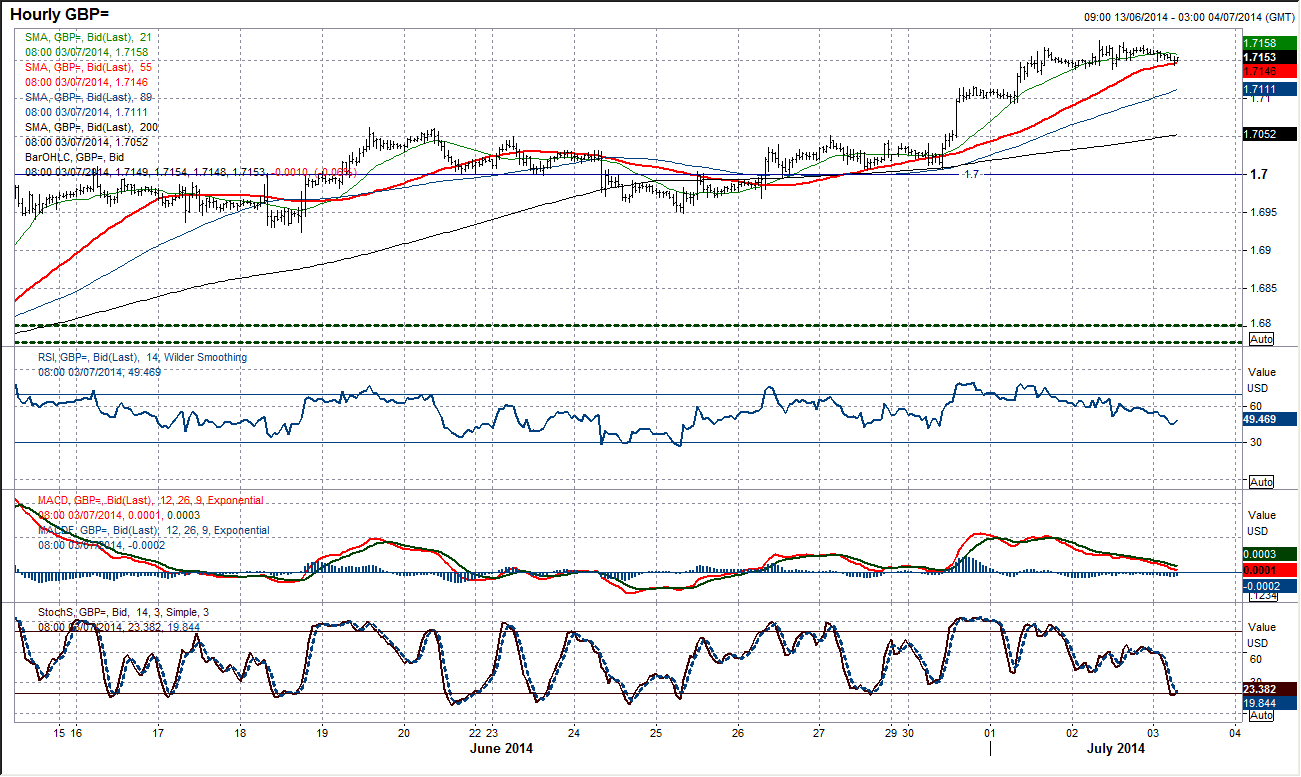

GBP/USD

Markets do tend to move into a mode of consolidation around Non-farm Payrolls day and the advance in Cable has certainly shown signs of a deceleration in the past day or so. This comes with the RSI moving above 70 which can denote strong momentum but also reduced upside potential. The intraday chart shows that the initial strength (following the strong UK construction PMI yesterday morning) could not be sustained and the rate has just been drifting slightly since. The strong ADP report has introduced an element of doubt into traders’ minds that had been solidly backing a sterling rally, however if Payrolls are also strong today then this would certainly give an excuse for the profit-taking to commence. Already the hourly momentum is unwinding. The support on the intraday chart comes initially at $1.7130 and then more significantly at $1.7100. Any near term correction should then start to find the buyers more interested in the support band $1.7000/$1.7060. The resistance from yesterday’s high comes in at $1.7176.

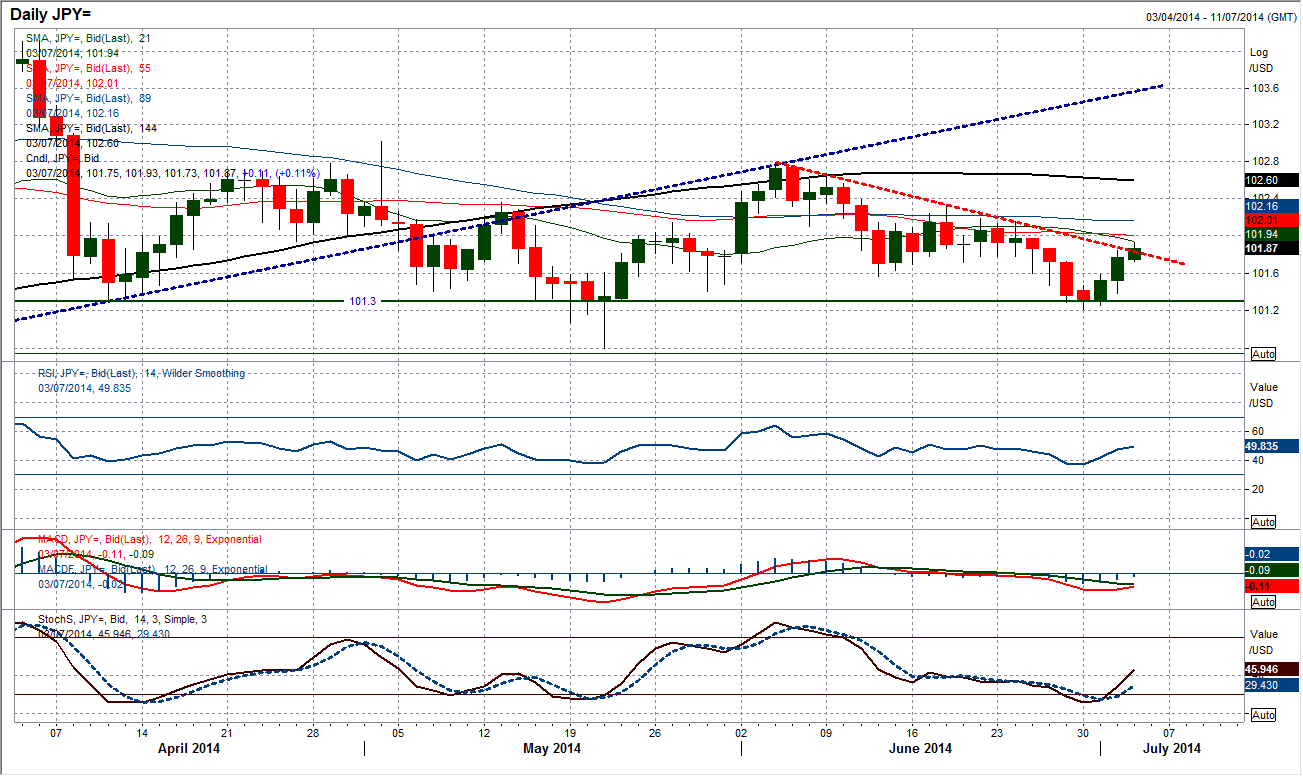

USD/JPY

Sentiment has turned around sharply in the past 24 hours. Having found resistance at 101.60, the dollar bulls stepped up the pressure after the ADP data to push the dollar through the key resistance band around 101.80 which has also now breached the resistance of the 4 week downtrend. The hourly intraday chart shows momentum indicators improving and hourly moving averages also turning positive. The next barrier to negotiate is the pivot level around 102.00. The daily chart shows that there is still much work for the bulls to change the medium ter outlook positive. There is a cluster of moving averages between 101.90/102.20 which have formed as resistance and there is price resistance up to 102.30 to break through. Backing this rally should come with much caution due to the sizeable overhead supply, however the dollar has momentum on its side for a change. The key near term floor for the dollar is now the old resistance at 101.60 which has since turned around into the new support.

Gold

There has been an element of consolidation over the past 3 days as gold traders have just shifted their expectations slightly higher since the attempted upside break last week. This is now forming a new level of support above $1320 which is also coming at the topside of the old downtrend (which is acting as support for the time being). This should result in further pressure on the highs with $1332.10 before $1342.43 (a minor high from March). However there is still a lack of conviction in the move, with small daily ranges recently which suggests an uncertainty. Momentum indicators are still arguably strong but if this indecision continues for much longer then a deterioration will begin to set in. There is probably a sense of waiting for Non-farm Payrolls today and seeing how that impacts the dollar. The near term support comes in at $1310, but the more important level is $1306 which is the bottom of the previous consolidation phase.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.