Market Overview

Investors were given some respite from the recent selling pressure on Wall Street as a minor recovery was seen yesterday. US retail sales of +1.1% for March was the strongest month on month reading since September 2012. Markets were also helped higher as Citigroup’s quarterly results came in ahead of estimates with growth of $1.30 per share up from $1.29 in Q1 last year. However, Asian markets were fairly mixed with traders apparently unwilling to take a view in front of the key China GDP data which is announced overnight tomorrow morning. Despite this though, the Japanese Nikkei closed higher after the weaker yen helped exporters.

This could be a more volatile day for forex trading today, with special focus on Cable, as the key inflation data for both UK CPI (at 09:30BST) and US CPI (at 13:30BST) is announced. The UK number is expected to fall to 1.6%, with the US forecast to rise year on year to 1.4%.

Euro investors will also be interested in the German ZEW Economic Sentiment (at 10:00GMT). The final factor at play is that Janet Yellen is due to be speaking at the Atlanta Federal Reserve conference today at 13:45BST, with any focus on monetary policy sure to impact on the dollar.

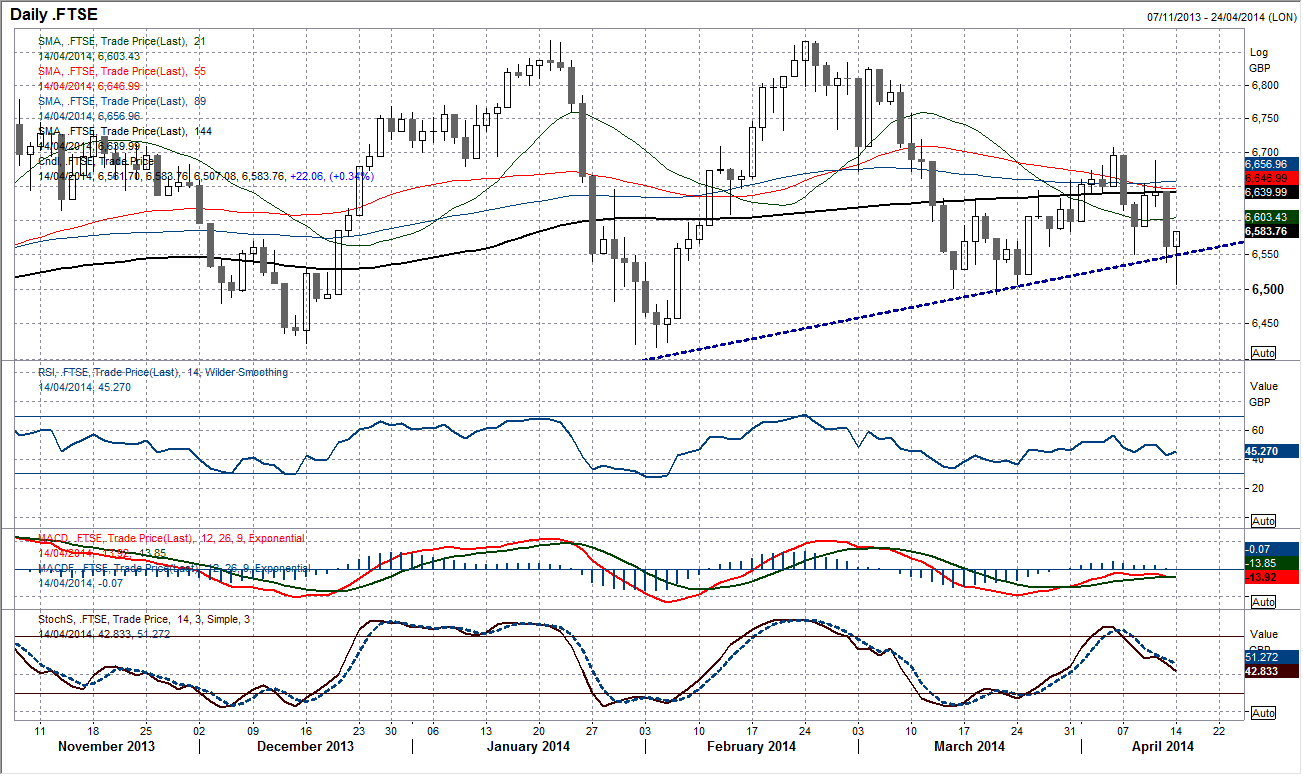

Chart of the Day – FTSE 100

A choppy and messy period of trading saw the FTSE 100 yesterday test the support of the primary uptrend. However the key support sat 6492 has remained intact and leaving another low at 6507, the primary uptrend has survived (for now) as the bulls reacted well, forming a positive hammer candlestick for the day which is a reversal signal. This makes today’s trading important as this needs to be followed up by further supportive gains. The intraday hourly chart is also giving some positive signals, with a small head and shoulders reversal pattern completed yesterday above 6575 which implies 6640, whilst there has also been a crossover buy signal on the MACD, with RSI and Stochastics also positive. There is little resistance until 6620 now. Initial support on the hourly chart comes in at 6549.

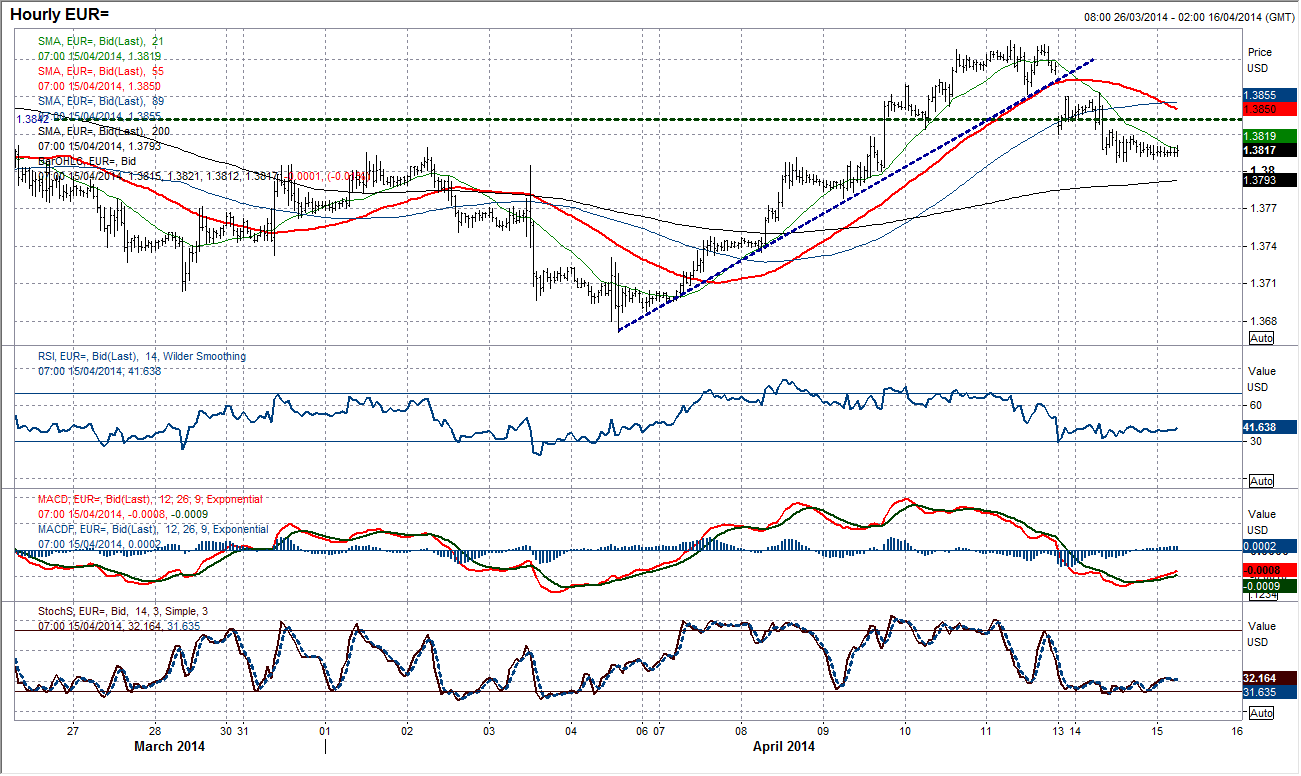

EUR/USD

Once more it looks like the beginnings of a correction may be taking hold. Yesterday’s intraday gap down following the weekend was bearishly filled before falling once more. The daily chart now shows a key high potentially having been left at $1.3905 and a drift lower which may just now be seen. Momentum indicators have begun to turn lower once more with a crossover sell signal on the Stochastics, suggesting a near term correction. The intraday hourly chart shows the potential for a correction in more detail. There is a top pattern that has formed on a break below $1.3830 which gives an implied target of $1.3765, whilst the breakdown of the support at $1.3830 has acted as a basis of resistance overnight. It is worth keeping an eye on the falling 21 hour moving average which had been an excellent basis of support through the rally, however since the correction has set in, it has become the basis of resistance, currently at $1.3819. Look to use any move towards the $1.3830 breakdown as a chance to sell today. The risk to this is a strong German ZEW number or more significantly a weak print for US inflation.

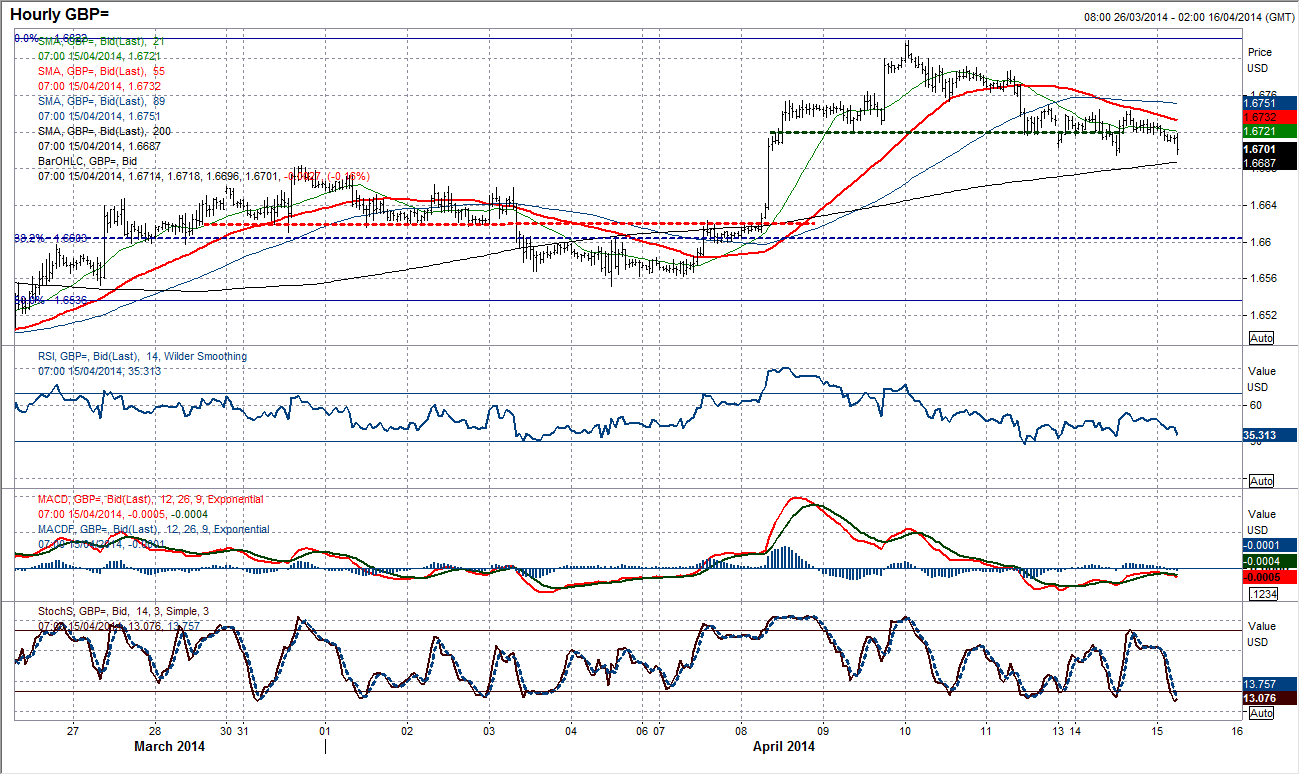

GBP/USD

Once more a head and shoulders top formation has completed which suggests that there will be a correction and the key high at $1.6822 will remain in place. Yesterday’s move below $1.6703 confirmed the top which targets $1.6620. The fact that the bounce yesterday failed under the resistance at $1.6749 helps the reinforce the corrective outlook. The falling 55 hour moving average at $1.6733 now appears to be capping the upside. Intraday hourly moving averages are in bearish configuration and point to further weakness. Yesterday’s low at $1.6694 should be seriously tested, below which is the old breakout high at $1.6682 and then $1.6663. A recovery back above $1.6753 would be needed to begin to improve the outlook once more.

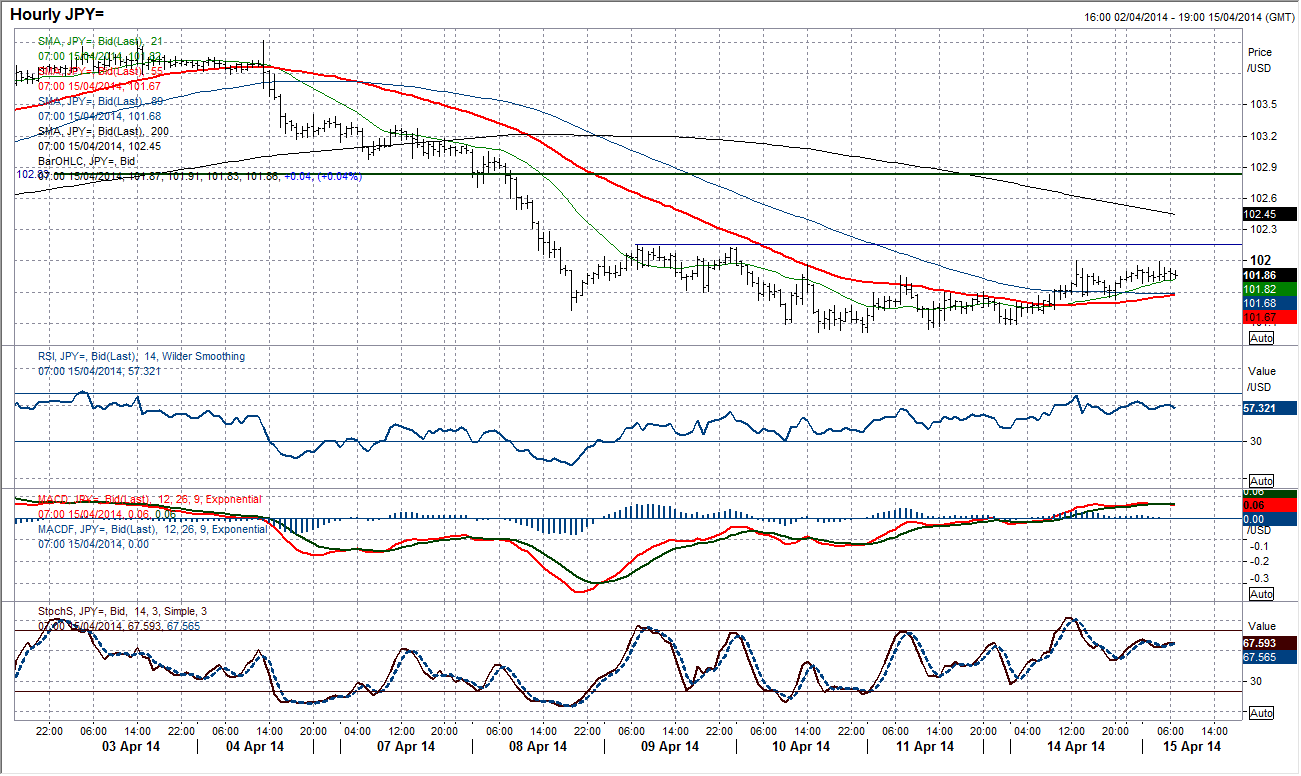

USD/JPY

There is an increasing sense now that a basing process is building. The support has formed around the rising 144 day moving average (currently at 101.63) and the momentum indicators are showing signs of improvement once more. After three sessions of dips below 101.40 formed support, the early positivity in the Asian session now raises the prospect of higher lows. The intraday hourly chart shows this improvement in more detail, with the 55 hourly moving average which had become the basis of resistance, now turning up to be the basis of support (currently 101.67. Hourly momentum indicators also continue to improve and upside pressure on resistance levels is being seen. Breaching the previous level at 101.97 was short lived overnight, but the intent remains. Above 102.00 would be psychological, but the key level is 102.15. A move above here would complete a rounding bottom and open recovery upside towards 102.71. A break back below the overnight low at 101.63 would be a disappointment for the bulls and increase the downside pressure.

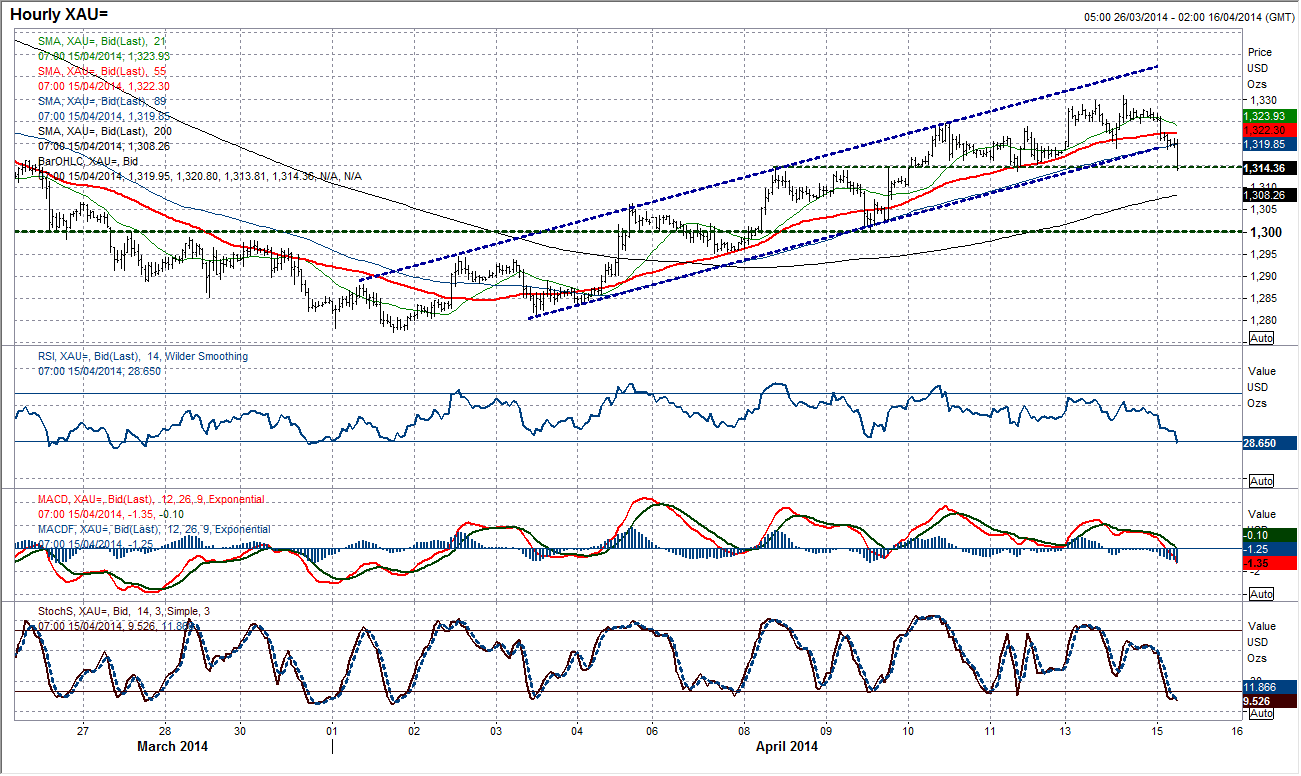

Gold

Whilst gold achieved a ninth consecutive higher low yesterday, today the sequence has been breached. Daily momentum indicators are just showing the early signs of falling over, while the initial price moves in the early hours of this morning has taken gold back below the 38.2% Fibonacci retracement of the $1392/$1277 correction at $1321. Furthermore, the intraday hourly chart shows a serious breach of the uptrend channel support. The hourly momentum indicators are also now on the limit and need the current support to hold otherwise the outlook may begin to change very near term. There is good price support in the band around $1315 and if this holds then the broken trend channel could still turn out to be a consolidation. The key near term support is at $1313.74 and a breach would imply a potential move back towards $1300 once more. If the bulls can regain their poise a push above $1330.90 then the way is once more open towards the resistance on the daily chart at $1342.43.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.