Market Overview

After yet more losses on Wall Street on Friday, Asian markets were mixed on Monday. The S&P 500 lost almost another per cent with weak results from JP Morgan, the first of the big banks to report, weighing on sentiment, while the tech-laden NASDAQ came under even more pressure. Focus is once more on Ukraine as the government threatened pro-Russian separatists in the eastern city of Slaviansk with military action. With the UN Security Council holding an emergency meeting today, the situation is certainly not getting any better and this could mean that investor risk appetite takes a knock once more.

Forex trading early in the European session shows the US dollar is finding support and beginning to claw back some lost ground. European equity markets are following the selling pressure from Wall Street with further losses this morning. Trading will be hoping that Eurozone Industrial Production can give them something positive to focus on this morning at 10:00BST, while the US Retail Sales at 13:30BST are expected to show a month-on-month improvement from 0.3% to 0.8% which could also help to support the dollar.

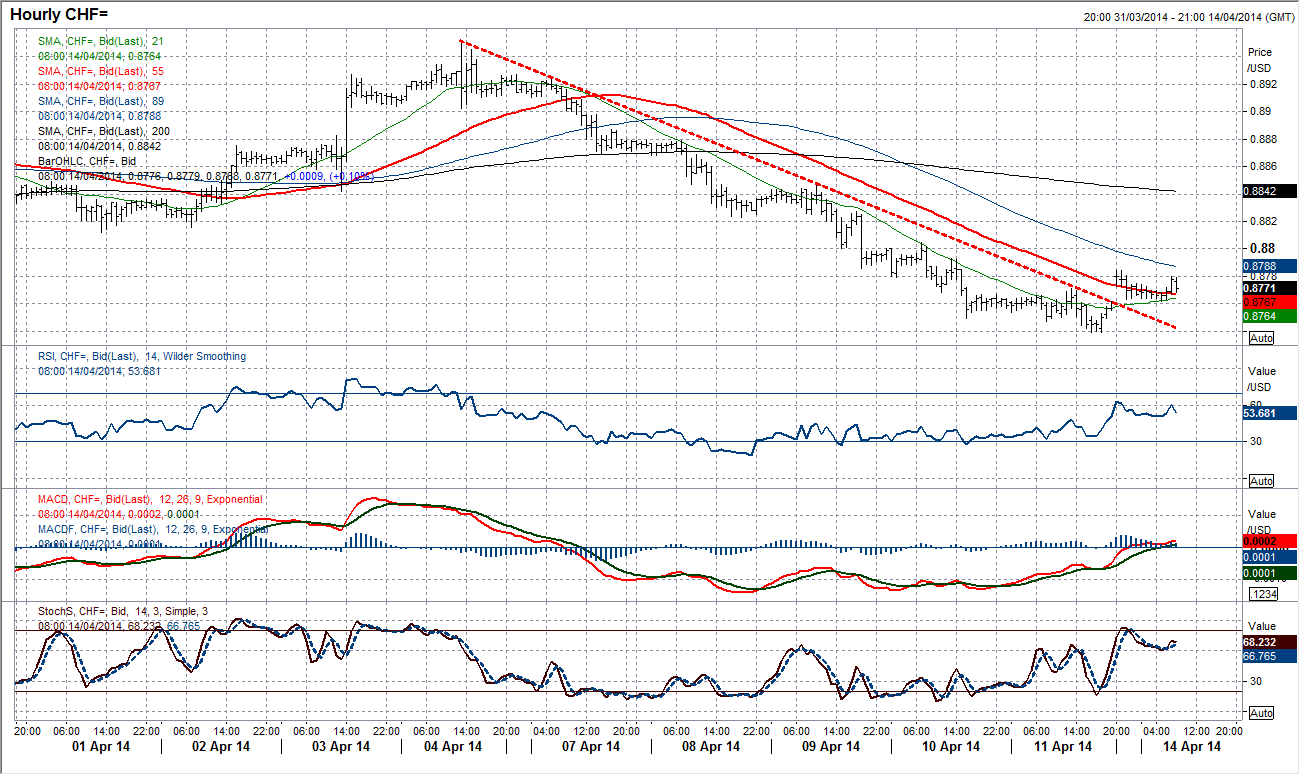

Chart of the Day – USD/CHF

After five straight days of declines on Dollar/Swiss, there are signs of a turnaround. For the past week, the falling 21 hour moving average has been used as the basis of resistance as the sell-off has taken to the lowest since 19th March. With support now in place at 0.8739, the dollar has rallied this morning and a gap higher after the weekend has moved clear of the 21 hour moving average (now 0.8764), which has also now turned higher. Intraday hourly momentum indicators are also improving strongly. The early European trading has been positive for the dollar once more and a move above the overnight high at 0.8784 would open 0.8805, above which opens the minor trading band 0.8823/46.

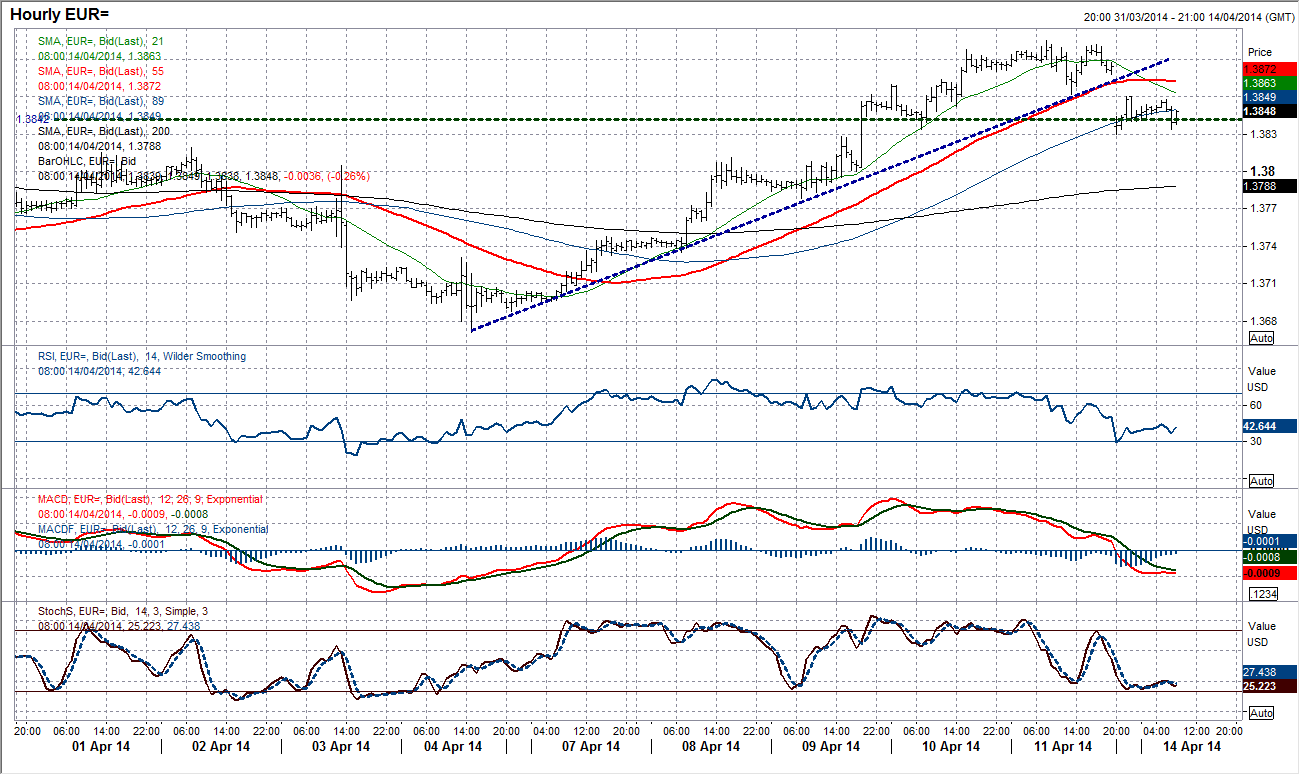

EUR/USD

Signs of a correction could be brewing once more. After four strong daily candlesticks last week, a “doji” candle denoting indecision, on Friday has now been followed by weakness on Monday morning. After the weekend break, a gap lower has been seen on Euro/Dollar. The daily chart shows to gap to Friday’s low at $1.3862 as still open and should be filled today, but if the price action merely fills the gap (returns to the gap price but then closes below it which is bearish) and cannot close the gap (return to the price and close above it) then this would be seen as a bearish indication near term. The intraday hourly chart has deteriorated by the move, trading under the 55 hour moving average once more. A breach of the overnight low at $1.3830 would bring the Euro back into the next band of support around $1.3778/$1.3811.

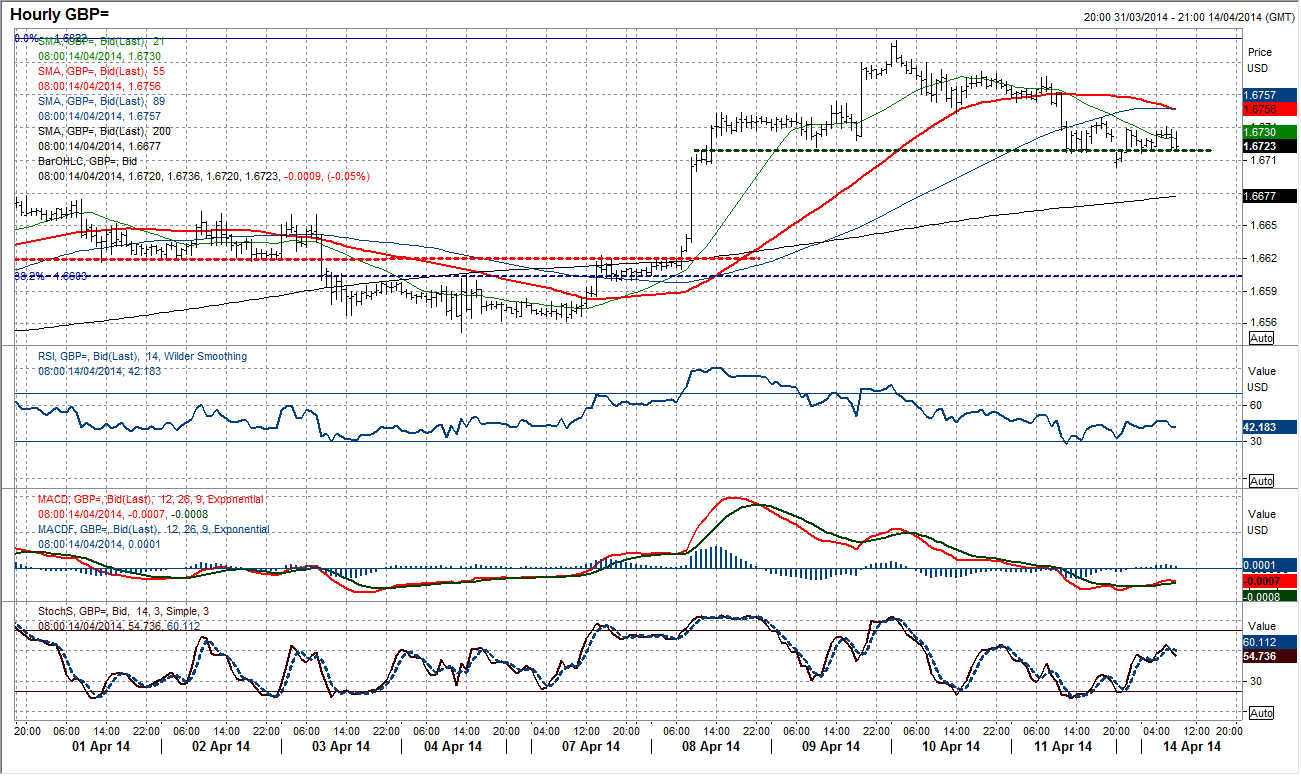

GBP/USD

The failure to make the move above the key multi-year high at $1.6822 has resulted in a consolidation in Cable. However this consolidation is threatening to form a corrective top pattern. The overnight gap lower below the intraday support at $1.6716 has opened the prospect of a head and shoulders top pattern. The rate has immediately recovered to reject the move, however the pressure could now increase to the downside and any move back below today in European trading would suggest the intent of a correction. The pattern gives an implied move back to $1.6612. Intraday hourly momentum indicators are in weak configuration and with deteriorating moving averages, if Cable is unable to move back above the resistance band around $1.6750 then this downside momentum could tell.

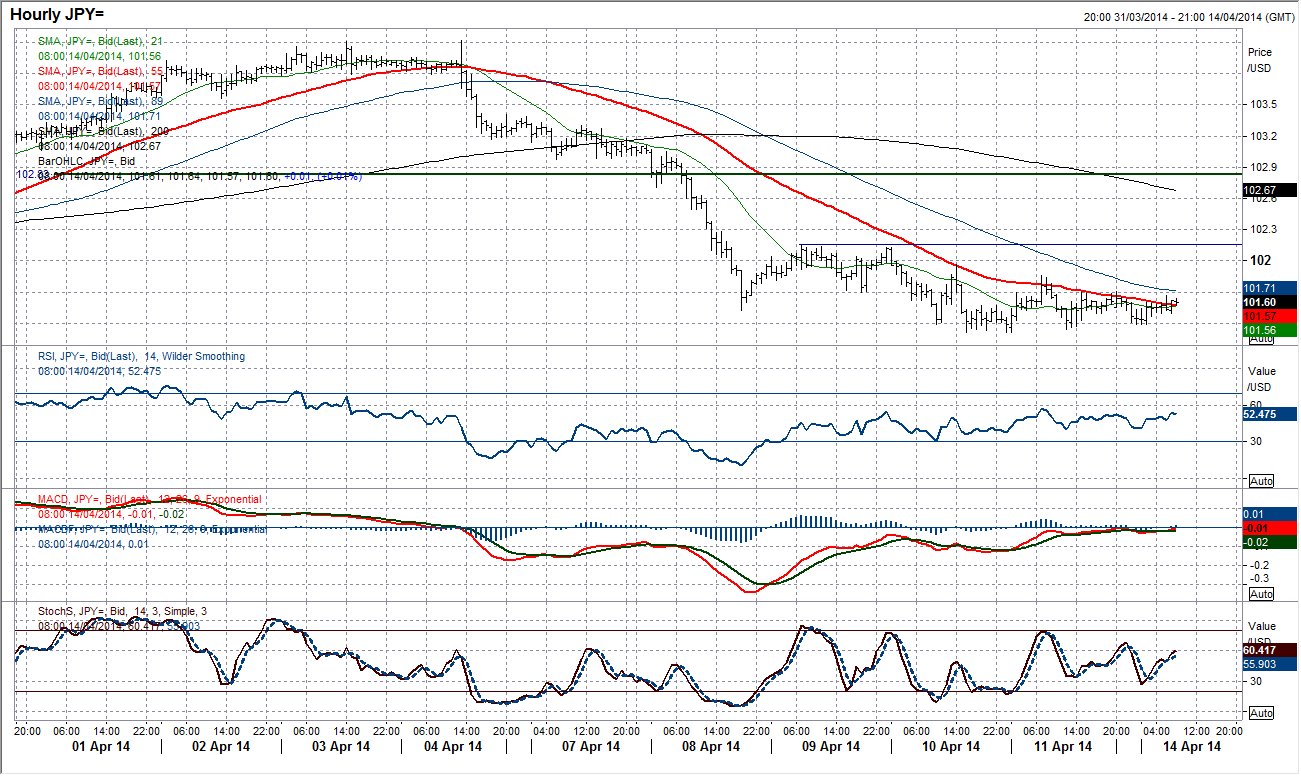

USD/JPY

The strength of the downside pressure has just reduced in the past couple of days as Dollar/Yen has consolidated and trades at the bottom of the 10 week sideways trend channel. The 144 day moving average can still be considered to be supportive at 101.60, whilst the daily momentum indicators look to pick up once more from a ranging configuration. For signs of a recovery, on the intraday hourly chart, watch for a supported move above the 55 hour moving average which has been resistance over the past couple of sessions. Also a move above 101.71 and 101.84 which have been the last two peaks. The intraday support band is 101.31/39. The intraday momentum indicators are improving although they are still in bearish configuration. For signs of a potentially sustainable recovery there would need ot be a move above the reaction high at 101.97.

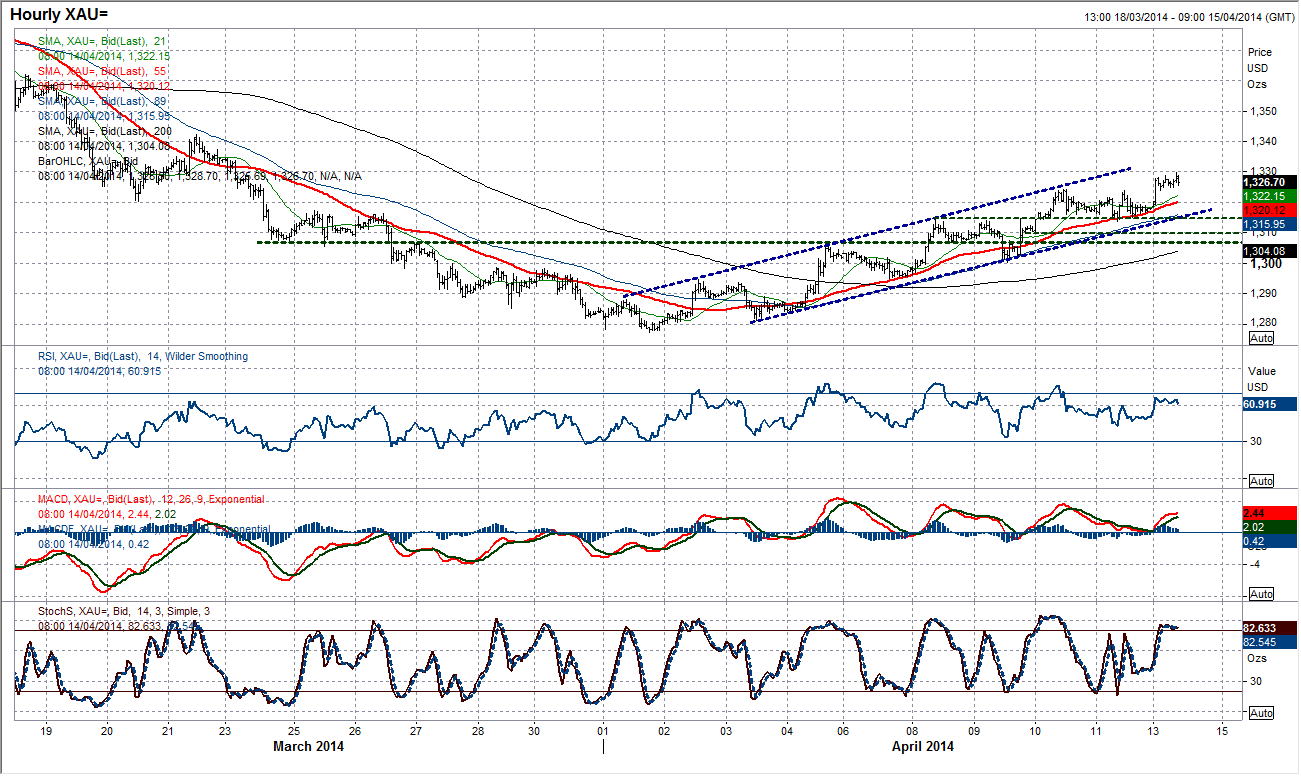

Gold

The gold price complete its 8th consecutive higher low on Friday as the recovery continues. Having now moved through the 38.2% Fibonacci retracement of the $1391.76/$1277.29 at around $1321, the upside is now be open for a move towards the 50% Fibonacci level at $1334, whilst the next price resistance comes in at $1342.43. Daily momentum indicators are nicely pushing higher as a crossover buy signal has formed on the MACD lines. The intraday hourly chart shows the uptrend channel continues to pull the price higher as corrections back towards previous breakout highs are seen as chances to buy. The low of the channel currently comes in around $1315, whilst the hourly moving averages are all rising strongly as a combination of the 55 and 89 hour moving averages are supportive between $1315/$1320.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

USD/JPY crashes nearly 450 pips to 155.50 on likely Japanese intervention

Having briefly recaptured 160.00, USD/JPY came under intense selling to test 155.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD rallies toward 0.6600 on risk flows, hawkish RBA expectations

AUD/USD extends gains toward 0.6600 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.