Market Overview

The declines on Wall Street continued last night as once more the Dow and S&P lost over a per cent, while the technology stocks on the NASDAQ bore the brunt of the selling pressure. This move permeated into Asia trading overnight, with the Nikkei under pressure once more as the yen strengthened again as the Bank of Japan sat on its hands and failed to ease monetary policy (albeit this was expected by the market). The move out of US equities is not really showing in other assets yet, with only slight gains in gold, while only a small dip in US treasury yields. Perhaps this money will be waiting on the sidelines for US earning season which begins unofficially with Alcoa this evening.

Trading in Europe has begun with the bears exerting moderate control, but not a huge degree of selling yet. Forex trading has been fairly quite so far with the Euro and Sterling basically flat, but interestingly the Aussie and Kiwi dollars have started strongly, along with the continued strength in the Japanese yen following the BoJ decision.

There is not a huge amount of economic announcements today with UK Manufacturing Production at 09:30BST, with a year on year 3.1% growth expected. There are also a couple of Fed members, Kocherlakota and Plosser, both speaking this evening which might impact on the dollar.

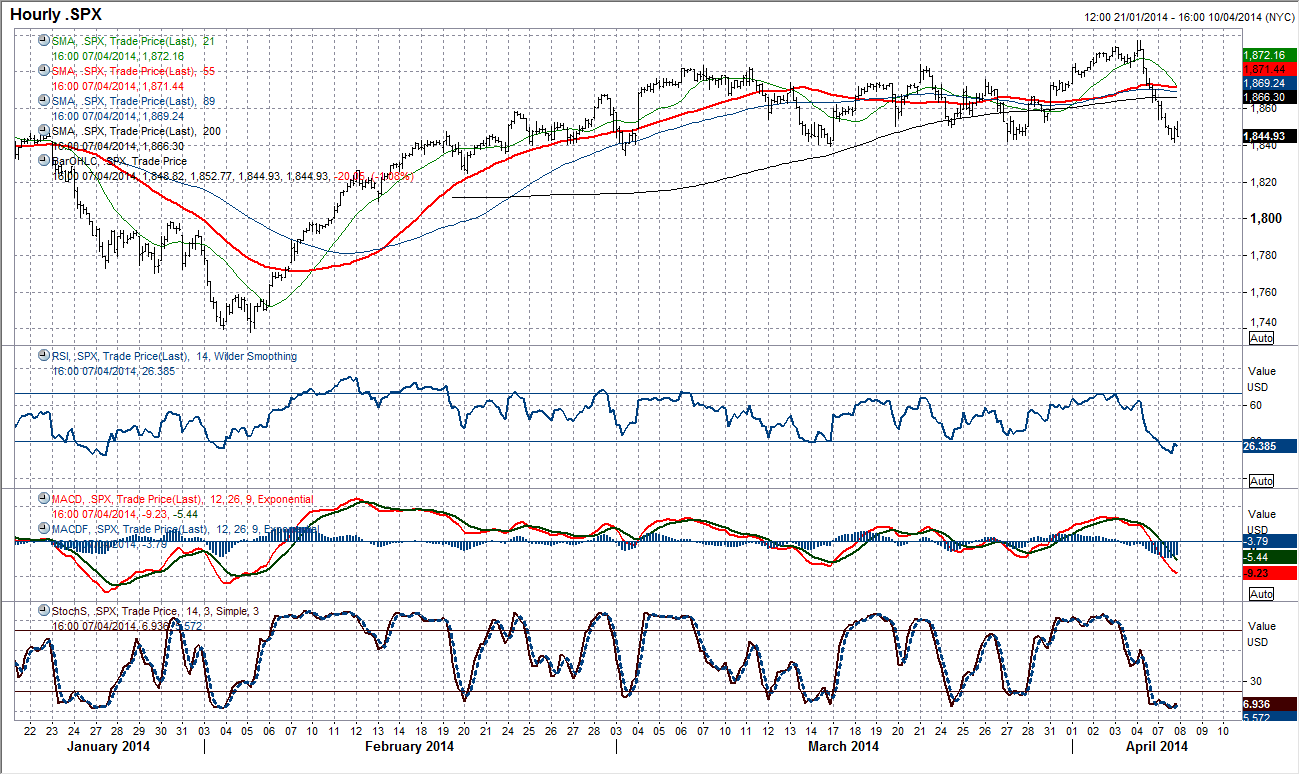

Chart of the Day – S&P 500

Friday’s bearish key one day reversal was followed up yesterday by a session of almost consistent selling pressure. This is now putting significant importance on the two reaction lows at 1834.44 and 1839.57 which are two key lows within this trading band for the S&P. Daily momentum indicators are not especially conclusive for a decline, with a sideways drift within a bullish configuration. However on the hourly chart the last time the momentum indicators were as negative as this was in late January when the S&P 500 corrected back to the support of its big uptrend on the daily chart and the 144 day moving average (both currently around 1793). Breaching the support at 1834.44 could well open a test of these longer term indicators once more. This support is therefore crucial for the near term outlook and the continuation of this range.

EUR/USD

The Euro spent the day just unwinding the sell off from the end of last week. However whilst the stepped decline of the past few weeks continues, this does still just have an outlook of a rally that will be sold into. The 21 day moving average is in decline and having provided support now has become resistance at $1.3808, while the daily momentum indicators remain corrective. I still feel the Euro will retreat to have a proper test of the rising 144 day moving average (currently $1.3653) which has supported the big corrections since September. The intraday hourly chart shows the minor recovery that is still within the downtrend intact since 17th March (which currently comes in around $1.3780). There is a band of resistance around $1.3750 which looks to be a decent area to sell, with the hourly momentum indicators now beginning to fall over the recovery is likely to peter out before a test of the $1.3671 low once more.

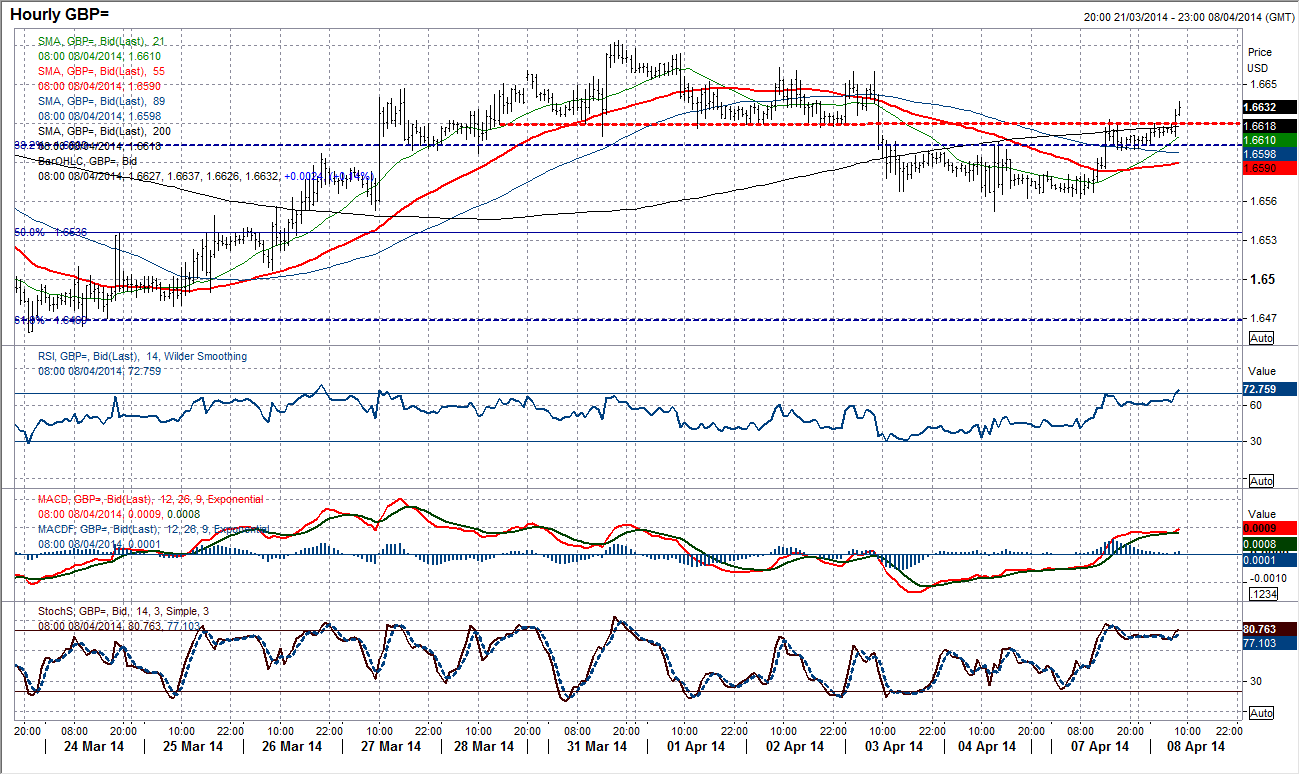

GBP/USD

The outlook is fairly uncertain as Cable has formed support once more around the uptrend on the daily chart that has been in place since August. On an intraday basis Cable continues to pay considerable attention to the 38.2% Fibonacci retracement at $1.6603. Yesterday the rate recovered back higher through the pivot level once more and has been using it as a basis of support overnight. However, the upside is currently being capped by the neckline resistance of the previous top pattern that formed below $1.6620. The outlook has got some mixed signals here now. Hourly momentum indicators have significantly improved, with near term moving averages picking up, however the 200 hour moving average is providing resistance. Exactly how Cable deals with this resistance around $1.6620 is key to whether the bulls can regain control to test $1.6663. A slide below $1.6600 would re-open $1.6551. A difficult call as things stand.

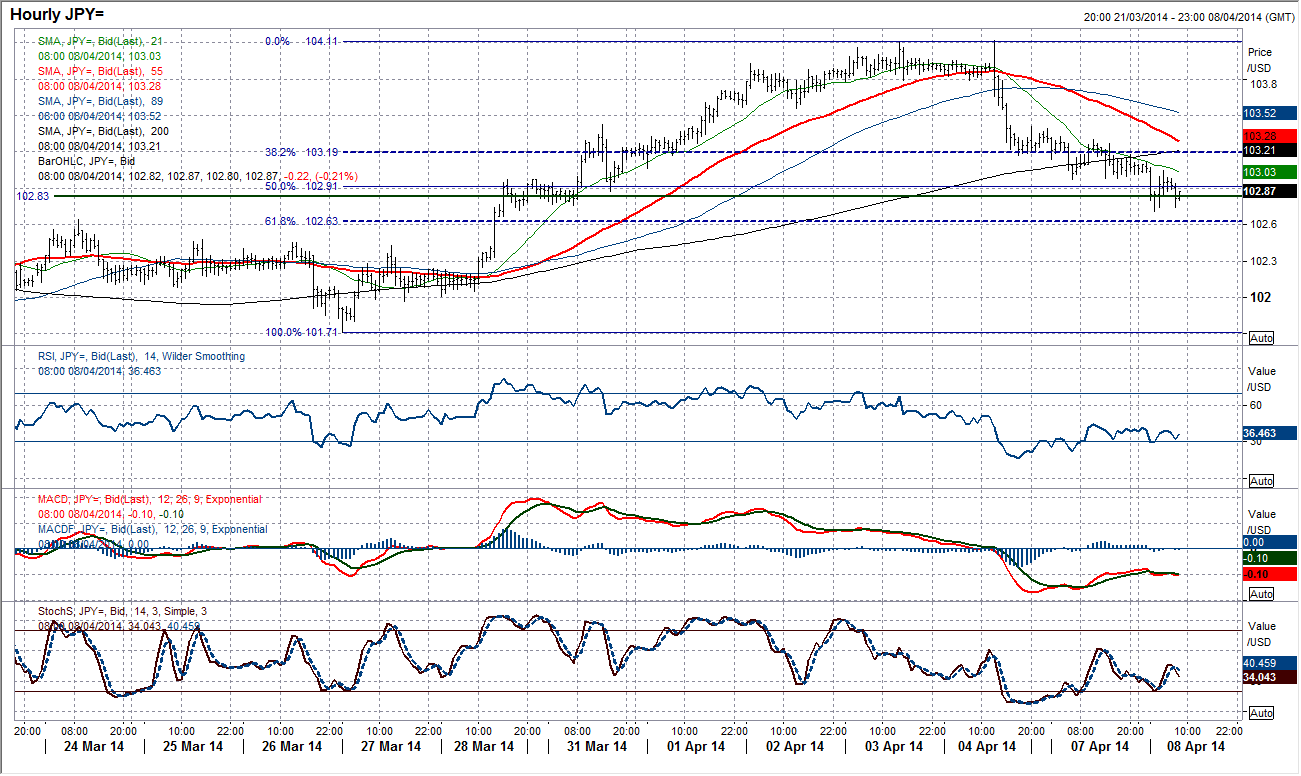

USD/JPY

The decision of the Bank of Japan to stand pat only had a minor impact with the corrective slide continuing overnight as the rate pushed below the 102.83 pivot level. There has been a low at 102.71 but with the consistent tendency for lower highs since the Non-farm Payrolls related correction, there is little sign that this low will not be retested. Hourly momentum indicators remain very much in correction mode. A breach of the 61.8% Fibonacci retracement of the 101.71/104.12 rally at 102.63 would suggest a much deeper correction. The bulls would now need a reaction above 103.30 to suggest that they were regaining control once more.

Gold

Despite the selling pressure sweeping international equity markets yesterday there was no significant shift into gold, although early European trading today suggests that interest is beginning to pick up. The recovery in the gold price found support nicely at the rising 55 hour moving average yesterday which in the past week has become a very good gauge for gold, currently around $1298. This support at $1295.19 also came just above the breakout support of $1294.60. Furthermore the hourly momentum indicators are turning increasingly positive, with the MACD lines showing a bullish crossover just around the neutral line and the RSI turning higher at 40. A break above $1306.60 resistance has opened $13.17.25.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.