Technical Bias: Bullish

Key Takeaways

- British Pound surged higher against the US dollar and the Japanese yen, as buyers were in control.

- UK retail sales report will be released by the National Statistics today, which is expected to increase by 0.4% in March 2015, compared to the preceding month.

- GBPJPY breached an important resistance around the 179.00 area to clear the way for more gains in the short term.

Recent break higher in GBPJPY suggests that the pair might continue to trade higher as long as buyers remain in control.

Technical Analysis

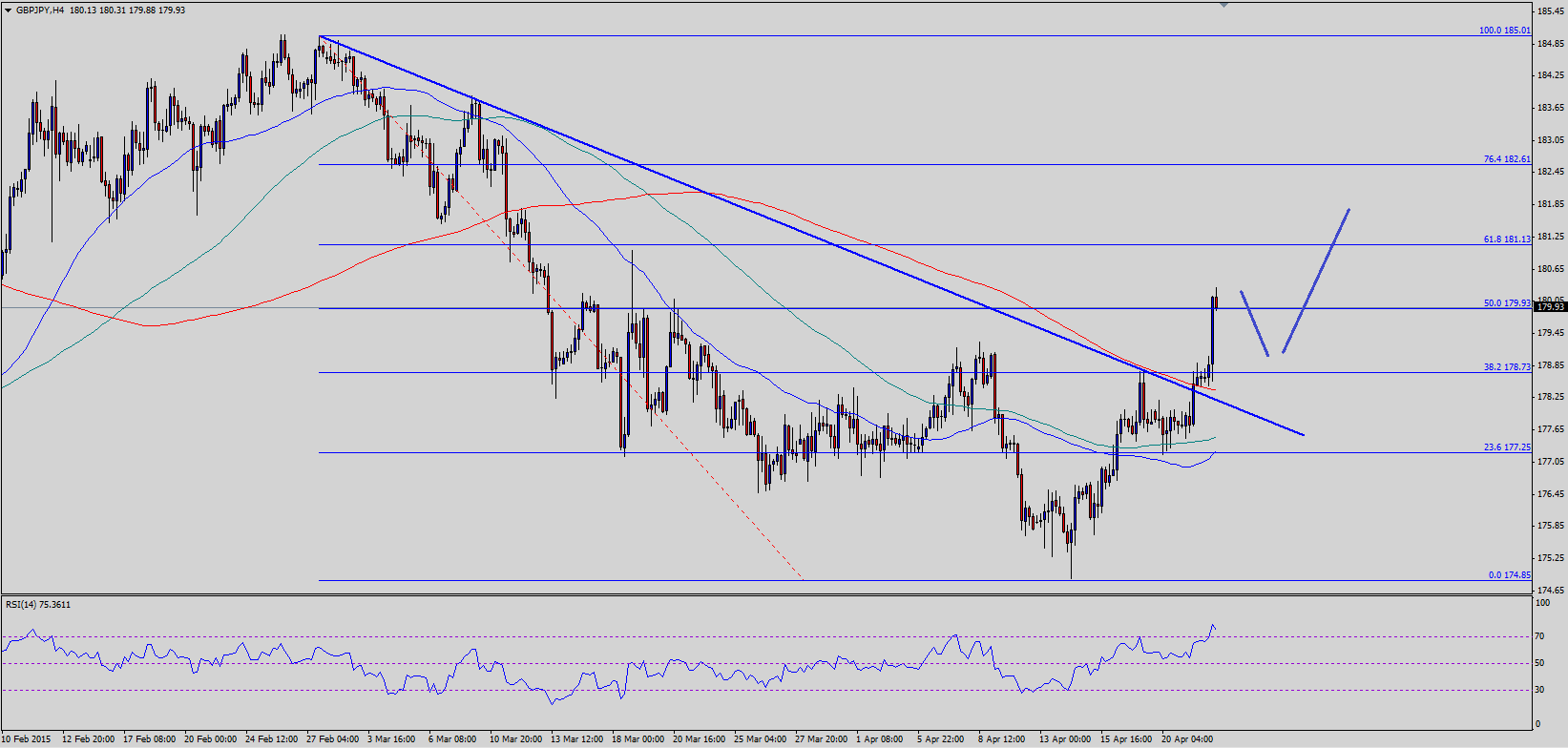

As mentioned the GBPJPY pair managed to clear an important resistance around 179.00, as there was a bearish trend line on the 4-hour which was breached. The most crucial thing is that the same trend line was coinciding with the 200 simple moving average (SMA) – 4H. Moreover, the pair also settled above the 38.2% fib retracement level of the last leg from the 185.01 high to 174.65 low. In short, the recent break was critical, and suggests that the pair might continue heading higher in the near term. Currently, it is testing the 50% fib retracement level, which means there is a chance of a correction.

If the GBPJPY pair corrects lower from the current levels, then the 200 SMA (4H) might act as a support in the short term.

On the upside, the next level of resistance can be around the 61.8% fib level.

UK Retail Sales

Later during the London session, the UK Retail Sales measuring the total receipts of retail stores will be released by the National Statistics measures. The forecast is lined up for an increase 0.4% in March 2015, compared to the preceding month.

Trade Idea

Buying dips in the GBPJPY pair around the 200 SMA looks good as long as it stays above the same.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.