Technical Bias: Bearish

Key Takeaways

Australian dollar traded higher earlier this week, but failed to break an important resistance area.

In the US, the number of new home sales will be released by the US Census Bureau, which is expected to decline this time.

AUDJPY rallies might be sold as long as the pair is trading below the 93.50-94.00 pivot area.

Aussie dollar weakness might continue in the near term not only against the US dollar but also against the Japanese yen.

Technical Analysis

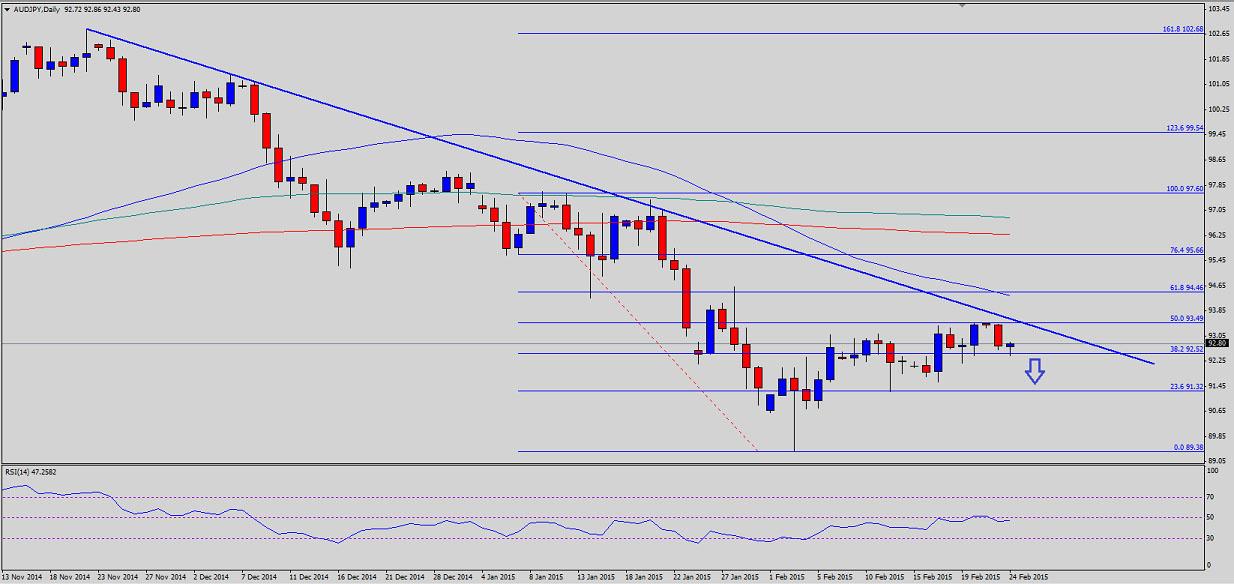

The AUDJPY pair after trading towards the 90.00 support area managed to correct higher, but found sellers on the upside. There is a major bearish trend line formed on the daily chart, which stalled the upside in the pair. Moreover, the 50% fib retracement level of the last leg from the 97.60 high to 89.38 low was also sitting around the same area. So, overall one can say that the 93.50 area is a major hurdle for the AUDJPY pair. This raises the probability that the pair might head lower in the near term. However, on the downside, the last swing low of 91.50-91.00 area might act as a barrier for the Aussie dollar sellers moving ahead.

If the AUDJPY pair manages to clear the highlighted trend line, then the next resistance might be around the 50-day simple moving average, which is around the 61.8% fib level.

Any further gains might be limited and dependent on how the Aussie dollar trades in the near term.

US New Home Sales

Later during the NY session, the number of new home sales in the US will be released by the US Census Bureau. The forecast is slated for a minor decline of 1.3% in January 2015, compared to the preceding month.

Trade Idea

One might consider selling rallies in the AUDJPY pair around the highlighted trend line considering the medium term view.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.