Technical Bias: Bearish

Key Takeaways

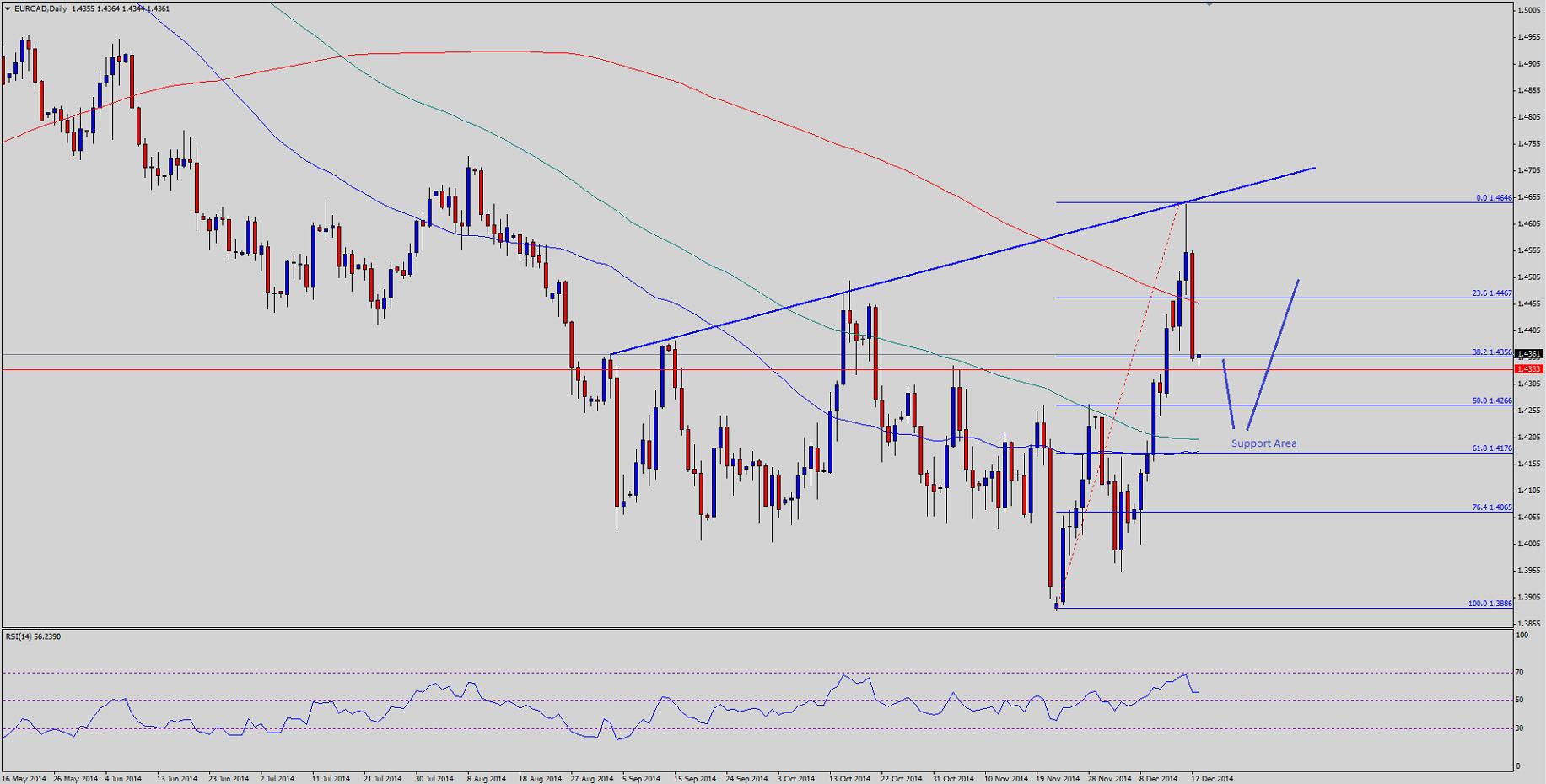

Euro surged higher against the Canadian dollar recently but failed to break a critical resistance area.

EURCAD might correct lower moving ahead if Euro sellers gain control.

German IFO Business climate index is a major risk event lined for release up later today.

EURCAD upside stalled right around an important resistance area of 1.4650, which has opened the doors for a major correction in the near term.

Technical Analysis

The EURCAD pair recently managed to clear the 200 day simple moving average, and challenged a critical resistance trend line on the daily chart around 1.4650. The pair failed to break the mentioned resistance area and currently trading lower. On the downside, the first and foremost support is seen around the 200 day SMA, followed by the 38.2% Fibonacci retracement level of the last leg from the 1.3884 low to 1.4646 high. A daily close below the stated support area would put a lot of pressure on the Euro bulls which might lead to more losses towards the 1.4350 swing support zone. There is a chance of recovery in the Canadian dollar and that’s why we cannot deny a major correction in EURCAD moving ahead. EURCAD might even head towards the 100 day SMA which is sitting around the 61.8% fib retracement level. Moreover, the 50 day SMA is also around the stated level.

On the upside, the recent high of 1.4646 might act as a major support for the EURCAD pair. The pair could retest the highlighted bearish trend line if it manages to clear the last high.

German IFO Business Climate Index

Later during the London session, the German business sentiment index will be released by the CESifo Group. The forecast is slated for a minor rise from the last reading of 104.7 to 105.4. Moreover, the German IFO Current assessment is expected to rise from 110.0 to 110.4. Any miss in the result might take Euro lower in the short term.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.