Technical Bias: Bullish

Key Takeaways

Euro jumped higher against the Canadian dollar recently and looks set for more gains in the short term.

German consumer price index will be released later during the London session which might cause moves in the EURCAD pair.

EURCAD has resistance around 1.4350 and support at 1.4150.

Euro climbed higher against a basket of currencies recently and managed to maintain gain Intraday especially against the Canadian dollar.

Technical Analysis

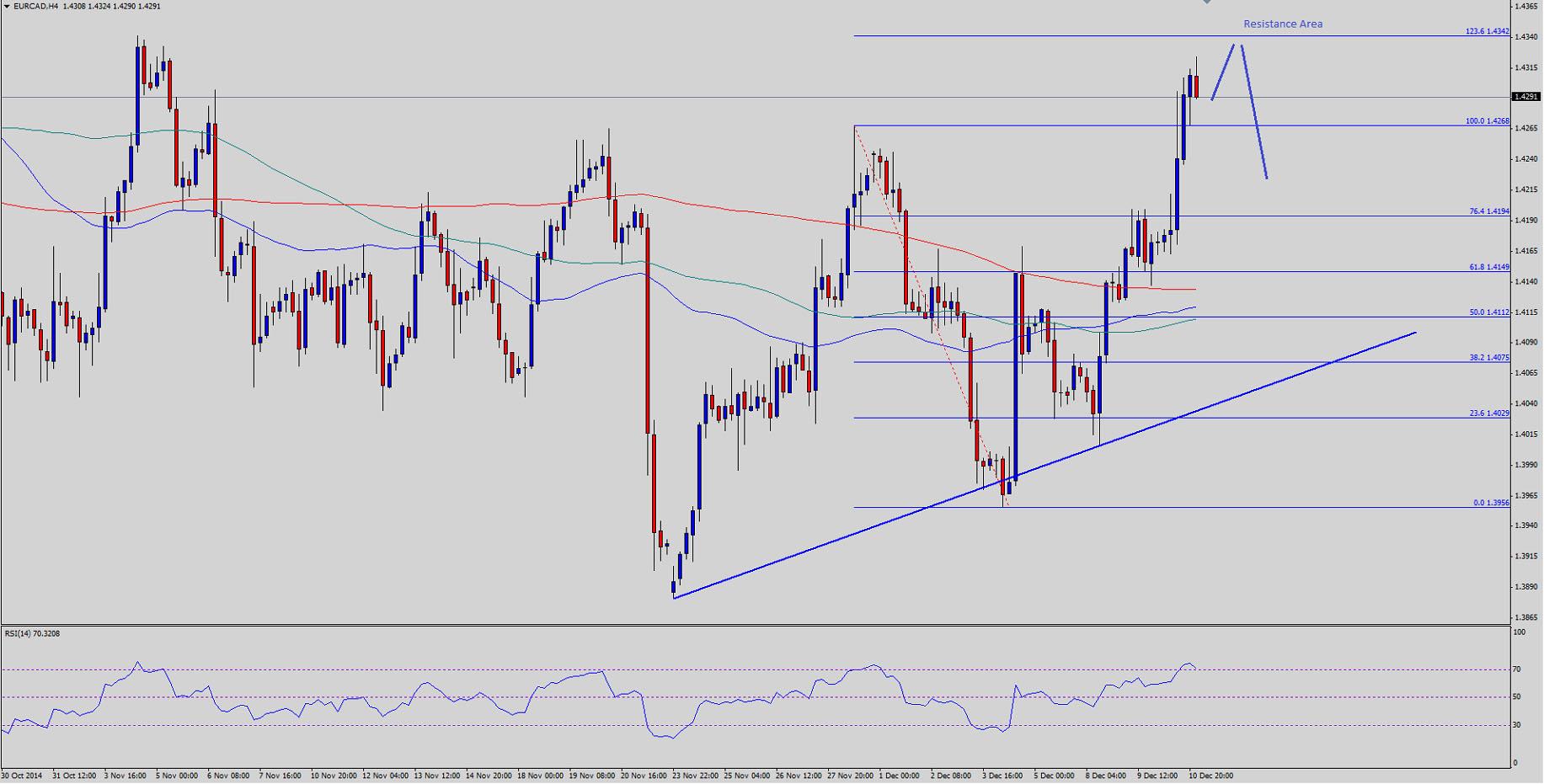

The EURCAD pair successfully managed to settle above all three important simple moving averages (200, 100 and 50), which can be considered as a bullish sign in the near term. Yesterday, the pair spiked around the last swing high of 1.4268 on a couple of occasions. There is a chance that the pair might head towards the 1.236 extension of the last leg from the last leg from the 1.4268 high to 1.3956 low. In that situation, the Euro sellers are likely to appear and protect further upside in the pair. The 4H RSI is around the overbought reading, which is warning sign moving ahead. A break above the 1.4350 level might signal more gain towards the 1.4400 resistance area.

On the downside, there are a lot of support areas starting with the 200 SMA (4H), which is sitting just above the 100 SMA. The most important support can be seen around a critical bullish trend line forming on the 4 hour chart of the EURCAD pair. Basically, any major correction lower from the current levels might be considered as a buying opportunity.

German CPI Report

Later during the London session, the Germany consumer price index released by the Statistiches Bundesamt Deutschland. The forecast is slated for an increase of 0.6% in November 2014, down from the last reading of 0.8%. If the outcome exceeds the expectation, then there is a chance that the Euro might continue heading higher in the near term.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.