Technical Bias: Bullish

Key Takeaways

US dollar index broke an important resistance and moved towards the 89.00 level.

A test of the last swing high is possible in the near term.

Today, the US ISM Non-Manufacturing Index will be released by the Institute for Supply Management (ISM), which might cause an impact on the US dollar moving ahead.

US dollar regained bullish bias after a mild correction during the last week and looks set for more gains as long as the incoming economic data does not disappoint.

Technical Analysis

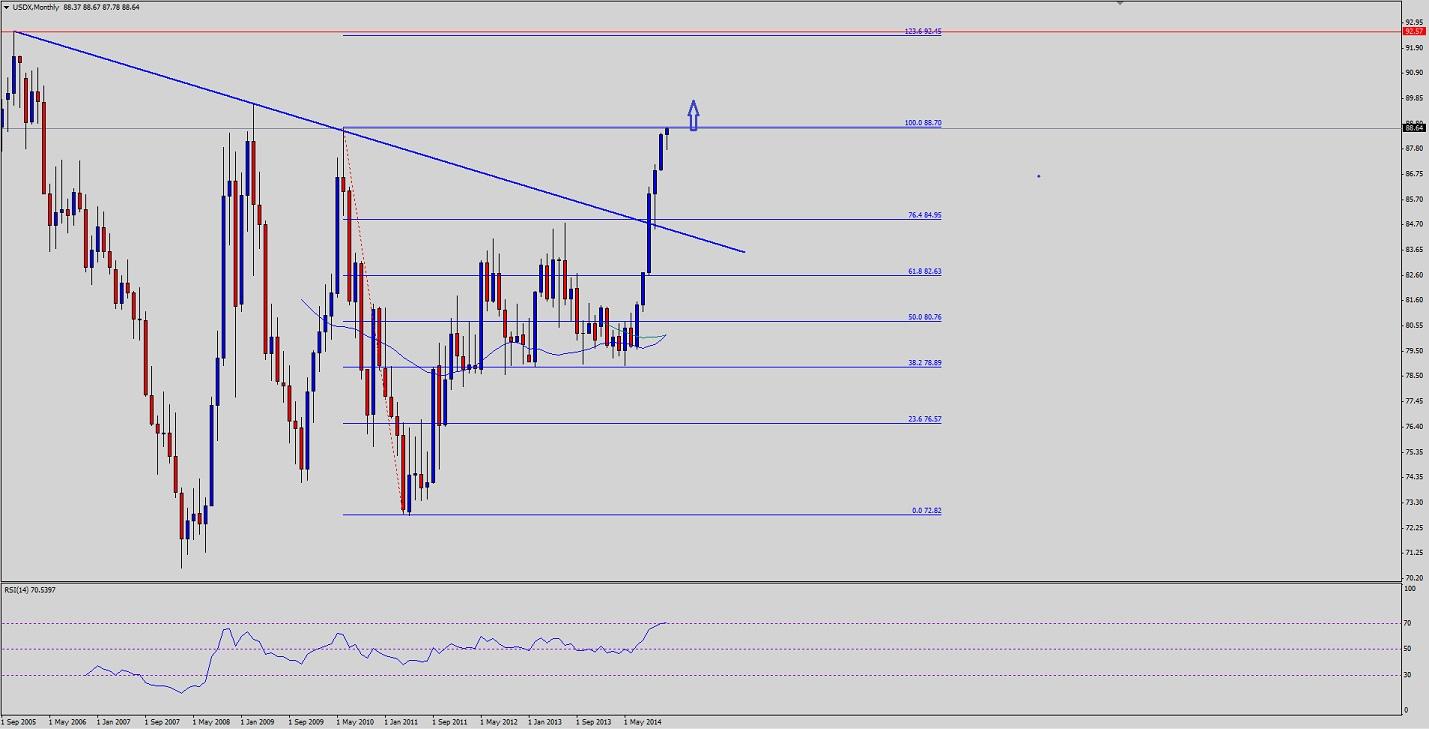

There was a monster bearish trend line on the monthly chart of the US dollar index, which was broken a couple of months ago. This particular break has ignited a solid bullish momentum in the US dollar as can be seen in the chart attached. The dollar index almost tested the 100% extension of the last drop from the 88.70 high to 72.82 low. It looks like that it might head toward the 1.236 extension of the last leg in the near term. The most important point to note from the charts is the fact that the mentioned extension is sitting right around the 2005 high. So, it would be interesting to see whether the US dollar index can move towards the 92.50 level or not. In that situation, we might witness a solid selling interest as it represents a major swing area.

On the downside, the broken resistance around the 87.50 area might act as a support for the US dollar index. Any further losses might take it towards the 87.00 area.

Moving Ahead

Later during the NY session, the US ISM Non-Manufacturing Index will be released by the Institute for Supply Management (ISM). The forecast is slated for 0.4 point rise from the previous reading of 57.1 to 57.5. If the outcome matches the forecast or exceeds the expectation, then we might witness more gains in the US dollar moving ahead.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.