Technical Bias: Bullish

Key Takeaways

US dollar corrected sharply Intraday which can be seen as a stop hunt for the next trend move.

EURUSD was one of the major gainers as it posted a massive correction of more than 60 pips considering the current market sentiment for the Euro.

USDCHF got rejected around an important fib level at 0.9607.

Looking Ahead, there is a possibility of further retracement in the US dollar which can be considered as a buying opportunity.

Technical Analysis

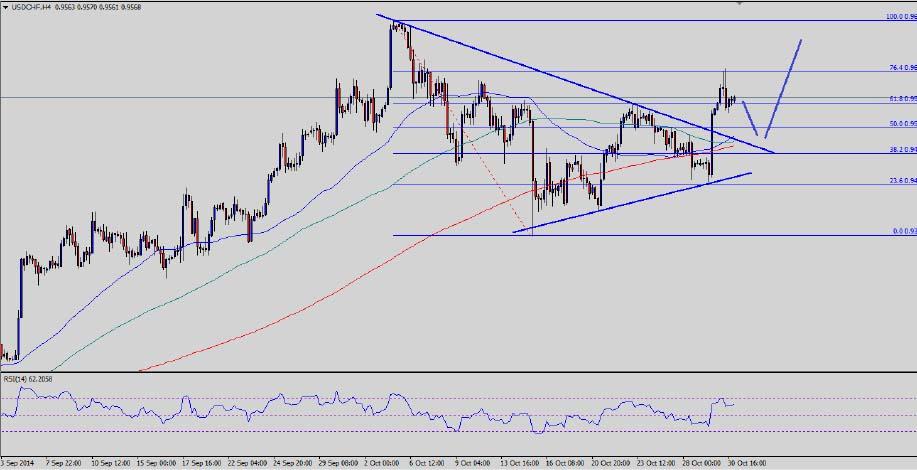

There was a monster triangle formed on the 4 hour timeframe for the USDCHF pair, which was breached earlier during this week. The pair climbed towards the 76.4% Fibonacci retracement level of the last drop from the 0.9683 high to 0.9362 low where it found sellers. There was a solid selling interest noted around the mentioned fib level, as the pair was completely rejected and moved lower. However, if it continues to move lower, then the broken triangle might come into play again. It could act as a support in the near term and the most important point is that the 100 and 50 SMAs are also sitting around the same area. So, the US dollar buyers might appear around 0.9500 to protect further downside and ignite a new trend moving ahead.

On the upside, the recent rejection level might continue to act as a monster resistance for the USDCHF pair. Only a break and close above the same could take it back towards the last swing high of 0.9683. In the medium term, a test of 0.9700 cannot be denied.

Moving Ahead

There are a couple of low-risk events lined up during the NY session today. The chance of a major move is very less and we might mostly witness ranging moves. We need to be very careful, as it is the month end and anything is possible in such conditions.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.