Technical Bias: Bullish

Key Takeaways

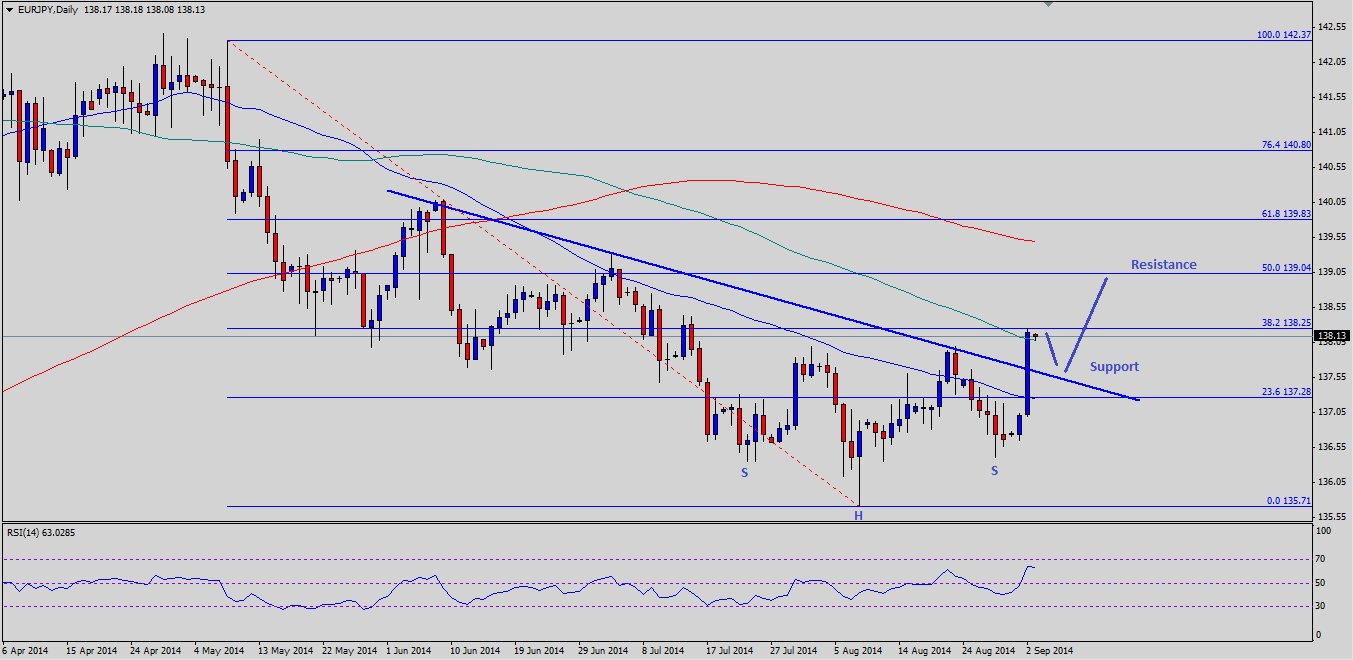

- Euro managed to gain bids against the Japanese yen and broke an important barrier to trade towards the 138.00 level.

- Possible inverse head and shoulder pattern forming on the daily timeframe.

- EURJPY support seen at 137.50 and resistance ahead at 138.25.

The Euro climbed against the Japanese yen yesterday, as the latter one fell sharply against most major currencies.

Technical Analysis

There was a critical bullish trend line on the daily timeframe for the EURJPY pair, which was breached yesterday. Currently, the pair is trading around the 38.2% Fibonacci retracement level of the last drop from the 142.37 high to 135.71 low. The most important thing to note that the mentioned fib level also coincides with the 100-day simple moving average (SMA). So, there is a chance that the pair might fail and correct lower from the current levels. In that situation, the broken trend line might come into play, and could act as a support in the near term. However, that cannot be seen as a bearish sign, as there is a high probability that the pair is heading towards the 50% fib retracement level in the short term, and it might even not correct lower from here.

On the upside, the 50% fib retracement level is at 139.04, followed by the 200-day SMA. Any further gains might take the pair towards the 61.8% fib retracement level.

Euro Zone Services PMI

The Euro-zone Services Purchasing Managers' Index (PMI) will be released by the Markit later during the London session. The forecast is of no change, and the Euro zone services PMI is expected to register a reading of 53.5. If the outcome beats the forecast, then the Euro might continue trading higher not only against the Japanese yen, but also against the US dollar.

Overall, buying dips is a good option as long as the EURJPY pair is trading above the 50-day SMA.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.