Technical Bias: Neutral

Key Takeaways

- Euro broke an important resistance area against the Japanese yen recently which could trigger a rally moving ahead.

- 136.80 level must hold if the EURJPY pair has to continue trading higher.

- EURJPY support seen at 136.80 and resistance ahead at 138.25.

The Euro buyers managed to push the shared currency higher against the Japanese yen, and if the momentum continues then more gains are possible in the short term.

Technical Analysis

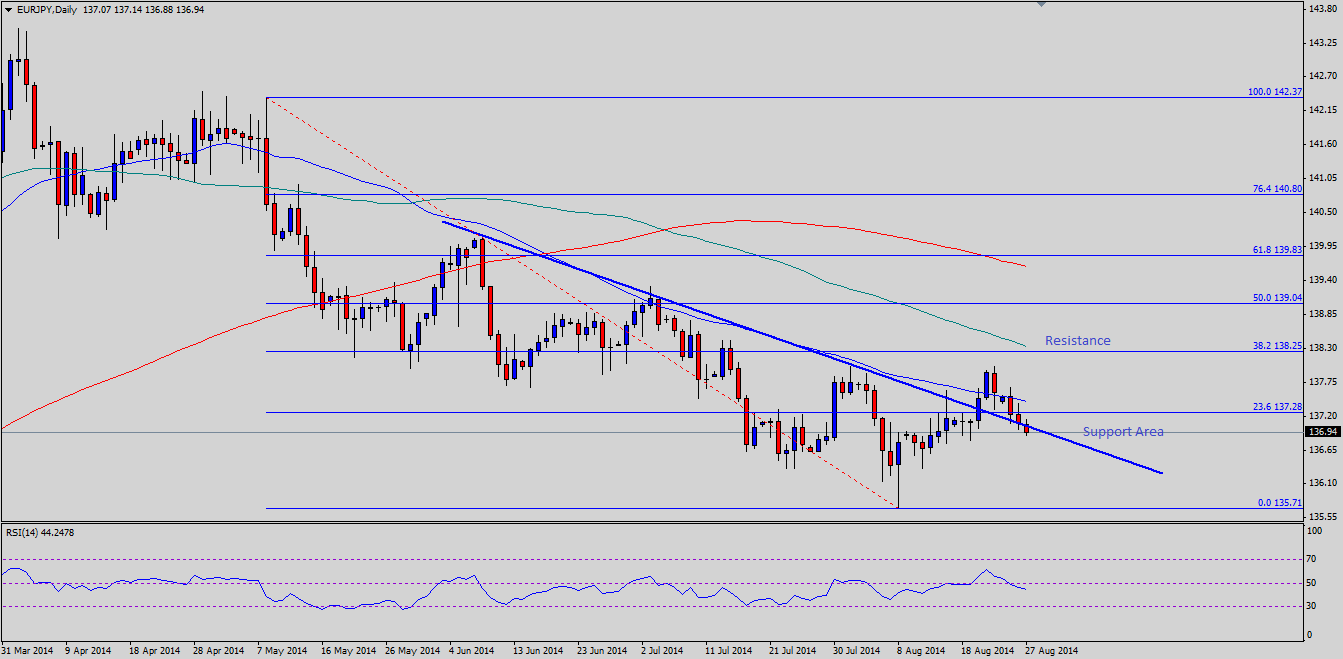

There was a critical bearish trend line formed on the daily timeframe for the EURJPY pair, which was breached recently. However, the pair dropped again, and is currently testing the same broken trend line. There is a chance that the pair might find support around the 136.80 level, but for this to happen there should be no daily close below the highlighted trend line. If the pair bounces from the 136.80 support area, then initial resistance can be seen around the 50-day simple moving average (SMA), followed by an important confluence area of 100-day SMA and the 38.2% Fibonacci retracement level of the last drop from the 142.37 high to 135.71 low. The only negative point to note from the charts is that the RSI has breached the 50 mark, which encourage the Euro sellers in the short term.

If the pair closes below the 136.80 support area, then a move towards the last low of 135.70 is possible moving ahead. A break and close below the mentioned area might call for a test of the 135.00 support level.

German GFK Consumer Climate

Today, during the London session the German GFK consumer climate data will be published. The Forecast is of no change from the previous reading. If the outcome misses the mark, then the Euro might move lower in the short term.

Overall, if there is no daily close below the 136.80 level, there is a chance that the pair might find buyers.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.