Technical Bias: Bearish

Key Takeaways

- British pound dived against the US dollar post MPC meeting minutes and Mark Carney’s speech.

- BOE’s dovish tone pushed the GBPUSD pair lower to create a new weekly low.

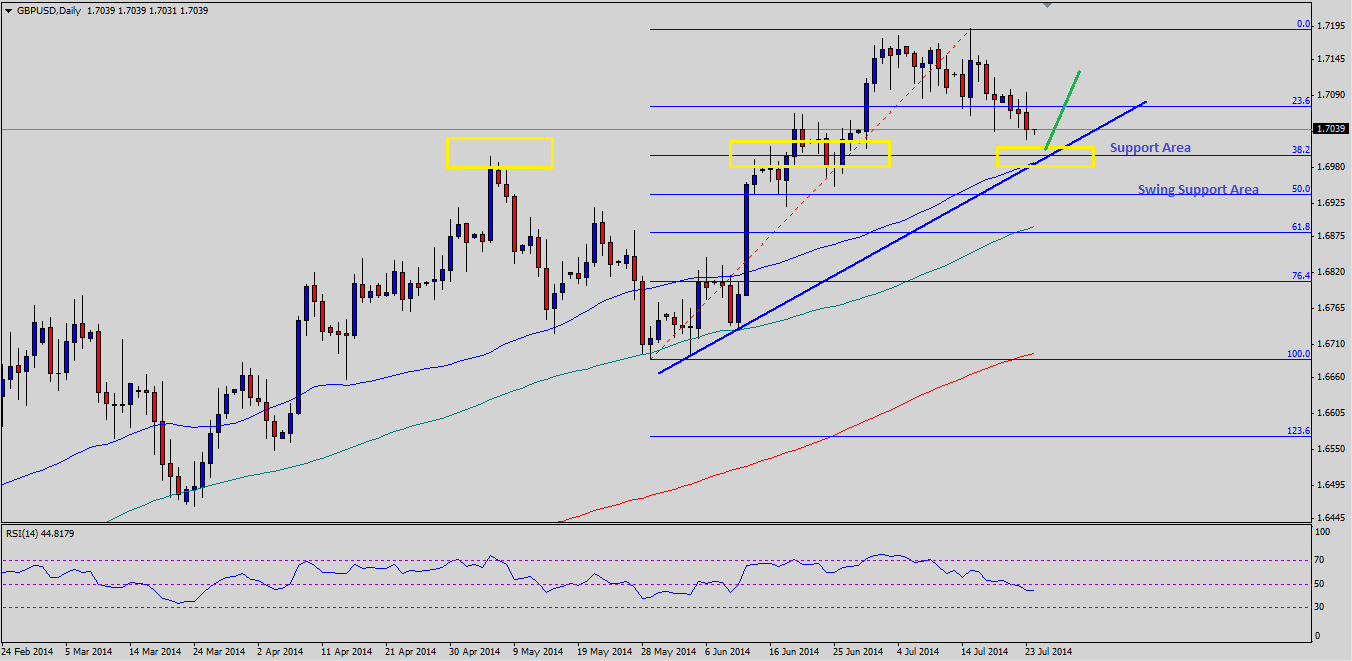

- GBPUSD support seen at 1.6998 and resistance ahead at 1.7060.

The Bank of England released its July monetary policy meeting minutes yesterday, which highlighted the fact that premature tightening in monetary policy might leave the economy vulnerable. The GBPUSD pair was seen trading lower after the release, and looks set for more losses in the near term.

UK Retail Sales Data

The UK retail sales data will be released later during the London session by the National Statistics. The forecast is of a 0.3% increase, compared to the previous 0.5% decline. If in case the outcome fails to match the forecast, then the British pound sellers might try to push the GBPUSD pair lower. Alternatively, a positive outcome could boost the GBPUSD pair in the short term.

Technical Analysis

There is a two-point trend line formed on the daily timeframe for the GBPUSD pair, which is currently moving along with the 50-day simple moving average (SMA). More importantly, the 38.2% Fibonacci retracement level of the last major leg from the 1.6689 low to 1.7189 high is also meeting the trend and 50-day SMA around the 1.6990-95 levels. So, technically the mentioned support area holds a lot of importance moving ahead, and if the pair falls closer to the 1.6995 level, then chances of buyers appearing to hold the downside would be very high. If buyers fail to hold the downside in the pair, then it might fall towards the 50% fib level at 1.6940.

Overall, as long as the pair is trading above the highlighted trend line it is very likely that the pair might trade back higher. However, the daily RSI has dipped below the 50 level, which is not an encouraging sign in the short term.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.