Technical Bias: Bullish

Key Takeaways

- US dollar climbed higher yesterday post solid labor data.

- The headline nonfarm payrolls number came in much better at 288K and the unemployment rate dropped to 6.1%.

- US dollar index support seen at 80.00 and resistance ahead at 80.30.

The US dollar registered an impressive rise against most of its counterparts, including the Euro, Swiss franc and the Japanese yen. However, the US dollar index stalled right around an important resistance area, which might cause a pullback in the near term.

Technical Analysis

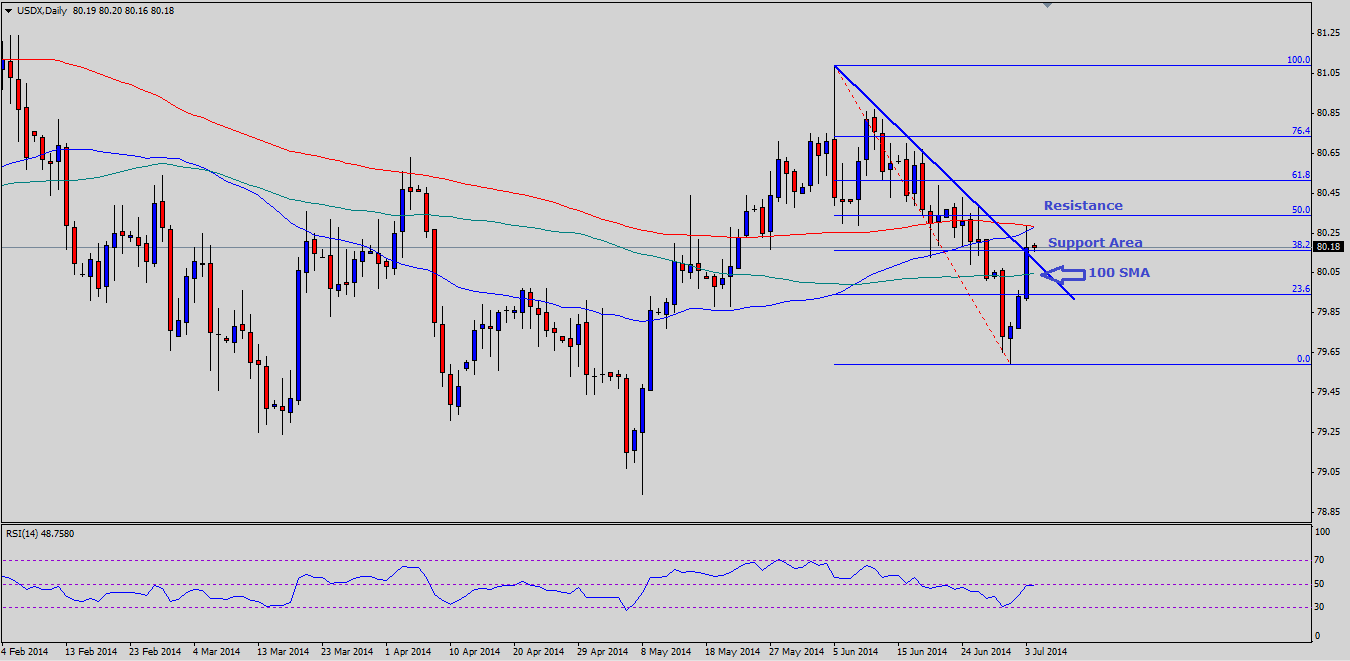

There is an important bearish trend line on the daily timeframe for the US dollar index. The US dollar index jumped higher during yesterday’s NY session after the release of the jobs data. It managed to break the 80.00 resistance level and breached the trend line as well. However, it found resistance in the form of a crucial confluence zone of 200 and 50-day simple moving averages. The 200-day SMA is also sitting just below the 50% Fibonacci retracement level of the last drop from the 81.09 high to 79.59 low. The daily RSI also reached the 50 level at the same time. This was one of the main reasons for which the rally in the US dollar stalled. The US dollar index just managed to close above the trend line, but it cannot be considered as a convincing break. So, if it climbs again, then it would be interesting to see how it reacts around the mentioned confluence resistance zone. A break above the resistance might take it towards the 61.8% fib level.

On the other hand, if the US dollar index moves lower again, then it might find support around the broken trend line area. Any further losses might take it towards the 100-day SMA, which could hold the downside moving ahead.

The daily RSI needs to break the 50 level if the US dollar has to gain traction in the coming sessions else a move lower is quite possible.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.