Key Takeaways

- Swiss franc continues to struggle against US dollar.

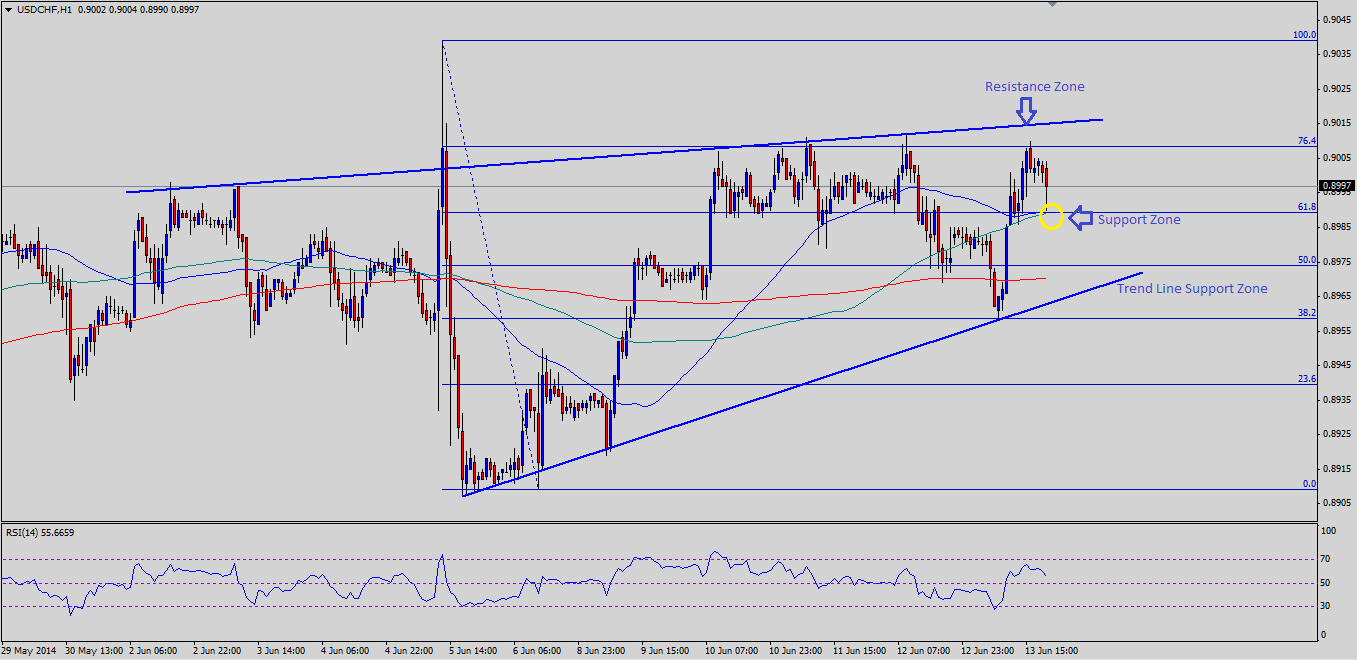

- An important triangle to play a key role moving ahead for the USDCHF pair.

- USDCHF support seen at 0.8980 and resistance ahead at 0.9020.

The US has been dollar consolidating against the Swiss franc just below a critical resistance zone, as the USDCHF awaits a short-term breakout.

Technical Analysis

There is a triangle forming on the hourly timeframe for the USDCHF pair with resistance around an important technical level. The triangle resistance area coincides with the 76.4% Fibonacci retracement level of the last major drop from the 0.9040 high to 0.8905 low. The pair has struggled a lot of times around the mentioned resistance zone, but the bullish momentum remains intact in the short term. If the pair manages to climb higher, break the triangle resistance zone and settle above it, then it might open the doors for further upside acceleration towards the previous high, followed by the test of the 0.9060 level. The pair is trading above all three key simple moving averages on the hourly timeframe, which adds value to the bullish view moving ahead.

On the downside, initial support can be seen around an important confluence zone of 100 and 50 hourly SMA, followed by the 200 hourly SMA. If sellers gain control, then a test of the triangle support area is possible in the short term. However, a break of triangle support area looks difficult as of now, as the sentiment still favors the US dollar against the Swiss franc. There are some important risk events scheduled during this week, which might act as a catalyst for the pair moving ahead.

Overall, as long as the triangle support holds and RSI stays above the 50 level on the hourly timeframe, then more gains cannot be denied in the short term.

Recommended Content

Editors’ Picks

EUR/USD extends sideways grind below 1.0900

EUR/USD stays in a consolidation phase below 1.0900 following the previous week's rally. In the absence of high-tier data releases, the US Dollar stays resilient against its rivals as investors scrutinize comments from central bank officials.

Gold pulls away from record highs, holds above $2,400

Gold rose sharply at the beginning of the week on escalating geopolitical tensions and touched a new all-time high of $2,450. With market mood improving modestly, XAU/USD erases a majority of its daily gains but manages to hold above $2,400.

GBP/USD holds steady near 1.2700, Fedspeak in focus

GBP/USD fluctuates in a narrow channel near 1.2700 on the first trading day of the week. The cautious market stance helps the US Dollar hold its ground, while market participants assess remarks from central bank officials ahead of this week's key events.

Ripple stays above $0.50 on Monday as firm backs research on blockchain and quantum computing

XRP price holds steady above the $0.50 key support level and edges higher on Monday, trading at 0.5130 and rising 0.70% in the day at the time of writing.

Week ahead: Nvidia results and UK CPI falling back to target

What a week for investors. The Dow Jones reached a record high and closed last week above 40,000, for the first time ever. This is a major bullish signal even though gains for global stocks were fairly modest on Friday, and European stocks closed lower.