The U.S. Dollar has outperformed this week against a basket of major currencies, including the Euro, New Zealand dollar, Australian Dollar and Japanese Yen, as the recent economic data exceeded the Forecasts.Following better than expected retail sales data, it was the turn of CPI to come in stronger than consensus had hoped for, to help the U.S. dollar to recover some ground. The CPI figures exceeded the forecasts to register an increase of 0.2 percent in March.

The U.S. dollar traded higher against the Euro, British pound, Australian Dollar and Japanese Yen after the release. There was a noticeable shift in the market sentiment, which suggests that the recent rally in the dollar might have legs, but it faces a major hurdle on the way up.

Technical Analysis

U.S. dollar index recently found support around a critical area at 79.31 level.There is a major bullish trendline connecting all recent lows, sitting around the mentioned level. The most significant thing to note here is that the current rally faces a monster hurdle at 80.0 level, which represents 50.0% Fibonacci retracement level of the recent drop from 80.63 high to 79.31 low. A key simple moving average (50-day) also lies around the same level. So, sellers are expected to appear at 80.0.

There is a possibility of a break higher considering the sentiment shift, which might open the doors for a test of a crucial trendline connecting previous major highs at 80.60. It is very interesting that 200-day SMA waits around the same area to inspire sellers.

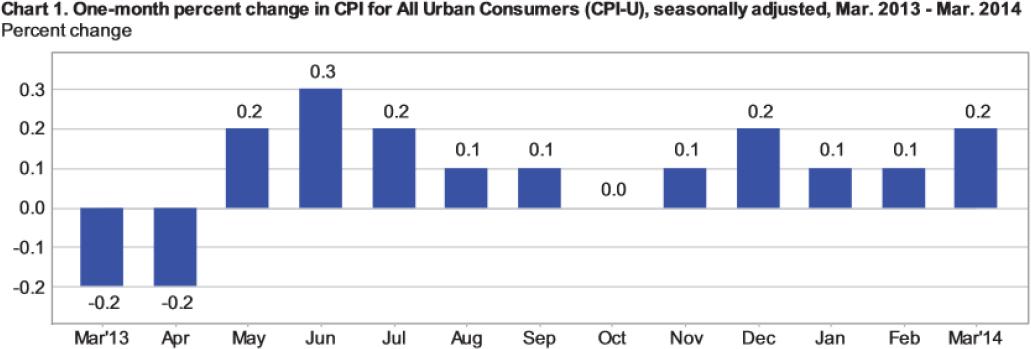

U.S. Inflation Report

Yesterday, the U.S. Consumer Price Index (CPI) figures were released by the US Department of Labor Statistics. The report suggested that the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in March on a seasonally adjusted basis, and over the last 12 months, the all items index increased 1.5 percent before seasonal adjustment. A key point to note from the report is that the higher housing and food costs helped lift overall consumer prices last month, which could encourage some Federal Reserve officials to continue backing tapering.

The report also highlighted that “the index for all items less food and energy has increased 1.7 percent over the last 12 months, as has the food index”. This suggests that core inflation continue to strengthen this year.

Overall, back-to-back improved economic data would certainly encourage the dollar bulls, and as long as the market sentiment remains intact, aggressive buying might be a possibility.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.