Shire (SHP): Exhaustion Gap Targets 4,600p Zone Again

Although shares of Shire are very much a blue chip FTSE 100 fixture, as far as the price action of the stock in recent times it could be said that those involved here have experienced the kind of rocky ride normally associated with small cap biotechs. This point is underlined by the volatile decline within a falling trend channel on the daily chart, one which has guided the stock down from 5,500p plus to 3,500p last month.

The good news for the near term though, is the way that there has been a higher low put in place above 3,500p. There is an added charting buy signal in the form of an exhaustion gap reversal of the mid March gap to the downside. The top of the gap is at 3,753p, with the implication being that while there is no end of day close back below this level one would be looking to further significant gains.

The favoured initial target over the next week is the former February resistance at 3,980p. Above this on an end of day close basis could unleash a sharper move higher towards the area of the 200 day moving average at 4,618p / December resistance. The timeframe on the 200 day line target is as soon as the next 1-2 months.

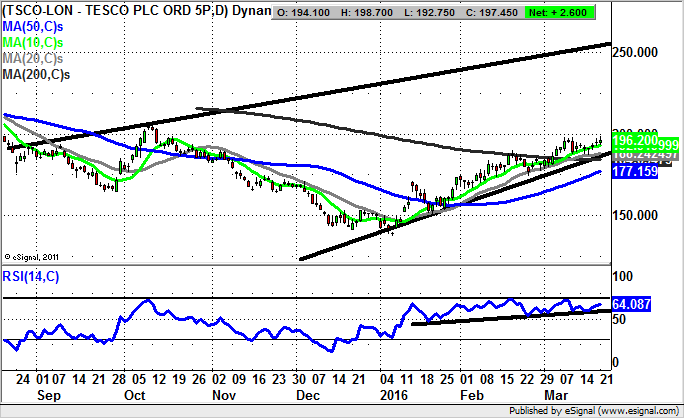

Tesco (TSCO): Above 200p Could Lead To 250p

It would appear that Tesco in the recent past has been a good example of the divergence which can occur between technicals and fundamentals, and how to focus on either one or the other in order to get on the right side of this major retail sector play. For instance, over the course of the last three months we have traded in the aftermath of a December – January double bottom bear trap gap reversal from below 140p. This has left a couple of unfilled gaps below the 155p level, something which on the face of it is a very strong backbone for the latest recovery. On this basis one would expect to see further significant gains, especially given the way that for the bulk of March to date we have seen this stock hold well above the 200 day moving average now at 184p.

The idea now is that as little as an end of day close back above the latest swing high of 198p could unleash a move as high as 250p over the next 2-3 months. This target zone is derived from a resistance line projection which can be drawn from as long ago as August last year.

Also helping back the idea that this turnaround is here to stay is the way that one can draw a multi tested uptrend line in the RSI window from as long ago as the middle of January.

The line in question runs at the 55 / 100 level, suggesting that at least while this holds there is little reason for bulls of this stock to blink in terms of the buy bets they are holding.

We are not authorised by the Financial Conduct Authority of England and Wales. The information and/or data on this website is provided by us and any data providers which may be used by us for your general information and use only and is not intended for trading purposes or to address your particular financial or other requirements. In particular, the information and/or data on the website:

(1) does not constitute any form of advice (financial, investment, tax, medical, legal, spread -betting or otherwise); and (2) does not constitute any inducement, invitation or recommendation relating to any of the products listed or referred to; and (3) is not intended to be relied upon by you in making (or refraining to make) any specific investment, placing any bet or making any other decision; and (4) has not been issued or approved by Tip TV for the purposes of section 21 of the Financial Services and Markets Act 2000 (as amended from time to time).

Opinions expressed by speakers in the videos, writers of the blogs are only opinions and not expert advice. These opinions do not necessarily agree with those held by Tip TV, its directors, agents or employees who disclaim any intent to make betting, securities or securities markets recommendations. The value of investments and the income derived from them may fall as well as rise. APPROPRIATE EXPERT INDEPENDENT ADVICE SHOULD BE OBTAINED BEFORE MAKING ANY INVESTMENT, PLACING ANY BET OR MAKING ANY OTHER DECISIONS.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.