JPY: Japan is now in recession following a 2nd consecutive contracting GDP, which is -0.4% missing expectations of 0.5%. The previous quarter was -1.8%. The consensus is for a snap election and delay of the next sales tax rise.

AUD: Vehicle sales down -1.6%

UP NEXT:

TECHNICAL ANALYSIS:

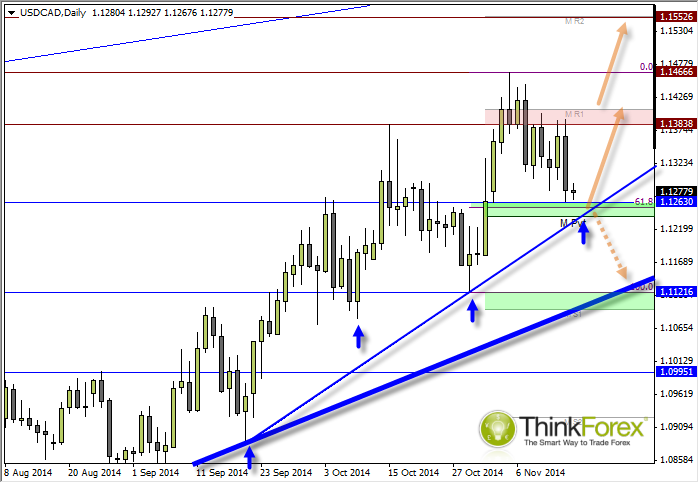

USDCAD: Potential for swing low to form above support

There are several technical levels close by which may act as support and offer the potential for a relatively high reward/risk ratio to assume a long position.

The cycle troughs have been quite rhythmical, so if these remain consistent then we can expect a cycle low this week.

If there is anything going against the trade right now, it's the Bearish Engulfing Candle from Friday and that price remains around the lows of this candle. However if you look back at previous swing lows you'll notice that each swing low has seen a grizzly bearish candle right before the turning point.

Those eager to get in could consider buying at market. These who prefer a little more confirmation can see if we generate a bullish candle today or tomorrow.

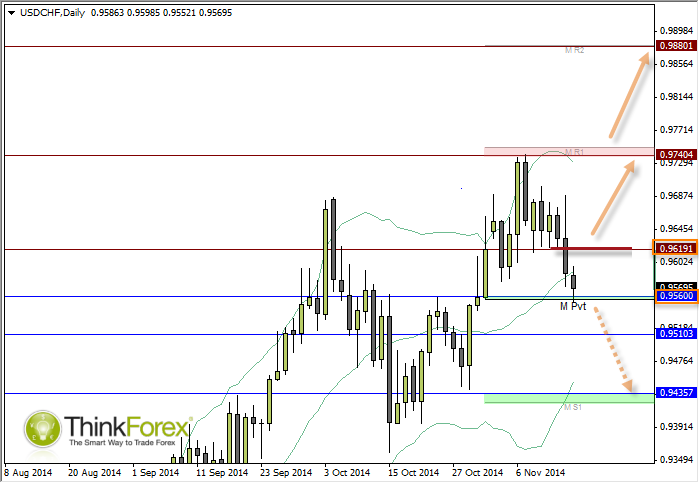

USDCHF: Swissy ponders at a juncture

We have seen price revert to the mean as suggested on the 12th November and now await for either a basing pattern to form around current levels, or for a deeper retracement.

One option would be to set a buy-stop above 0.9720 resistance to catch any upside break. Should price break below 0.9560 then the order can be cancelled.

Alternatively a break below 0.9560 support could be taken as a sign for price to visit the lower Bollinger Band. However keep in mind this is trading against the dominant, bullish trend.

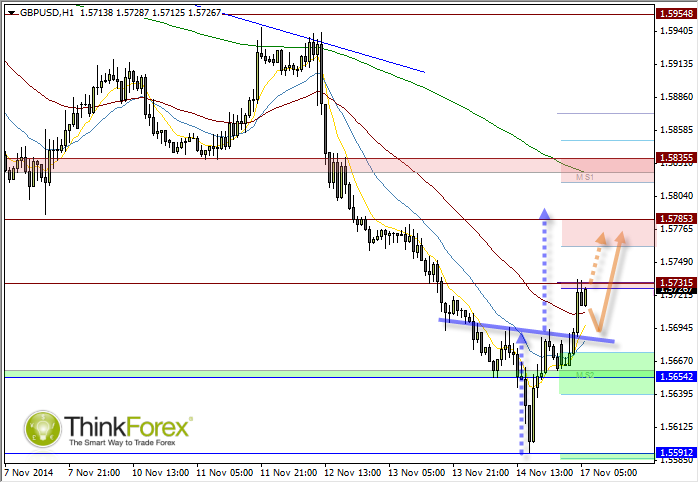

GBPUSD: Inverted Head and Shoulders in play

The 'Head' of the H&S rejected 1.56 with a V-Bottom to suggest aggressive buying at this level. The neckline has been confirmed and may act as support upon any retracements. A break below the neckline invalidates the setup.

However we may not see a retracement as price is forming a Bull Flag below 1.573 resistance. A break above this level should open up 1.578.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.