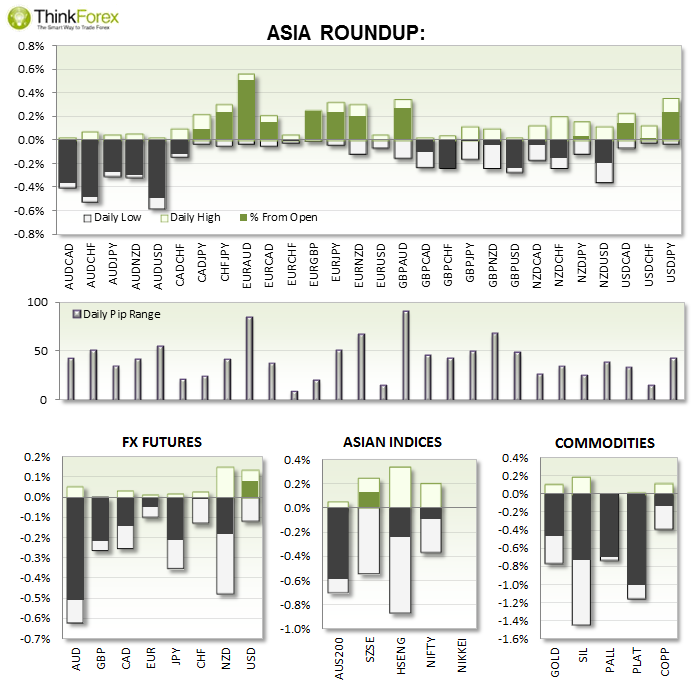

Australian Dollar continues to unravel: 2 members of RBA (including Glenn Stevens) expect the A$ to continue to unwind over the foreseeable future, so perhaps we are finally seeing the resumption of the A$ downtrend I have been banging on about all year! Maybe...

USD remains strong: Traders continue to pile into the Greenback in the lead-up to next week FOMC and FED meetings next week. It could be another explosive week, especially if they disappoint.

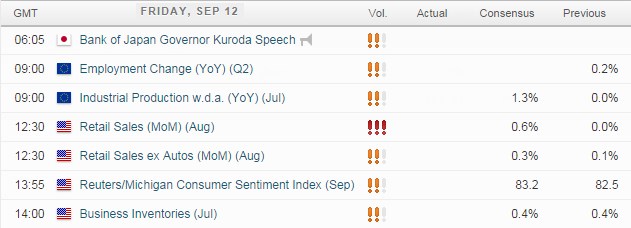

UP NEXT:

EUR: High expectations for industrial production, which leaves room for disappointment if falls flat. EURUSD remains within range but could be due a breakout this session.

US: Data from the US is more likely to provide any catalysts tonight. Keeping in mind that the Greenback has been exceptionally strong, so if we see enough poor data tonight this could cause deeper retracements. Until then it is advisable to stick with the dominant, USD bullish trend.

TECHNICAL ANALYSIS:

USDCAD: Hovers below resistance; Awaits next directional clue

With a US data dump tonight we do run the risk of low-range trading leading up to this event. This makes an ending diagonal (bearish wedge) below the resistance zone a likely scenario, which if confirmed would target the base of the wedge pattern as a minimum.

At which point, taking into consideration the bullish trend on daily, weekly and monthly timeframes then I can consider bullish setups at the highlighted support zones.

Should the bearish wedge not materialise then we can expect direct gains above the weekly highs to the next resistance zone.

EURUSD: Potential triangle; Selling into rallies below 1.30

With data form Eurozone and US tonight it should [hopefully] be enough to break out of range. Fingers crossed. Whilst it may be tempting to look at EURUSD D1 and say 'this looks oversold' it always leaves room for another leg lower if we see poor Euro data and string US.

That said, if we close the week around current levels it will provide a Bullish Hammer on D1. until then, I am seeking sell set-ups below 1.30 as this is a string zone of resistance. Ideally we will see direct losses as part of a continuation pattern.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.