UP NEXT:

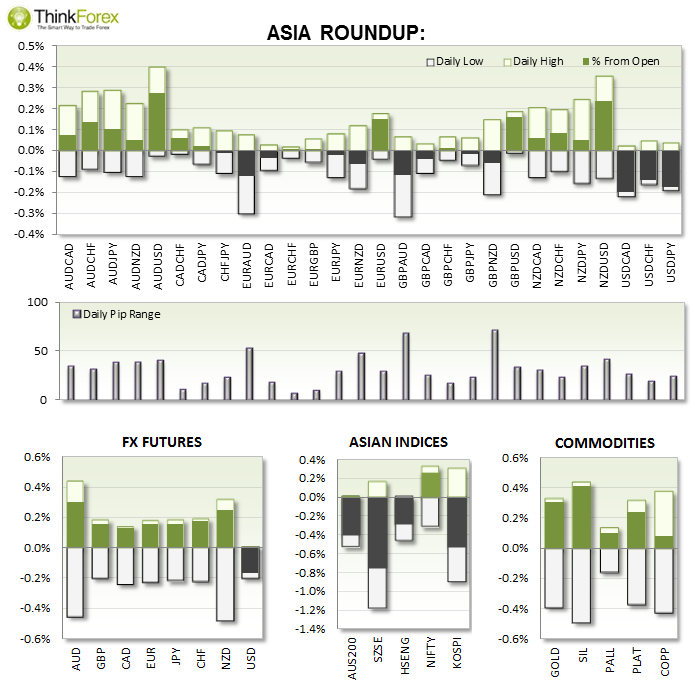

EUR: With ECB now not expected to act next week with extra stimulus, EURUSD may continue to rebound from the lows. Considering this we could assume that even mediocre news from Europe could help EURUSD rebound from the lows with less effort.

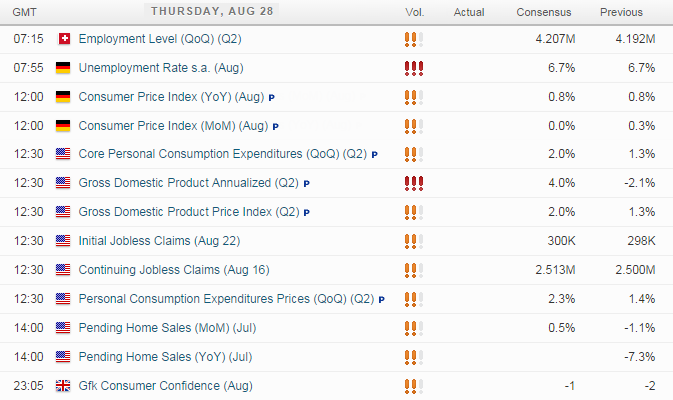

US: Core PCE is widely regarded as the 'real' inflation gauge used bythe FED so could end up being the headline figure if it comes in or above 2%. GDP has high expectation at 4% so any shortfall here could also help USD retrace further across the majors board. Employment and Housing is unlikely to be the main driver tonight, but if if we see it back up inflation and growth data we should be presented with cleaner trends.

TECHNICAL ANALYSIS:

AUDUSD: Hangs near 3-week highs

I suspect that US data will deliver tonight and to bring downwards pressure upon AUDUSD. However with Europe and London due to open we do run the risk of further highs, as they absorb good CAPEX data and buy before the US data dump tonight.

0.937 is the 3-week high with a break above here targeting 0.9380 and 0.9340. Positive data from US should see AUDUSD back below 0.937.

GBPUSD: Approaches potential sell-zone

Gold remains within a clearly bearish channel and there are obvious zones of resistance to sell into, should we be presented with signs of weakness around these levels.

Cable is currently enjoying a retracement from the lows, but whilst we remain within the bearish channel then bearish setups at resistance is preferred.

A break out of the bullish channel may provide near-term long positions, but there are plenty of levels of resistance which could be used as target, so try not to outstay your welcome trading against the trend.

GOLD: $1292 is the line in the sand

$1292 is a pivotal S/R level which was also the high from the Shooting Star Reversal. Yesterday was an Inside Day to suggest a hesitation to retest these highs but at time of writing we are close to breaching the high from the Inside Day. What would be nice to see is for yesterday's high to hold - then we can assume the Shooting Star Reversal was a swing high, and to seek a short position down to $1274. A break below here opens up $1259.

The counter-analysis is to seek bullish setups above $1292 to target $1300-$1302.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.