ASIA ROUNDUP:

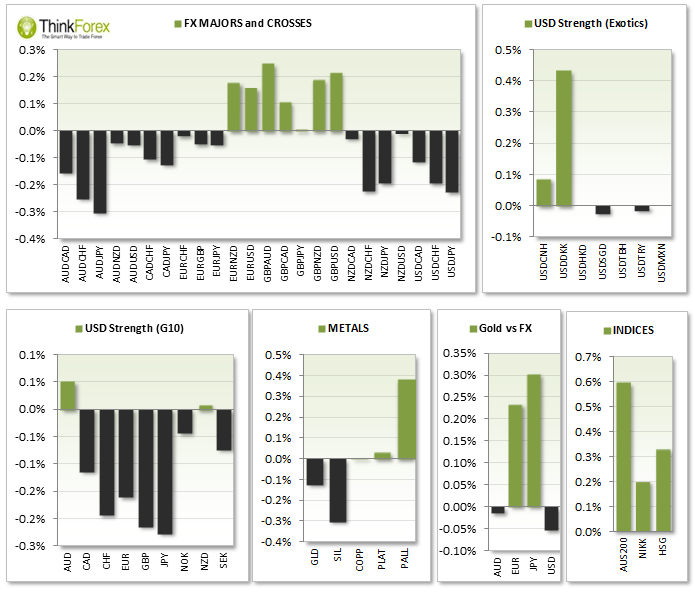

Initially a quiet session Asia trading heated up towards the end to see AUD and NZD sell-off across the board and Indices continuing the bullish lead from Wall Street.

USD retraced against G10 currencies early Asia trading with AUS200 and Nikkei posted modest gains, following the bullish lead from Wall Street.

Markets continue to suspect an interest rate hike next week of 25bps next week by RBNZ but there is talk of the end of year rate projections being lower than 3.75% following yesterday's lower CPI.

AUD business confidence and New Motor vehicle sales came in lower to see A$ edge lower initially but sell-off more heavily towards the back of the Asia session.

UP NEXT:

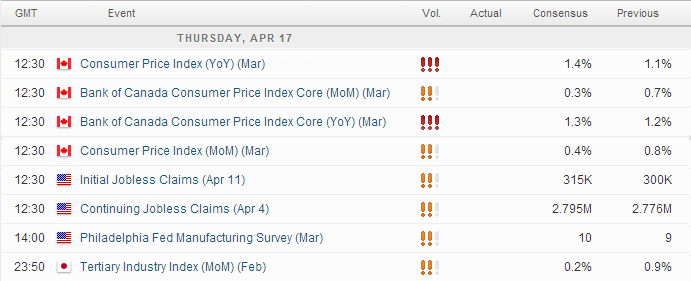

With data from the US and CAD at 12:30GMT we can safely expect some action on USDCAD later. The trouble is, due to there being such an array of data it does increase the odds of whipsaws and confused price action during and potentially just after the release.

Both Boc and Statistics of Canada will release their version of CPI y/y with higher readings than forecast being bullish CAD. We also have Jobless claims in the US which would be bullish USD for a lower reading. Unemployment is within a downtrend so a significantly higher reading could see the Greenback sell-off, as looking against all the majors the USD has produced reversals around areas of support or resistance.

Shortly after we also have the Philly Fed Manufacturing with a reading above 0 indicating improving manufacturing sentiment.

Pairs to Monitor: USDCAD, GBPUSD, EUUSD, USDJPY, AUDCAD,

TECHNICAL ANALYSIS:

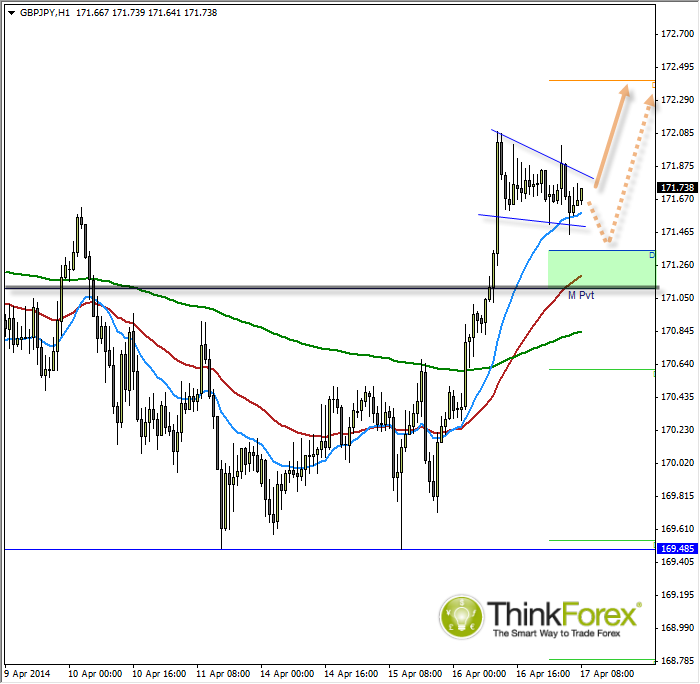

GBPJPY: Déjà Vu? Intraday Bull Flag

This is an identical set-up to yesterday which turned out very well. GBP is also gaining bullish momentum across the board which provides an extra confluence of confidence for this bullish run continuing.

Whilst I have drawn a pennant/flag formation I am hoping for a retracement towards the daily pivot to provide a tighter reward/risk and enable a lower stop placement and target DS1.

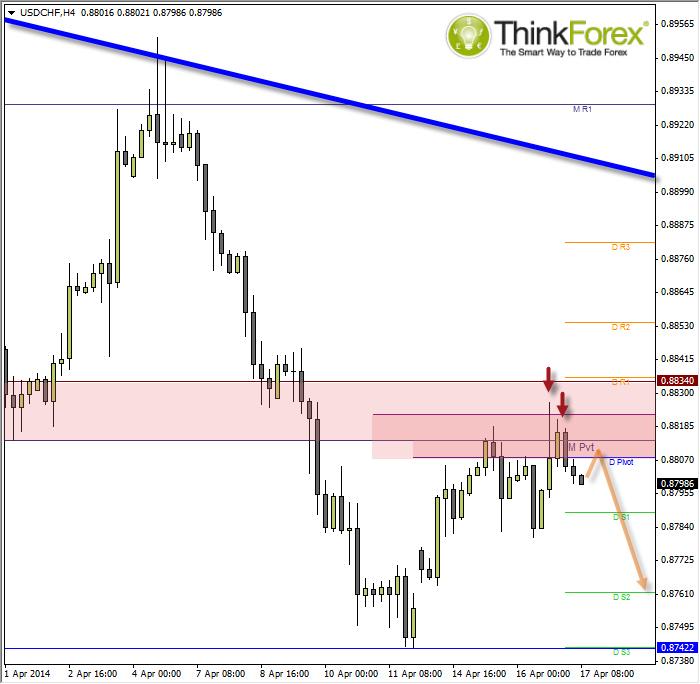

USDCHF: Resistance zone

H4 has produced a Shooting Star Reversal followed by a Dark Cloud cover, which failed to reach the high o the Shooting Star Reversal. Since then we have sold off below the Dark Cloud cover and below the daily pivot.

Retracements towards the daily pivot and Monthly Pivot could be used as opportunities to seek bearish candles on H1 or lower to join a (hopefully) bearish run down towards DS1 and DS2.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.