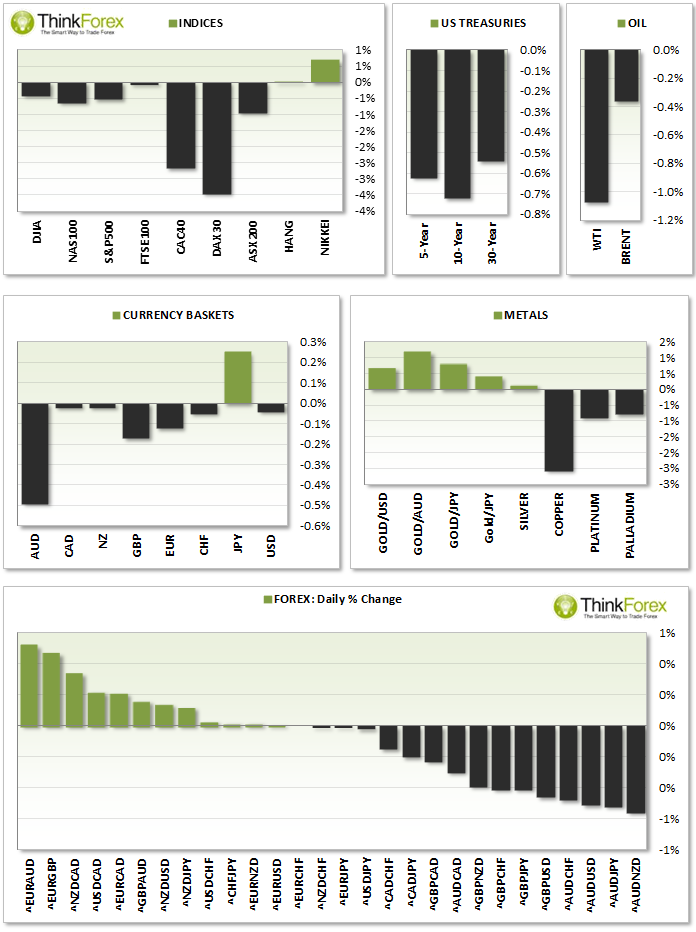

MARKET SNAPSHOT:

Following the record low in China exports recently along with news of China’s first company to default, Copper and Iron ore prices fell heavily resulting in AUDUSD trading back below 0.90.

NYLON ROUNDUP (New York - London)

COMMODITIES: WTI down -1.5% for a 2nd consecutive session finding support at 99.40; Gold broke above 1350; Copper currently trading at 30-week lows following China default;

USD: Job openings down for 2nd consecutive month; USD Index tests our 79.90 resistance but remains technically bearish

GBP: Manufacturing production m/m steady at 0.45 but industrial production fell short at 0.1% vs 0.3% expected. Cable approached 2 week lows but holds above 1.658 support

INDICES: Equities close the session at their weekly lows following the news from China. FTSE100 back to 3-week lows; Dax at 3-week lows; CAC40 at 6-week lows

ASIA ROUNDUP

AUD: Consmer sentiment down; Home loans at 5-month low coming in a 0% vs 0.8% expected; AUDUSD back below 0.90;

CNY: Iron ore prices have fallen following dissapointing trade numbers

JPY: Tertiary Industry activity is up at 0.9% vs 0.7% expected;

INDICES: AUS200 recouped early losses to produce a bullish hammer on the close; Nikkei 225 closes lower for 3rd consecutive session; Hang Seng at 4 week lows

COMING UP:

EUR: Industrial production m/m; French final NFP

USD: Crude oil inventories; 10yr bond auction;

CHARTS OF THE DAY:

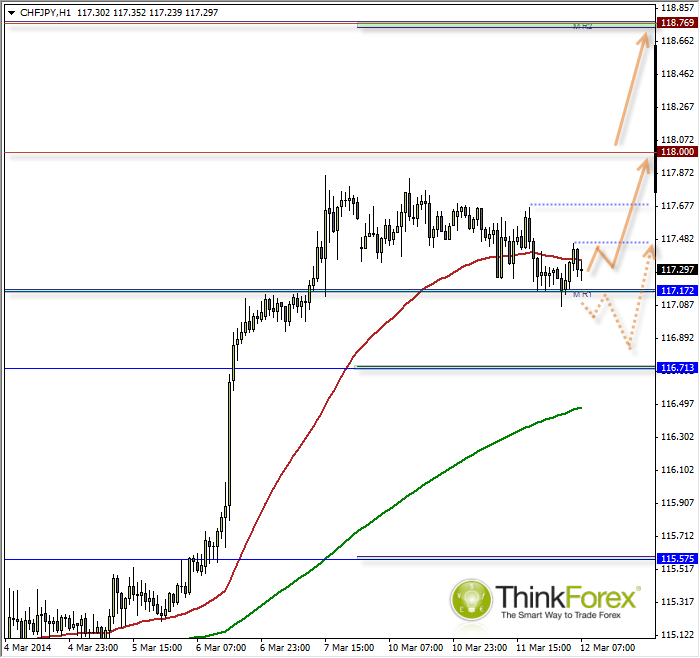

CHFJPY: Holds above 117 with potential base forming

This follows on from yesterday's analysis which has now seen the initial pullback and may provide a more precise entry. When you consider that JPY was the only currency basket to finish in the green yesterday (see above) it bodes well for CHF that it managed to hold ground against Yen.

At time of writing we are hovering above 117 support with the potential for a 'higher low’ to form. If this continues and we then break above the 117.48 swing high then there is potential for a trend to develop and target the 118/118.7 targets highlighted yesterday.

We still may see a deeper pullback towards 116.7 but until we break below 117 then I favour a continuation of the bullish trend sooner than later.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.