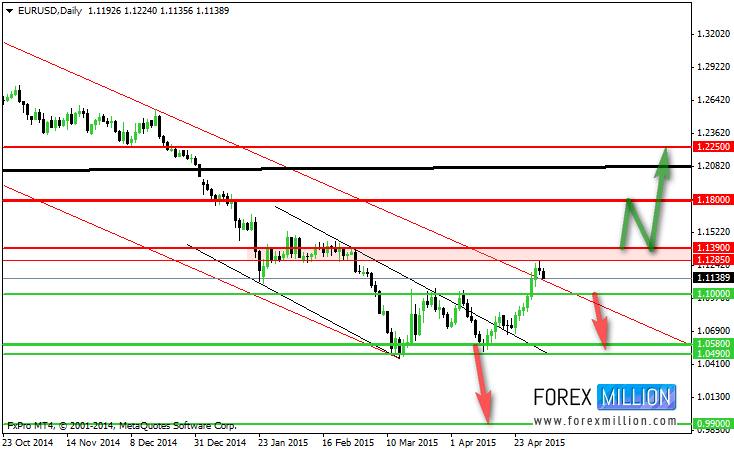

Main scenario:

With rebound from resistance level 1.1285 - 1.1390, the pair is now trading along an sideways trend.

The uptrend may be expected to continue in case the market rises above resistance level 1.1390, which will be followed by reaching resistance level 1.1890 and then to 1.2250.

Alternative scenario:

An downtrend will start as soon, as the pair drops below support level 1.1000, which will be followed by moving down to support level 1.0580 - 1.0490 and if it keeps on moving down below that level, we may expect the pair to reach support level 0.9900.

Recommended Content

Editors’ Picks

USD/JPY crashes below 157.00, Japanese intervention in play?

Having briefly recaptured 160.00, USD/JPY came under intense selling and sank below 157.00 on what seems like an FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.