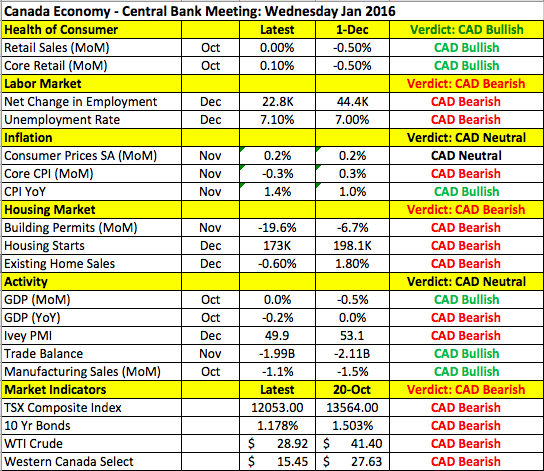

Considering that the Bank of Canada is not opposed to the idea of negative interest rates, a 25bp rate cut that takes the lending rates down to 0.5% would not be out of the question. Last month, BoC Governor Poloz said "The bank is now confident that Canadian financial markets could also function in a negative interest rate environment." It is important to note that he does not plan to bring rates to negative levels at this time but his comments reflect his dovish bias. Oil prices have fallen too far too fast and the situation for Canada has gone from bad to worse so a rate cut is certainly possible. The majority of economists surveyed by Bloomberg are not looking for a reduction because they believe that the central bank will want to wait for the first budget from Trudeau's government before taking action. The new Prime Minister promised a massive fiscal stimulus program to get the economy moving and is more specifically considering an immediate $1-billion handout for the hard hit Alberta and Saskatchewan provinces. We believe that the BoC should lower rates but it's a close call. Given this uncertainty, it is probably best to hold off on trading USD/CAD until after the BoC announcement.

Aside from the loonie, our focus remains on the British pound, which fell to its lowest level against the U.S. dollar since February 2009. After dropping below the 2010 low, GBP/USD easily took out the 1.4200 level, trading as low as 1.4130. While consumer prices rose more than expected in December, Bank of England Governor Mark Carney said point blank that "now is not yet time to raise interest rates." The head of the BoE expressed concerns about weaker global growth and the downside risks to emerging markets. He specifically talked about moderating wages and the questions that it raises for labor slack. We are particularly interested in this point because U.K. employment numbers are scheduled for release tomorrow. No major changes are expected for jobless claims but wages are expected to slow significantly which could drive GBP/USD towards 1.40. Meanwhile it is worth recognizing that the weaker sterling is finally helping to boost inflation but at 0.2%, the BoE is still a long way from reaching their 2% target.

The New Zealand dollar has also been on our radar all day. For the second time this year, dairy prices fell at the Global Dairy Auction. This week, prices declined -1.4%, compared to -1.6% at the Jan 5th auction. Its not a good start to the year for New Zealand dairy farmers who will likely see a lower payout from Fonterra. The Reserve Bank of New Zealand was reluctant to call a bottom in dairy after prices increased in the third quarter and their caution is now validated. If we don't see a recovery in the coming month or two, the RBNZ may have to consider lowering interest rates again especially since consumer prices fell -0.5%, matching the decline in Q4 2008 which was the largest drop since the fourth quarter of 1998.

With no U.S. economic reports released today, there was very little consistency in the performance of the dollar. The greenback appreciated against the British pound, Japanese Yen and Canadian dollars but lost value versus the euro, Swiss Franc, Australian and New Zealand dollars. U.S. stocks erased their earlier gains to end the day unchanged while 10 year yields moved slightly higher. We finally have some U.S. data tomorrow with housing starts, building permits and consumer prices scheduled for release. Chances are given the rise in the dollar and fall in oil prices, CPI either held steady or turned negative in December.

The euro traded slightly higher on the back of a better than expected ZEW survey. Despite market volatility and the problems in China, investors grew more optimistic about the current conditions in Germany. Their outlook deteriorated but less than economists anticipated. The fact that both parts of the report surprised to the upside was enough to lend support to the currency. Investors hope that between last year's Quantitative Easing program and the weaker euro, the German economy stands some chance of recovering in the coming year.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.