- Will RBA Cut 25bp, Driving AUD to 5 Yr Lows?

- CAD: Current Account Deficit Grows

- NZD: Watch Out for Dairy Auction

- Dollar Bulls March on Despite Weaker Data

- Euro Bounces on Positive Data

- Sterling Fails to Benefit from Stronger PMI

Will RBA Cut 25bp, Driving AUD to 5 Yr Lows?

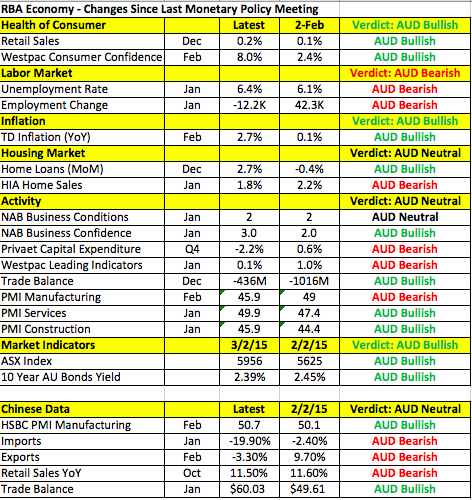

The are no shortages of important events and data on this week's FX calendar and one of the most market moving is likely to be tonight's Reserve Bank of Australia monetary policy announcement. Four major central banks are meeting this week and only one (the RBA) is expected to change interest rates. The Australian dollar traded lower on Monday, signaling that investors are positioning for a rate cut but even though 18 out of the 29 economists surveyed by Bloomberg also expect the RBA to ease, a rate cut is not a done deal. Taking a look at the table below, there has been just as much improvement as deterioration in Australia's economy. While the labor market weakened, private capital expenditures plunged and manufacturing activity in the month February contracted at its fastest pace since July 2013, retail sales, consumer confidence, home loans, business confidence, trade, service and construction sector activity improved since the last monetary policy. In other words, there isn't enough broad based deterioration to warrant back-to-back 25bp rate cuts. It is also hard to dissect how the RBA will interpret this weekend's surprise rate cut from China. Easing by China reduces the pressure on the RBA to take similar action but at the same time, China's decision was motivated by weaker manufacturing and inflation data. The bottom-line is that it will be a close call. If the RBA cuts rates, it should drive the AUD/USD to fresh 5.5 year lows below 0.7626. If they leave rates unchanged, a short squeeze driven rally should drive the currency pair towards 78 cents. How much further it extends beyond that level will be determined by forward guidance. If the RBA chooses to forgo a back-to-back rate cut, we still expect the central bank to maintain a dovish bias, leaving another round of easing in 2015 on the table. Aside from AUD. the Canadian and New Zealand dollars will also be in play on Tuesday with Canadian GDP and another dairy auction for New Zealand don the calendar.

Dollar Bulls March on Despite Weaker Data

The U.S. dollar powered higher today despite another round of weaker data. The market's relentless appetite for U.S. dollars is impressive considering that the latest economic reports hardens our view that the Federal Reserve will raise interest rates in September and not in June. In fact, Rabobank pushed out their forecast for Fed tightening to December on the premise that the stronger dollar will delay a rate hike. While we do not believe that they will wait until year-end to raise rates, we agree that they are in no rush to tighten. Personal income, personal spending, the ISM manufacturing index and construction spending all surprised to the downside, leaving the rise in U.S. yields as the only explanation for the strength of the greenback. Manufacturing activity has been particularly weak with all of the regional and national reports surprising to the downside. Spending also contracted for 2 months in a row but the silver lining is that Americans are saving at the fastest pace since 2012. Weaker U.S. data does not support the rise in yields but record-breaking moves in equities could be driving investors out of bonds and into stocks but this is a weak argument at best. We are still waiting for a pullback in the dollar before reloading our long positions. Meanwhile USD/JPY broke through 120 after a massive option expiration and the break coincided with a broad based intraday rally in the greenback. There are no major U.S. economic reports scheduled for release on Tuesday but as the week progresses, the dollar will take its cue from Federal Reserve speak and labor market reports. Since non-farm payrolls are not scheduled for release until Friday, this should be one of those weeks where global data/events are just as important as U.S. data.

Euro Bounces on Positive Data

The euro may have ended the day unchanged against the U.S. dollar but the currency pair rebounded nicely from its intraday lows. The tides could finally be shifting with Eurozone data surprising the upside and U.S. data falling short of expectations. Easy monetary policy, the weakness of the euro and low energy prices could finally be lending support to the Eurozone economy. Last week, ECB President Draghi said he saw the first signs of confidence in the economy and today we learned that consumer prices fell less than expected in the month of February and the unemployment rate dropped to 11.2% from 11.3%. Manufacturing activity in Germany was stronger than initially anticipated but activity in the Eurozone was revised slightly lower. There are a number of Eurozone economic reports scheduled for release this week most of which we believe will show further stabilization in the Eurozone economy. However the most important event risk will be the European Central Bank's monetary policy meeting. No changes are expected but the ECB will provide details on its Quantitative Easing program. QE is scheduled to begin in March and one of the greatest challenges for the central bank is finding enough government bonds to buy. If you recall, the ECB committed to buying 60 billion euros each month until September 2016. Some of the details that we expect from Mario Draghi include the exact date of when asset purchases will begin, how long they will last, the breadth of bonds purchased and whether National Central Banks can buy other country's bonds or only their own. EUR/USD trades will be most sensitive to the ECB's economic latest forecasts. We expect the central bank to raise its growth outlook but lower its inflation forecast.

Sterling Fails to Benefit from Stronger PMI

The British pound traded sharply lower against the U.S. dollar today despite better than expected manufacturing data. We are actually extremely surprised by the weakness in sterling given the importance of the PMI index and the fact that it rose to the strongest level in 7 months. The service sector may encompass a wider part of the U.K. economy than manufacturing but the three PMI numbers scheduled for release this week are central to shaping the market's expectations for BoE tightening. Yet we don't need to dig deep to find a reason for sterling's weakness as this morning's housing market reports surprised to the downside. House prices fell 0.1% in the month of February according to Nationwide and mortgage approvals rose less than anticipated. We don't feel that this weakness is material enough to affect the chance of tightening by the BoE in 2015 and therefore we view the current decline in sterling as an opportunity to buy the currency pair at a lower level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.