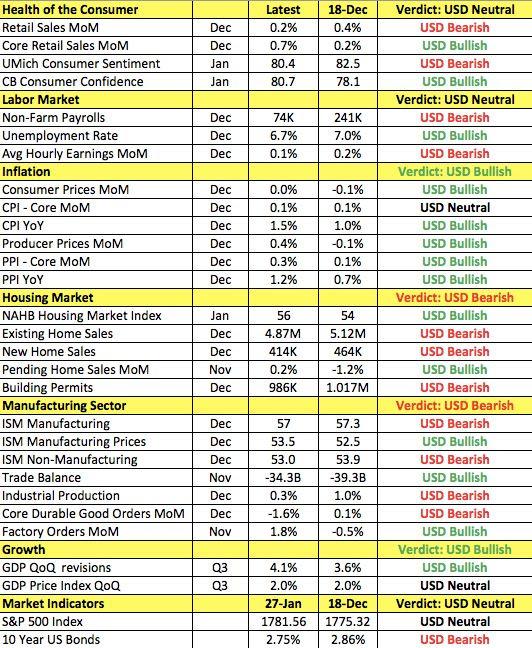

After the CBRT meeting comes Federal Reserve Chairman Ben Bernanke's final monetary policy meeting. The Federal Reserve is widely expected to reduce asset purchases by another $10 billion. Although non-farm payrolls growth slowed to 74k from 241k in December, the following table shows improvement as well as deterioration since the last FOMC meeting. In the labor market alone, the unemployment rate dropped to closer to the central bank's 6.5% threshold and even though advance retail sales growth slowed, core retail sales accelerated to 0.7% fro 0.2%. Consumer confidence has been mixed, manufacturing and service sector activity slowed but inflation is stabilizing and ticking higher on an annualized basis. Overall the US economy continues to improve and the decision to begin tapering last month was carefully calculated. Therefore the Fed is expected to overlook last month's softer economic reports and forge forward with reducing asset purchases. However don't expect Wednesday's FOMC announcement to be unambiguously positive for the dollar because the central bank will also stress that monetary policy will remain extremely easy.

How the US Economy Changed Since December FOMC Meeting

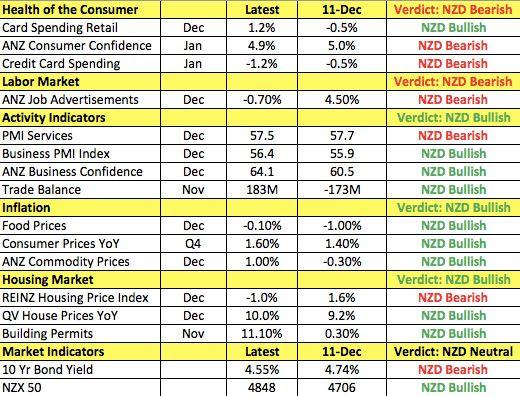

Shortly after the Federal Reserve meeting, the Reserve Bank of New Zealand will deliver its own monetary policy announcement. While the RBNZ is not expected to change interest rates, they will be preparing the markets for a rate hike in very near future. As shown in the table below, there have been more improvements than deterioration in New Zealand's economy since the last RBNZ meeting. Inflation is on the rise, along with manufacturing activity, business confidence and housing. The drop in consumer confidence, job advertisements and service sector activity has been nominal. We expect the New Zealand dollar to hold onto its gains ahead of the RBNZ announcement.

How the New Zealand Economy Changed Since December RBNZ Meeting

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY holds rebound near 156.00 after probable Japan's intervention-led crash

USD/JPY consolidates the rebound near 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.