Technical Analysis

EUR/USD stays unchanged below 1.2580

“One number does not change the monetary policy outlook, but the stability in core inflation may help to offset some of the Fed's concerns about declining inflation expectations.”

- JP Morgan (based on Reuters)

Pair’s Outlook

On Thursday the EUR/USD currency pair hovered in the range between major level at 1.25 and the closest resistance line, still represented by the weekly R1 at 1.2580. Despite changes in perceptions of daily technical indicators from bearish to bullish, we predict the pair to stay around the current trading level for the remaining part of the week, while from Monday the pair is likely to start losing value and prolong its long-term downward trend.

Traders’ Sentiment

Market sentiment on EUR/USD remained fully unchanged in course of last 24 hours, as 50% of all positions are still held both by bulls and bears. Pending orders in both ranges improved and 55% of them are now set to acquire to single currency in 100-pip range.

GBP/USD refuses to cross weekly PP

“Cheaper food and petrol prices are a boon for consumers that should help keep their confidence healthy and return some of the sparkle to U.K. growth next year.”

- Berenberg Bank (based on Bloomberg)

Pair’s Outlook

GBP/USD rose in value during last 24 hours; however, the pair refused to breach a resistance at 1.5733 and returned back below the 1.57 major level. It seems that a significant bearish pressure continues to weigh on pair’s performance. Therefore, we forecast the Sterling to decline further in the medium-term, but today it will most probably stay above the monthly S2 at 1.5662. This scenario is supported by technical studies on daily and weekly charts.

Traders’ Sentiment

Distribution between bullish and bearish opened positions stays the same for a fourth day in a row at 56% and 44%, respectively. Alongside, pending orders experienced no major changes either, as ones in 100-pip range from the spot are neutral right now.

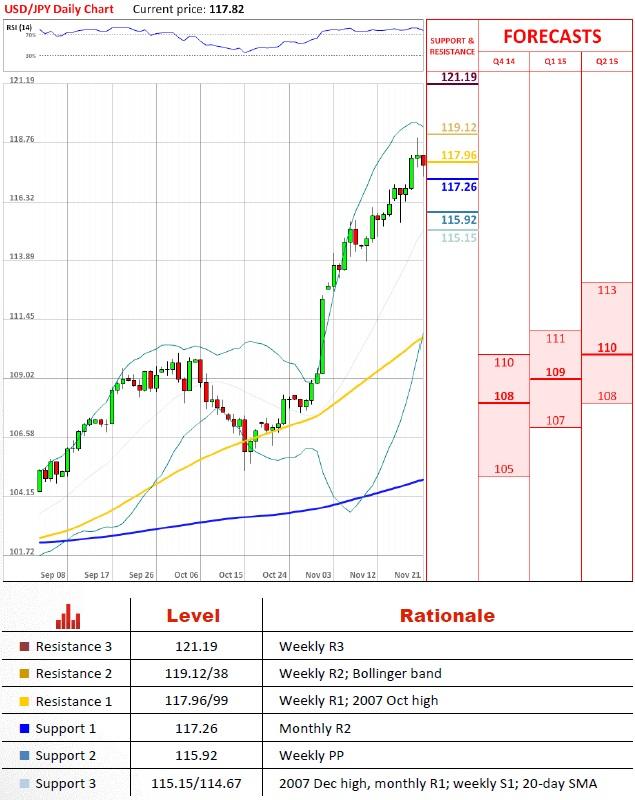

USD/JPY drops down to monthly R2 at 117.26

“Are our economic policies correct or incorrect? Are there any alternatives? We will clarify these points through this election.”

- Japan’s Prime Minister Shinzo Abe (based on MarketWatch)

Pair’s Outlook

The Japanese yen strengthened against the American dollar for the first time since Monday, as comments from Japan’s Finance Minister pushed the USD/JPY cross down. The pair has even surpassed a strong support line around 118 and neared the next one at 117.26. Nevertheless, this move looks like a short-term correction, meaning that the Yen will continue depreciating in the nearest future and may return above the 2007 Oct high during next 24 hours.

Traders’ Sentiment

Both market sentiment and pending orders were little changed from yesterday, as bulls continue to hold a majority in both situations. Right now 52% of opened positions are long on US currency, while 72% of orders in 100-pip range are bullish as well.

Demand at 0.9550 holds USD/CHF from slipping further

“The probabilities about when the Fed would move off the zero bound are all piling up on this June meeting.”

- James Bullard, St.Louis Fed President (based on MarketWatch)

Pair’s Outlook

USD/CHF’s bears failed to push the cross below 0.9550 for a second consecutive day, being that This demand area is supported by monthly PP, weekly S1, 55-day SMA and a Bollinger band. As still estimated by technical indicators, any downside movement can be expected only in the long-term. At the same time, in the medium-term the mentioned demand zone is likely to push the US dollar to the upside with the weekly R1 at 0.9760 as a potential target line.

Traders’ Sentiment

Attitude towards USD/CHF pair remains strongly bullish, as 63% of all positions are long. Meanwhile, 52% and 49% of pending orders are now set to acquire the Greenback in 50 and 100-pip ranges from the current market price.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.