Technical Analysis

EUR/USD to bounce off the ceiling at 1.37

“We were trading really tight ranges and then we got this data [GDP] and it really surprised to the downside. The U.S. economy is not just trying to regain strength after a winter freeze, but actually has real structural problems.”

- Monex Europe (based on Bloomberg)

Pair’s Outlook

EUR/USD still does not exhibit any willingness to advance either north or south. From the upside the currency pair is capped by the resistance consisting of the 55 and 200-day SMAs. On the other side the Euro is supported by the weekly PP and 20-day SMA. And even though there is a tough level at 1.35 (monthly S1 and 2014 low) and the monthly indicators are mostly bullish, a path of the least resistance is considered to be to the downside.

Traders’ Sentiment

The sentiment with respect to EUR/USD remains stable—44% of positions are long and 56% are short. Meanwhile, the distribution between the buy and sell orders is highly volatile—the share of the former 50 pips from the spot plummeted from 60% to 34%.

GBP/USD stays at 2009 high

“The main concern for sterling traders was whether the macroprudential norms would impact interest rate hike expectations. Clearly they have not, much to the relief of traders.”

- Western Union (based on Reuters)

Pair’s Outlook

The bulls turned out to be persistent, as for now the Cable is refusing the leave the vicinity of the 2009 high. The Sterling was expected to fall from 1.7044 down to 1.68 in order to form a rising wedge. Instead, the currency’s recent behaviour signifies the technical studies might be correct by giving ‘buy’ signals, and the price could soon push through the nearest resistances to reach the upper rising trend-line at 1.74.

Traders’ Sentiment

The SWFX market continues to hold the view the Pound is going to weaken against the buck—as many as 73% of all open positions are short. Concerning the orders, the share of the sell ones rocketed from 52% up to 67%.

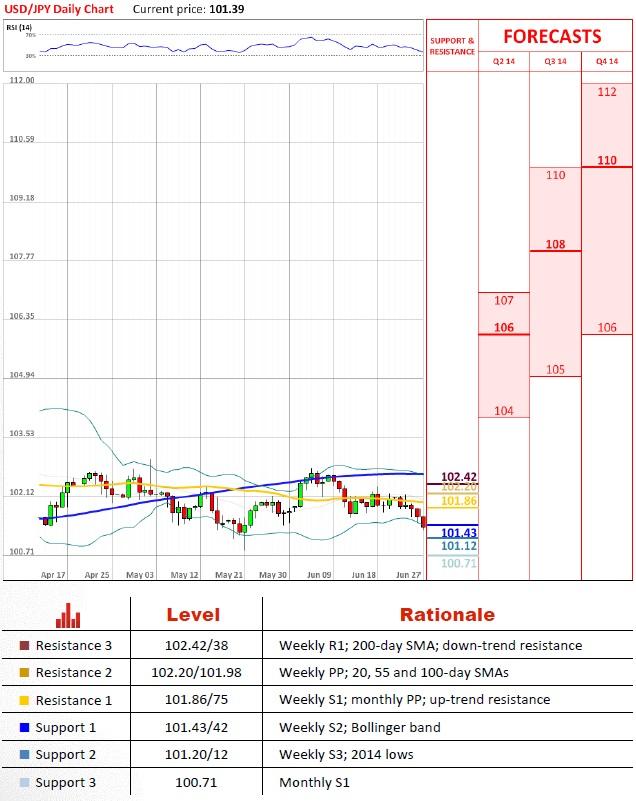

USD/JPY runs towards 101.20

“It’s hard to sell the yen in the current environment because there’s no need for the BOJ to act any time soon. The yen is being bought.”

- Credit Agricole (based on Bloomberg)

Pair’s Outlook

Since one of the major trend-lines has just been breached, USD/JPY is expected to hit 101.20 in the coming days. This mark is likely to be the last bastion of the bulls who continue defending the positive outlook. The risks are nevertheless skewed to the downside, but a close below this level is going to further reinforce the idea of the U.S. Dollar not following a path suggested by the monthly technical indicators and depreciating.

Traders’ Sentiment

There are a little more long positions than yesterday (73% against 71%), as the traders are taking advantage of the U.S. Dollar’s lower price. As for the pending orders, 61% are to purchase and 39% are to sell the buck against the Yen.

USD/CHF probes 55-day SMA

“There is really nothing substantial to hang your pro-dollar thesis on right now. There is nothing unequivocally in the data to suggest rates are going higher.”

- BK Asset Management (based on CNBC)

Pair’s Outlook

Although USD/CHF does not seem to be in a hurry to decline at the moment, there are also low chances of the currency pair returning above the 200-day SMA in the nearest future. Instead, the greenback is more likely to focus on the support at 0.8911/04 (weekly S1 and 55-day SMA). Once this demand area is penetrated, the next obstacle will be represented by the monthly PP and 100-day SMA at 0.8881/57.

Traders’ Sentiment

The sentiment towards USD/CHF is perfectly unchanged, being that 69% of the positions are still long and 31% are short. At the same time, the percentage of the buy commands 50 pips from the spot price increased, specifically from 72% up to 76%.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.