Technical Analysis

EUR/USD probes monthly PP

“Draghi has his sight set squarely on the euro.”

- DailyFX (based on MarketWatch)

Pair’s Outlook

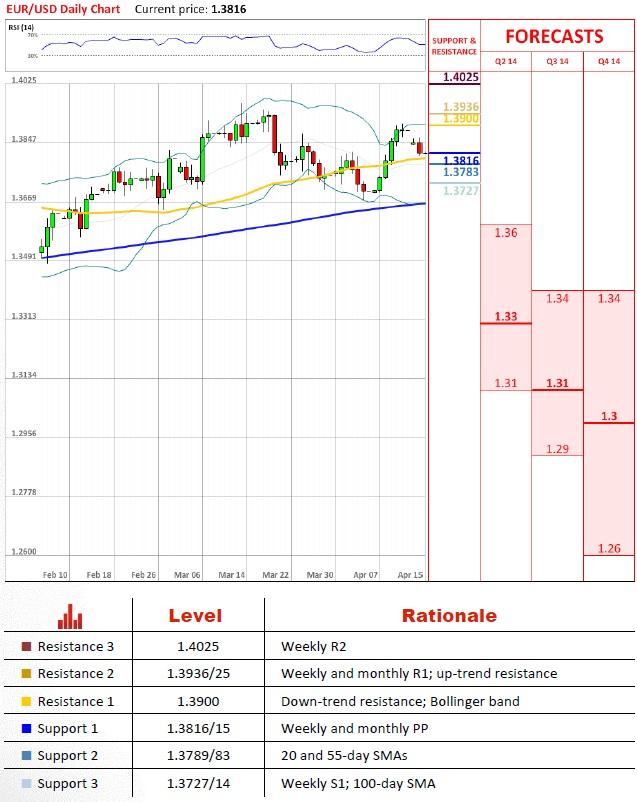

EUR/USD did not manage to close a downside gap yesterday, instead at the moment it gravitates towards the monthly pivot point at 1.3815. Additional support is at 1.3789/83, created by the 20 and 55-day SMA. But the currency pair is likely to go lower, in the direction of the up-trend support line at 1.37, even though most of the technical indicators on the weekly and monthly time-frames are pointing upwards.

Traders’ Sentiment

Although the relative amount of short positions in the market declined, there is still a significant difference between the bulls (34%) and bears (66%) and the sentiment therefore remains bearish towards EUR/USD.

GBP/USD may re-test Feb high

“Investors' love affair with the UK is still not over.”

- IronFX (based on Reuters)

Pair’s Outlook

Though the Cable has just encountered the Feb high, the sell-off from this level turned out to be short-lived. Accordingly, if the weekly PP at 1.6704 stays intact today, there will be an elevated chance of a re-test of 1.6822. Should this resistance give in to the buying pressure, the 2009 high at 1.70 will be exposed. However, given that it is reinforced by the weekly and monthly R2 levels, further advancement will be difficult.

Traders’ Sentiment

There was no activity observed on the part of the exchange rate, but the portion of traders expecting the Pound to lose value diminished, namely from 60% to 58%. Meanwhile, the share of buy orders soared from 55% up to 69%.

USD/JPY confirms support at 101.29/19

“The dollar was bought on the back of the stronger-than-expected retail sales numbers. If the data continue to print relatively firm, the dollar could claw back all its losses from last week.”

- Sumitomo Mitsui Banking (based on Bloomberg)

Pair’s Outlook

The support area around the level of 101.29/19 proved to be of great significance to the market, as it has once again prevented further depreciation of the U.S. Dollar. Now, after a small rebound, USD/JPY faces a tough supply zone, which consists of the falling trend-line and 55-day SMA. Potential extension of the rally beyond this point, which seems to be a viable scenario at the moment, will involve an attack on 102.96/72 (monthly PP and 100-day SMA).

Traders’ Sentiment

The distribution between the long and short positions stays perfectly unchanged—73% of open positions are long and the remaining 27% are short. On the other hand, the percentage of buy orders plummeted from 73% down to 63%.

USD/CHF rises to monthly pivot point

“The generally positive incoming data was enough to reverse some of the safe-haven bid from the pick-up in geopolitical risks over the weekend.”

- Barclays (based on CNBC)

Pair’s Outlook

Despite the bearish outlook implied by the weekly and monthly technical studies, USD/CHF turned around ahead of the monthly S1 and it is now challenging the monthly PP. In case this resistance fails to contain the pair, there is another potential ceiling at 0.8839 (20 and 55-day SMAs), which is supposed to ensure that the buck is eventually going to descend to the lower down-sloping trend-line of the falling wedge.

Traders’ Sentiment

Just as yesterday, a substantial majority (72%) of the SWFX market participants expect the U.S. Dollar to outperform the Swiss Franc. And the demand is likely to grow, since 65% of orders are to purchase the buck.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.