Forex News and Events

G20 in focus (by Peter Rosenstreich)

Ahead of the G20 meeting in Shanghai USDCNY FIX was marginally higher at 6.5481. What we are seeing is that the CNY is staying within normal trading range without any dramatic price changes (i.e. devaluation). This controlled exchange rate strategy which should persist near-term despite FX outflows not having slowed meaningfully (Jan FX outflow approx. $90bn). In support for our view of ordinary two-way trading, Chinese policy makers indicated that were was no effort to resort to competitive devaluation to support the economy. PBOC's Governor Zhou stated that the central bank "will not resort to competitive depreciation to boost our advantage in exports". In addition, Governor Zhou indicated his bias towards additional policy easing and highlighted the fact that there was scope for further action if necessary. We believe this to be correct and anchor our expectations that the Chinese economy will not deceleration significantly further nor will a credit crisis threaten stability. Todays, solid results in Asian equity markets are the results of lower volatility emulating from China and improvement in commodity prices. Elsewhere, BoJ Koruda continued to talk his book and indirectly defended this decision to turn to negative rates. He also indicated that potentially distortionary effect of below zero rates will be carefully monitored.

Central banks are struggling to satisfy their underlying mandates. With global growth decelerating, deflationary pressure is rising and steady bouts of volatility rolling though markets, investors might be tempted to turn to the G20 meeting this weekend. However, we wouldn’t expected too much. Ahead of the G20 meeting in Shanghai there is increasing speculation about an international coordinated policy response. The normal channels have become stuck yet coordinated exchange rate responses have not worked well in the past. A grand solution like the Plaza accorded feels far-fetched. Even less likely than a coordinated FX response, would be a coordinated expansion of fiscal policy options. Nations which comprise the G20 are too distinct to every find a critical consensus. Agreeing to which currencies are mispriced and who are the “winner and loser” might be is far too complex. Most likely the markets will get a strongly worded communiqué calling for nations to work together, limited excess FX volatility and abstain from competitive devaluation. While expectations are low a strongly word message form the G20 will help the current positive risk sentiment continue.

Crude prices rebounded as news spread that OPEC and non-OPEC energy ministers would meet next month. WTI front month rose 2.9% to $33.10 BRL. There are rumours that the primary discuss will revolve around further production freezing. Commodity prices have been recovering but from a very weak level as risk sentiment has improved and fear of global demand falling off the map dissipated. On the fringes there are developments which can be seen as positive for commodity demand. The most prominent has been oils forward curve moving into contango with the help of OPEC’s (select members) decision to halt production increases. While in China recent data indicates a renewed demand for iron ore and copper.

Too high expectations on the Mexican unemployment rate (by Yann Quelenn)

After yesterday’s current account balance that improved to $-7.7 billion from $-8.8 billion. Markets are now closely watching the unemployment data which will be released today. For the time being, it has dropped in February to a six-year low at 4.37%. We firmly believe that the unemployment rate may fall further.

Indeed, despite Mexican’s GDP is on the rise on the fourth quarter of 2015. Last December retail sales data printed negative at -1.6% m/m and industrial production has been also released at -0.1% m/m. Mexico is clearly suffering from the fact its central bank needs to carefully follow Fed’s monetary policy in order to avoid any capital outflow that may result from a narrowing rate differential. Mexico is way too dependent on the U.S. economy health.

Last but not least, Mexico is also paying the price of the lack of investments in its industry sector and in particular in its oil industry which infrastructure are very ancient and does not enable Mexico to be competitive. Mexico’s economy is set to decline. We remain bullish on the USDMXN and we target 19.00.

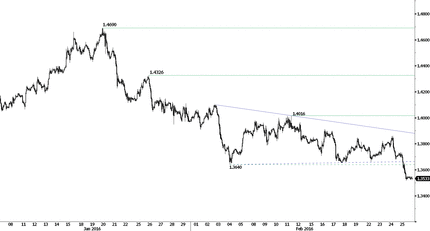

USD/CAD - Bearish Breakout

| Today's Key Issues | Country/GMT |

| Feb 20 Money Supply Narrow Def, last 8.37t | RUB/08:00 |

| Dec Total Mortgage Lending YoY, last 16,20% | EUR/08:00 |

| Dec House Mortgage Approvals YoY, last 16,40% | EUR/08:00 |

| Feb P CPI EU Harmonised MoM, exp -0,20%, last -2,50% | EUR/08:00 |

| Feb P CPI EU Harmonised YoY, exp -0,60%, last -0,40% | EUR/08:00 |

| Feb P CPI MoM, exp 0,10%, last -1,90% | EUR/08:00 |

| Feb P CPI YoY, exp -0,50%, last -0,30% | EUR/08:00 |

| Jan Retail Sales MoM, exp 1,50%, last -1,50% | SEK/08:30 |

| Jan Retail Sales NSA YoY, exp 3,70%, last 3,40%, rev 4,00% | SEK/08:30 |

| 4Q Manufacturing Wage Index QoQ, last 1,00% | NOK/09:00 |

| Feb Unemployment Rate, exp 3,30%, last 3,40% | NOK/09:00 |

| Jan Hourly Wages YoY, last 1,30% | EUR/09:00 |

| Jan Hourly Wages MoM, last 0,00% | EUR/09:00 |

| Feb Economic Confidence, exp 104,3, last 105 | EUR/10:00 |

| Feb Business Climate Indicator, exp 0,27, last 0,29 | EUR/10:00 |

| Feb Industrial Confidence, exp -3,6, last -3,2 | EUR/10:00 |

| Feb Services Confidence, exp 11,4, last 11,6 | EUR/10:00 |

| Feb F Consumer Confidence, last -8,8 | EUR/10:00 |

| Feb FGV Inflation IGPM MoM, exp 1,21%, last 1,14% | BRL/11:00 |

| Feb FGV Inflation IGPM YoY, exp 12,00%, last 10,95% | BRL/11:00 |

| Feb P CPI MoM, exp 0,50%, last -0,80% | EUR/13:00 |

| Feb P CPI YoY, exp 0,10%, last 0,50% | EUR/13:00 |

| Feb P CPI EU Harmonized MoM, exp 0,60%, last -1,00% | EUR/13:00 |

| Feb P CPI EU Harmonized YoY, exp 0,00%, last 0,40% | EUR/13:00 |

| Jan Advance Goods Trade Balance, exp -$61.200b, last -$61.513b, rev -$61.506b | USD/13:30 |

| Jan Net Debt % GDP, exp 35,90%, last 36,00% | BRL/13:30 |

| Jan Nominal Budget Balance, exp -31.9b, last -123.8b | BRL/13:30 |

| Jan Primary Budget Balance, exp 18.4b, last -71.7b | BRL/13:30 |

| 4Q S GDP Annualized QoQ, exp 0,40%, last 0,70% | USD/13:30 |

| 4Q S Personal Consumption, exp 2,20%, last 2,20% | USD/13:30 |

| 4Q S GDP Price Index, exp 0,80%, last 0,80% | USD/13:30 |

| 4Q S Core PCE QoQ, exp 1,20%, last 1,20% | USD/13:30 |

| Jan Personal Income, exp 0,40%, last 0,30% | USD/15:00 |

| Jan Personal Spending, exp 0,30%, last 0,00% | USD/15:00 |

| Jan Real Personal Spending, exp 0,30%, last 0,10% | USD/15:00 |

| Jan PCE Deflator MoM, exp 0,00%, last -0,10% | USD/15:00 |

| Jan PCE Deflator YoY, exp 1,10%, last 0,60% | USD/15:00 |

| Jan PCE Core MoM, exp 0,20%, last 0,00% | USD/15:00 |

| Jan PCE Core YoY, exp 1,50%, last 1,40% | USD/15:00 |

| Feb F U. of Mich. Sentiment, exp 91, last 90,7 | USD/15:00 |

| Feb F U. of Mich. Current Conditions, last 105,8 | USD/15:00 |

| Feb F U. of Mich. Expectations, last 81 | USD/15:00 |

| Feb F U. of Mich. 1 Yr Inflation, last 2,50% | USD/15:00 |

| Feb F U. of Mich. 5-10 Yr Inflation, last 2,40% | USD/15:00 |

| Fed's Powell Discusses Fed Communication at New York Forum | USD/15:15 |

| Fed's Williams Takes Part in Panel Discussion in New York | USD/15:15 |

| ECB's Peter Praet Speaks on Panel in New York | EUR/18:30 |

| Fed's Brainard Speaks on International Policy Synchronization | USD/18:30 |

| Jan Eight Infrastructure Industries, last 0,90% | INR/23:00 |

| G20 Finance Ministers Meeting in Shanghai | CNY/23:00 |

The Risk Today

Yann Quelenn

EUR/USD is trading mixed. Yet, the short-term technical structure still suggests a further bearish move. Hourly resistance lies at 1.1068 (intraday high) and hourly support is given at 1.0957 (24/02/2016 low). Expected to show continued weakness. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD keeps on consolidating. Hourly support lies at 1.3879 (24/02/2016 low) and hourly resistance is given at 1.4168 (22/02/2016 high). The technical structure suggests further decline. The road is wide open to stronger support at 1.3657 (11/03/2009 low). The long-term technical pattern is negative and favours a further decline towards the key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY has bounced back from 110.99 despite the medium-term technical structure is clearly negative. Hourly resistance can be found at 113.22 (intraday high). Stronger resistance is given at 114.91 (16/02/2016 high). Expected to further increase. We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF has exited uptrend channel. Hourly support is given at 0.9847 (16/02/2016 low). Hourly resistance is given at 1.0003 (22/02/2016 high). The bullish momentum has faded. Expected to see further weakening toward support at 0.9847. In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.

Resistance and Support:

| EURUSD | GBPUSD | USDCHF | USDJPY |

| 1.1561 | 1.4591 | 1.0328 | 117.53 |

| 1.1376 | 1.4409 | 1.0257 | 115.17 |

| 1.1193 | 1.4168 | 1.0074 | 114.91 |

| 1.1017 | 1.4004 | 0.9918 | 113.01 |

| 1.0893 | 1.3845 | 0.9847 | 110.99 |

| 1.0711 | 1.3657 | 0.966 | 105.23 |

| 1.0524 | 1.3503 | 0.9476 | 100.82 |

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD drops toward 0.6500 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is extending losses toward 0.6500, hit by an unexpected drop in the Australian Retail Sales for March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data failed to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY holds rebound to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold price traders remain on the sidelines ahead of FOMC decision on Wednesday

Gold price remains confined in a narrow range as traders prefer to wait on the sidelines. Reduced Fed rate cut bets revive the USD demand and act as a headwind for the metal. Investors now await the FOMC decision and US macro data before placing directional bets.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.