Forex News and Events

The dollar is under a lot of pressure since mid-March as traders started to price in a delayed first rate hike by the Fed from June to September 2015. In addition, the faltering US economy is raising concerns about its ability to generate sustainable growth in a strong dollar environment. The disappointing GDP figures triggered US government bonds sell-off. The US 5-year yields are up 20bps to 1.45% since its low from March 17 while the 10-year yields rose 21bps to 2.05%. However, we think that a big part of the recent US bond market development can be attributed to the recent correction of German yields. Since March 17, the German 10-year yields are up 37bps from 0.049% to 0.37% while the 5-year yields are up more than 18bps to 0.012%, back into positive territory. The pressure eases in Europe as hopes rise for a Greek deal, pulling yields to their levels from late January.

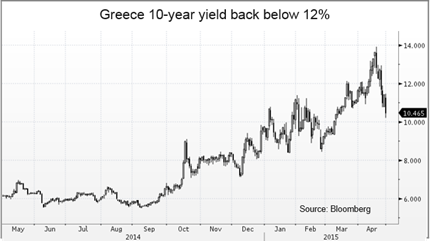

In Greece, the government has difficulties to complete pension payments as certain state social security fund are waiting on subsides from the government. In the meantime in Brussels, negotiations continue after Yanis Varoufakis, Greece’s finance minister, was sidelined from the ongoing negotiations by its own government. Markets welcomed the news and relived the pressure on Greek debt. The Greek 10-year yields peaked at 13.93% on April 21st while 5-year yields reached 20.33%. Greek yields are now back to 10.46% and 16.02%.

BoT cut rates (by Peter Rosenstreich)

This week, the Bank of Thailand unexpectedly cut its policy rate a further 25bp, bringing interest rates to 1.50%. Interestingly, despite clear fundamental reasons for Thai baht weakness, the currency has remained ominously resilient. In fact, the THB has been one of the only currencies to appreciate verse the USD, allowing it to remain one of the strongest regional currencies. Yet after a long wait, change in Bank of Thailand’s bias suggests that further THB weakness should be expected. The government, has struggled to create political legitimacy, support economic growth and to lift domestic confidence since taking power. Yet the THB continued to appreciate. A primary rationale for the strong THB has been the improvement to the current account, driven by lower imports. A sizable fall in imports can be attributed to lower oil prices and the slowing economic growth has limited the demands for automotive and capital goods. In addition, yield starved foreign investors have reinvested capital into Thai assets this year to take advantage of higher government debt. The central bank’s decision to cut interest rates was directly geared toward offsetting the negative impact of the THB. This cut had more support, with a vote of 5-2, with two dissenters preferring to hold rates. The accompanying statement was noticeably more dovish, with a heavy emphasis on the effect of a strong THB. It was clear that the BoT was now knowingly worried that exports and inflation would be effected by ‘pressure from recent Thai baht appreciation’. Given the explicit mention of the THB strength, our suspicions that the risk of interest rate cuts will put rates below the all-time low (1.25%) has increased significantly. Our expectations that the THB will outperform regional peers unless the BoT acts, domestic demand and inflation data to remain weak further accommodation should be expected. With further easing and potentially new rules to accommodate outflows, the central bank is committed to weakening THB.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.